QUOTE(lukenn @ Jan 1 2016, 04:58 PM)

Actually its in your 10y chart too. Because you're looking at all the funds at the same time, it does not look significant.

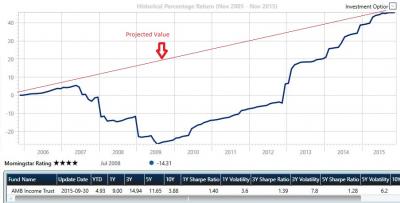

If you wanted a pure parking facility, use a money market fund instead. If you insist on fixed income, balance between large size vs. bond quality vs. historical performance. As a holding facility, your greatest concern is default.

The big drops you see are actually bond defaults. Not "poor performance".

from his earlier post at page # 5, post# 86, I think [yklooi] is looking for a quantum leap to jump up his IRR from his simulation of expectation.....

post#94 , he mentioned of what he had tried and post # 96, what he will be trying...

and from his post at page # 35, post# 700, he mentioned about FSM comments of small cap index....

therefore, I think he would not be so gung ho,...when the small cap index is higher.....

so I think he will reorganise or do his "portfolio transformation plan" again when that time comes....

he already mentioned in post # 693....."2016 will be the year of either make it or burst".

just hope that he can achieve his "portfolio transformation plan" in < 9 months....

looking at his planed portfolio allocation.....at 28% FI (AMB ITF), 21% M'sia Small cap & 11% KGF and 23% in Ponzi 1.0 (Ponzi 1.0 has 30% in M'sia).......

I think the chances of AMB losing 10% NAV which would affect his portfolio by 2.8% to be very slim compared to the chances of his M'sia coverage dropping 10% which would affects his portfolio by a large numbers to be MUCH higher.

This post has been edited by T231H: Jan 1 2016, 07:39 PM

Jan 1 2016, 11:05 AM

Jan 1 2016, 11:05 AM

Quote

Quote

0.0603sec

0.0603sec

0.38

0.38

6 queries

6 queries

GZIP Disabled

GZIP Disabled