QUOTE(ohcipala @ Oct 28 2015, 08:59 PM)

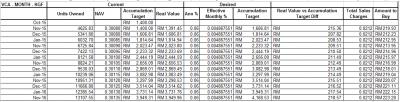

Wong seafood, if I plan to topup monthly using DVA, how to calculate the expected value for each month? And how to determine expected return pa? Is it by looking at the market where the fund invests in? Thanks ya sifu

Wong Sifu is right. DVA should be done at the most quarterly. In a prolonged bear market, you will run out of ammo very fast if you top up every month. For eg a situation where the funds turn red and maintain a loss of 10% for months.

Oct 28 2015, 10:50 PM

Oct 28 2015, 10:50 PM

Quote

Quote

0.0231sec

0.0231sec

0.55

0.55

6 queries

6 queries

GZIP Disabled

GZIP Disabled