QUOTE(Ramjade @ Oct 13 2015, 11:46 PM)

Really? Didn't know that. Hardly go 7-11.I still prefer the ibg way. Shiok sendiri that using both banks.

U shld goes out n social instead of keyboard warriorFixed Deposit Rates In Malaysia V. No.10, Please Read Post #1 & #2

|

|

Oct 14 2015, 02:48 PM Oct 14 2015, 02:48 PM

Show posts by this member only | IPv6 | Post

#401

|

Senior Member

10,001 posts Joined: May 2013 |

|

|

|

|

|

|

Oct 14 2015, 04:35 PM Oct 14 2015, 04:35 PM

|

Senior Member

1,338 posts Joined: Sep 2012 |

|

|

|

Oct 14 2015, 04:39 PM Oct 14 2015, 04:39 PM

|

Senior Member

1,338 posts Joined: Sep 2012 |

QUOTE(Ramjade @ Oct 14 2015, 12:25 PM) No rebate. Just not charged rm8 for it like most banks. If you want rebate, go for their true cc. 3% CB for online transactions cap at rm30/month without charges of administration fees for overseas online transactions. Some exclusions apply. Refer to their T&C. No annual fees. If you are going for local online shopping, uob vox would be a better choice. Other than that, no special rebates. Refer to cc thread. If can squeeze the bank more, why not right? You don't want to let the bank earn those rebates, do you? Already free IBG, no rm8 charge, high interest, still want to ask for rebate? Ish... |

|

|

Oct 14 2015, 04:42 PM Oct 14 2015, 04:42 PM

|

Senior Member

895 posts Joined: Dec 2013 |

|

|

|

Oct 14 2015, 04:54 PM Oct 14 2015, 04:54 PM

|

Senior Member

2,337 posts Joined: Oct 2014 |

|

|

|

Oct 14 2015, 06:35 PM Oct 14 2015, 06:35 PM

|

Senior Member

1,338 posts Joined: Sep 2012 |

|

|

|

|

|

|

Oct 14 2015, 06:55 PM Oct 14 2015, 06:55 PM

Show posts by this member only | IPv6 | Post

#407

|

All Stars

26,521 posts Joined: Jan 2003 |

Any tips on how to nego for higher rates?

If we already passed the banker's cheque to the teller, he/she would know that most likely we will make placement there so less chance to nego. No RM. |

|

|

Oct 14 2015, 07:00 PM Oct 14 2015, 07:00 PM

|

Senior Member

2,337 posts Joined: Oct 2014 |

QUOTE(Human Nature @ Oct 14 2015, 06:55 PM) Any tips on how to nego for higher rates? Ask at the ticketing counter, insist "big" amount, demand to see branch manager, if both fail, threaten to go another bankIf we already passed the banker's cheque to the teller, he/she would know that most likely we will make placement there so less chance to nego. No RM. |

