QUOTE(ohcipala @ Dec 23 2015, 11:01 AM)

In b4 Pinky and wongseafood say it's better and cheaper to DIY balanced fund

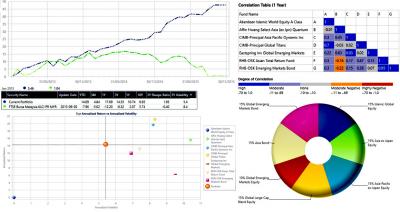

If compared to a traditional balanced fund, then that's absolutely correct.

RM100K invested

=> RM50K equities => RM1K fees

=> RM50K fixed income = > RM0 fees, RM25/quarter

=> rebalancing from fixed income to equities => xxx fees

RM100K invested into a balanced fund => RM2K fees

RM100K invested into an allocation funds also RM2K, but all rebalancing is done internally, so no fees.

(eg: Eastspring Dynamic, Eastspring Dana Dinamik, RHB GIFT, RHB Smart Balanced).

So if its worth it, you have to ask yourself :

1. how often do I switch ?

2. can my research outperform RHB-AM ?

3. can the cost savings cover the cost of my time ?

Seeing as most investors do not have enough fixed income in their portfolio, this would be one method of introducing more stability, without giving up too much growth.

Dec 22 2015, 02:37 PM

Dec 22 2015, 02:37 PM

Quote

Quote

0.0531sec

0.0531sec

0.37

0.37

7 queries

7 queries

GZIP Disabled

GZIP Disabled