Record-high unbilled sales 2QFY17 results within expectation:

Matrix’s 2QFY17 headline net profit of RM46.5m (-11% q-o-q, +49% y-o-y) was in line with consensus and our estimates.

Meanwhile, 2QFY17 revenue came in at RM225m (+15% q-o-q, +85% y-o-y), contributed by progress billings from its township developments as well as the sale of industrial land worth RM18.9m. Nevertheless, net margin was weaker at 20.7%, compared to 26.5% in the Jun 16 quarter and 25.6% in the Sep 15 quarter

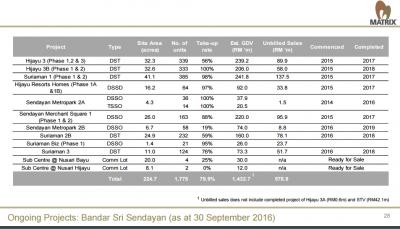

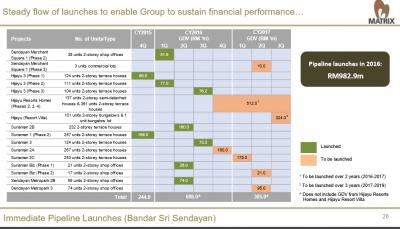

Matrix has bucked the trend with record high property sales at its two flagship projects, Bandar Sri Sendayan (BSS) in Seremban and Bandar Sri Impian (BSI) in Kluang, despite the relatively weak market sentiment.

BSS remains its jewel in the crown given the low average land cost of RM7psf (with infrastructure in place) when its affordably-priced properties are already selling at ~RM200psf, leading to significantly higher-than-average profit margins.

This unrivalled competitive advantage will make Matrix the best proxy to pure township developments which are set to

outperform in this challenging market. The new air force training base at BSS is expected to be completed by mid-CY17

which will then accommodate an additional ~1,500 personnel, further improving the vibrancy of the sprawling township.

http://mchb.com.my/wp-content/uploads/Matr...eDBS_161116.pdf

This post has been edited by BSS30112015: Nov 17 2016, 09:36 AM

Nov 17 2016, 09:25 AM

Nov 17 2016, 09:25 AM

Quote

Quote

0.0326sec

0.0326sec

0.82

0.82

6 queries

6 queries

GZIP Disabled

GZIP Disabled