|

|

Oct 14 2015, 07:08 PM Oct 14 2015, 07:08 PM

Show posts by this member only | IPv6 | Post

#409

|

All Stars

26,521 posts Joined: Jan 2003 |

|

|

|

Oct 14 2015, 07:12 PM Oct 14 2015, 07:12 PM

|

Senior Member

2,490 posts Joined: Sep 2011 |

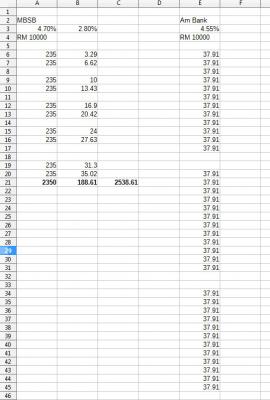

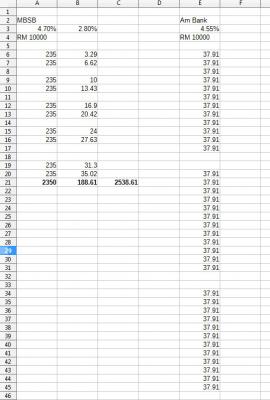

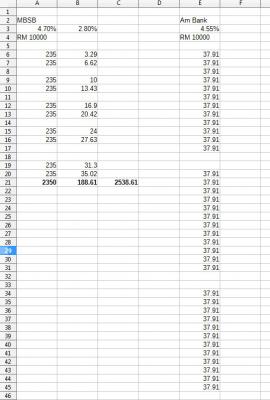

QUOTE(Human Nature @ Oct 14 2015, 06:55 PM) Any tips on how to nego for higher rates? Call the person in charge of FD to nego rate on the phone first...If we already passed the banker's cheque to the teller, he/she would know that most likely we will make placement there so less chance to nego. No RM. MBSB 5 years at 4.7% with paid semi annual interest VS Am Bank 5 years at 4.55% with paid monthly interest (50 years old and above). Let's say if put the both interests to Am Bank True Savers account, which one can earn more interest? I used below online calculator and I came out with the answer MBSB can earn more interest. Correct or not..? http://getsmarteraboutmoney.ca/tools-and-c...px#.Vh4ZIW5oDtw  ----> MBSB

----> MBSB ----> AM Bank

----> AM Bank

This post has been edited by BoomChaCha: Oct 14 2015, 07:14 PM |

|

|

Oct 14 2015, 07:14 PM Oct 14 2015, 07:14 PM

|

Senior Member

2,337 posts Joined: Oct 2014 |

|

|

|

Oct 14 2015, 07:16 PM Oct 14 2015, 07:16 PM

|

Senior Member

1,262 posts Joined: Aug 2005 From: Mars |

QUOTE(BoomChaCha @ Oct 14 2015, 07:12 PM) Call the person in charge of FD to nego rate on the phone first... I guess most of us here are younger than 50MBSB 5 years at 4.7% with paid semi annual interest VS Am Bank 5 years at 4.55% with paid monthly interest (50 years old and above). Let's say if put the both interests to Am Bank True Savers account, which one can earn more interest? I used below online calculator and I came out with the answer MBSB can earn more interest. Correct or not..? http://getsmarteraboutmoney.ca/tools-and-c...px#.Vh4ZIW5oDtw  ----> MBSB

----> MBSB ----> AM Bank

----> AM Bank

obviously MBSB is the one to go |

|

|

Oct 14 2015, 07:22 PM Oct 14 2015, 07:22 PM

|

Junior Member

74 posts Joined: Apr 2014 |

QUOTE(Human Nature @ Oct 14 2015, 06:55 PM) Any tips on how to nego for higher rates? not all banks have nego rate. other than br, which others? other may give if no promotional rate.If we already passed the banker's cheque to the teller, he/she would know that most likely we will make placement there so less chance to nego. No RM. |

|

|

|

|

|

Oct 14 2015, 07:27 PM Oct 14 2015, 07:27 PM

|

Senior Member

6,614 posts Joined: Mar 2011 |

QUOTE(Human Nature @ Oct 14 2015, 06:55 PM) Any tips on how to nego for higher rates? I thought you are at least PB of SCB ? If we already passed the banker's cheque to the teller, he/she would know that most likely we will make placement there so less chance to nego. No RM. I tried the trick with BR before when I opened account. Talk to the officer, get higher rate and gifts before hand over the cheque. Subsequently talked to the BR ABM to nego before going there. Got 0.2% in one instance for a large sum. QUOTE(cklimm @ Oct 14 2015, 07:14 PM) Depends on the bank. If there is already promo rate, 6 figure also may not work. My experience only. |

|

|

Oct 14 2015, 07:33 PM Oct 14 2015, 07:33 PM

|

Senior Member

6,614 posts Joined: Mar 2011 |

QUOTE(Human Nature @ Oct 14 2015, 07:08 PM) that's what i scared..sekali they see my amount kacang putih only For UOB when there is no promo, you can ask for increase. But only low 0.05% or so. But with promo rate, tough luck (unless very high amt >6 figures).BR wise, with 6 figure, can get 0.1% more. But it looks to me you are not BR kaki. QUOTE(mohdyusof @ Oct 14 2015, 07:22 PM) Yes, you are right. |

