QUOTE(xuzen @ Jul 10 2015, 01:37 PM)

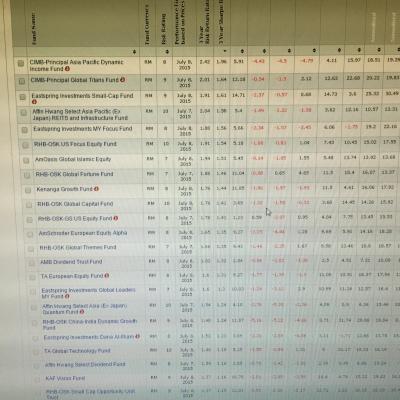

It is has gone above -1 SD liao... reversion to mean is highly likely.

Think of the mean or average as an imaginary elastic line. When you pull it too either side, it will want to go back to its original shape. The further you pull it from its resting line (aka the mean value) the more it wants to go back to the mean.

So in financial modelling, we use Standard Deviation as a marker from how far it has moved from the mean. Right now, the China fund has breached -1 SD and based on statistical modelling, it wants to revert to the mean (in technical term this is called regression to the mean). In financial modelling stats; -1 SD... it has a probability of 66.67% to move towards the mean. If it has gone to -2 SD.. then the probability becomes 95.00%. At - 3 SD... the probability becomes 99.99%. -3SD is the max liao. There is no -3.01 SD or whatever.

However do note that in

Black Swan Event all calculations are off as are all the modelling will be null and void.

Xuzen

Yar though keep in mind it went +2 to 3 SD up since er.. a year+/- back

thus this -1D(a bit more) is no biggie gua

ie the stretching of the rubber band UP, snapped back down a bit only comparatively (to its crazy up stretch)

thus, still havent reverted to mean yet (the fall)

thus, probability of it snapping back up after a fall of -1SD(++) is not as per norm

thus, ie dont all in / sai lang yet but may be peck a bit a bit

Just being the devil's advocate here to see 2 sides of the coin yar

This post has been edited by wongmunkeong: Jul 10 2015, 02:19 PM

This post has been edited by wongmunkeong: Jul 10 2015, 02:19 PM

Jul 10 2015, 11:19 AM

Jul 10 2015, 11:19 AM

Quote

Quote

0.0213sec

0.0213sec

1.54

1.54

6 queries

6 queries

GZIP Disabled

GZIP Disabled