QUOTE(dexk @ Dec 17 2015, 11:56 PM)

I'm no expert, just thinking out loud. With IRR below 4.5%, its much better off putting that money in your home loan account (I'm assuming you have one). It's capital guaranteed and ~4.5% savings/returns guaranteed.

Do you really need to be diversified globally and in return get a lower IRR? Each fund in itself is already somewhat diversified (of course there are those special focus funds) compared to single stocks etc. If you choose any of the good local fund and only wallop them, example only KGF or Eastspring small cap or RHB smart treasure and keep a 5-10 years horizon. Is the risk really that great in this case that die die must diversify?

BTW, I'm post 1997 era so maybe those who lived thru that era would feel differently?

......

"IF" can know the outcome before hand,...then like you said,..putting it in home loan is much better....

in investment, I could not foresee the outcome of my investment (unless I choose FI/mm funds).

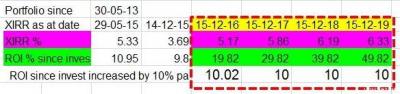

but now with my simulated data....I "can see" the possible outcome of my IRR......

but as Kimyee said.....IRR does not matters if ROI can be kept high yearly...

Do you really need to be diversified globally and in return get a lower IRR?

depending on the situation,...just for example.....due to Ringgit depreciation....some Global funds performed much better. I think diversification is to reduce portfolio volatility risk, to have a more stable portfolio......

yes,..because of that, it "may" reduce ROI. (because if did not diversify,....fire power concentrated on the wrong area would not gives much returns too)

Is the risk really that great in this case that die die must diversify?

depending on what one seek......better sleep or better pocket money.

yes, thanks for the suggestions....KGF or Eastspring small cap or RHB smart treasure

I had been planning on focusing on that too.....missed out on smart treasure thou...now will plan to add smart treasure on board.....

will not keep 5-10 yrs......Change, if they did not perform after 2~3 yrs.....(the more years that did not perform, they will drag down my IRR/ROI)

my preliminary new set up planning is 45% FI, 55% EQ, EQ focused on Asia pac, m'sia + 2% in global tech

like you said..."only wallop them" (the past high performers)

"I'm post 1997 era"...maybe a good thing too.....new ideas and inspiration too....

thanks again

Dec 14 2015, 09:44 PM

Dec 14 2015, 09:44 PM

Quote

Quote

0.0468sec

0.0468sec

0.64

0.64

7 queries

7 queries

GZIP Disabled

GZIP Disabled