|

|

Oct 14 2015, 07:37 PM Oct 14 2015, 07:37 PM

|

All Stars

24,333 posts Joined: Feb 2011 |

QUOTE(BoomChaCha @ Oct 14 2015, 07:12 PM) Call the person in charge of FD to nego rate on the phone first... Don't think mbsb will win cause previously one guy showed a 4.2% FD if compounded yearly can win against bsn 4.5%. MBSB 5 years at 4.7% with paid semi annual interest VS Am Bank 5 years at 4.55% with paid monthly interest (50 years old and above). Let's say if put the both interests to Am Bank True Savers account, which one can earn more interest? I used below online calculator and I came out with the answer MBSB can earn more interest. Correct or not..? http://getsmarteraboutmoney.ca/tools-and-c...px#.Vh4ZIW5oDtw  ----> MBSB

----> MBSB ----> AM Bank

----> AM Bank

This post has been edited by Ramjade: Oct 14 2015, 07:38 PM |

|

|

Oct 14 2015, 07:41 PM Oct 14 2015, 07:41 PM

|

Senior Member

2,490 posts Joined: Sep 2011 |

QUOTE(Ramjade @ Oct 14 2015, 07:37 PM) Don't think mbsb will win cause previously one guy showed a 4.2% FD if compounded yearly can win against bsn 4.5%. Aiyo You ask uncle to use pen and paper to calculate manually..? I can calculate MBSB as shown on attached Excel spreadsheet; but cannot calculate AM Bank.. Don't under estimate the 0.15%.. And don't forget BSN only pays interest upon maturity whereas MBSB pays semi annual interest.. This post has been edited by BoomChaCha: Oct 14 2015, 07:44 PM |

|

|

Oct 14 2015, 07:46 PM Oct 14 2015, 07:46 PM

|

All Stars

24,333 posts Joined: Feb 2011 |

QUOTE(BoomChaCha @ Oct 14 2015, 07:41 PM) Aiyo Since the interest you get monthly will be constant, you can create a new column to calculate thatYou ask uncle to use pen and paper to calculate manually..? I can calculate MBSB as shown on attached Excel spreadsheet; but cannot calculate AM Bank.. Don't under estimate the 0.15%.. And don't forget BSN only pays interest upon maturity whereas MBSB pays semi annual interest.. |

|

|

Oct 14 2015, 07:48 PM Oct 14 2015, 07:48 PM

|

Junior Member

74 posts Joined: Apr 2014 |

QUOTE(Ramjade @ Oct 14 2015, 07:37 PM) Don't think mbsb will win cause previously one guy showed a 4.2% FD if compounded yearly can win against bsn 4.5%. the guy is @aeiou |

|

|

Oct 14 2015, 07:49 PM Oct 14 2015, 07:49 PM

Show posts by this member only | IPv6 | Post

#420

|

All Stars

26,521 posts Joined: Jan 2003 |

QUOTE(bbgoat @ Oct 14 2015, 07:27 PM) I thought you are at least PB of SCB ? Wanted to become PB of SCB but since no more FD promo, no motivation to go to the branch...procrastinating procrastinating almost 1 year has passed I tried the trick with BR before when I opened account. Talk to the officer, get higher rate and gifts before hand over the cheque. Subsequently talked to the BR ABM to nego before going there. Got 0.2% in one instance for a large sum. Depends on the bank. If there is already promo rate, 6 figure also may not work. My experience only. QUOTE(bbgoat @ Oct 14 2015, 07:33 PM) For UOB when there is no promo, you can ask for increase. But only low 0.05% or so. But with promo rate, tough luck (unless very high amt >6 figures). Yeah, planning to try luck for nego rate with uob..but since it will be on top of the 4.2% promo, chances are less...somemore I tried to nego to reduce the BC rate to RM0.15 also not successful BR wise, with 6 figure, can get 0.1% more. But it looks to me you are not BR kaki. Yes, you are right. BR has my highest FD amount but never got the chance to nego because it will just roll over and my mom will go there to renew the cert. One fine day need to try nego there too. |

|

Topic ClosedOptions

|

| Change to: |  0.0297sec 0.0297sec

0.66 0.66

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 12:20 AM |