QUOTE(wongmunkeong @ Jul 3 2015, 03:41 PM)

Note for newbies: China, although Shanghai index down 25+/-% from highest 12 mths' closing, it is still 80%+ up from 12 mths ago

Thus pls don't go banzai / all-in and then get mowed down yar (then blame the stupid monkey sharing statistics pulak)

Are you talking to me?Thus pls don't go banzai / all-in and then get mowed down yar (then blame the stupid monkey sharing statistics pulak)

This post has been edited by xuzen: Jul 3 2015, 03:55 PM

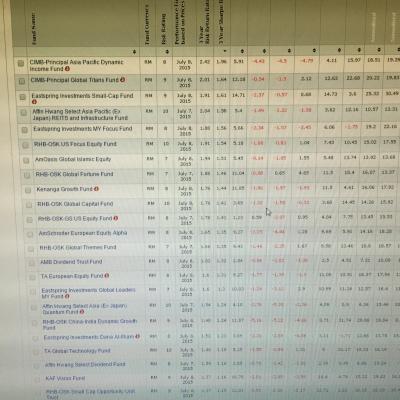

Attached thumbnail(s)

Jul 3 2015, 03:54 PM

Jul 3 2015, 03:54 PM

Quote

Quote

0.0448sec

0.0448sec

0.35

0.35

7 queries

7 queries

GZIP Disabled

GZIP Disabled