QUOTE(kimyee73 @ Dec 17 2015, 12:12 PM)

I feel you. I'm figuring out ways to get 10% ROI annually as well. If you can get that, IRR does not matter even if it is lower currently since you screwed up  for last couple of years. Your IRR will slowly rise with your 10% annual ROI

for last couple of years. Your IRR will slowly rise with your 10% annual ROI  . Let me know your method if you able to achieve it by end of next year. I'll let you know as well if I can achieve it by then

. Let me know your method if you able to achieve it by end of next year. I'll let you know as well if I can achieve it by then

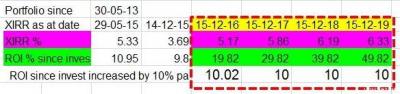

looking at my chart/data....it seems that the RATE of IRR movement from year to the next is getting less as the year goes by...even though the ROI rate is at 10% pa.....

have to think of a way to max the investment, at a risk reward pattern that i can take.

will be thinking of how....will post result here as usual...

YES...if you screwed up your youth...you will get harder at later stage of life......same philosophy as investment? ha-ha.....if your IRR are screwed up the first few years of your investment life.....your better investment IRR will be harder to achieves later in the investment life..

have to try to convince myself of your post about....

"if can get 10% pa annually, IRR does not matter"...

i know it is true...just that.........

thanks

Attached thumbnail(s)

Dec 17 2015, 12:32 PM

Dec 17 2015, 12:32 PM

Quote

Quote

0.0296sec

0.0296sec

0.38

0.38

6 queries

6 queries

GZIP Disabled

GZIP Disabled