reimbursed company allowance? What is that?

Income Tax Issues v4, Scope: e-BE and eB only

Income Tax Issues v4, Scope: e-BE and eB only

|

|

Mar 29 2019, 01:36 AM Mar 29 2019, 01:36 AM

|

Senior Member

3,158 posts Joined: Oct 2013 |

reimbursed company allowance? What is that?

|

|

|

|

|

|

Mar 29 2019, 03:59 AM Mar 29 2019, 03:59 AM

|

Senior Member

756 posts Joined: Dec 2016 |

Recently I was filing my own income tax for 2018, and I begin to realise the negative effects the progressive income tax has on myself.

As my gross income increased over the years, I got taxed much more that I am basically taking home about the same amount between and after an increase in my salary. It appears that the current tax regime demotivates Malaysians to earn more for a better living. It doesn't help when the costs of living is getting higher day by day. I understand that there are people who, after an increase in their income, continue drawing a similar amount of salary from the company, and by a separate agreement invoice their employer using a company registered under the employee's name, so the additional income would go into the company. In this way the employee's personal income will remain at a lower bracket, while the company, as the income is low, will get taxed less. Understandably with a registered Sdn Bhd, you ought to pay a certain amount to maintain the company's registration, accounts, returns, etc. So here my question is: 1. At what gross income range it is sensible to create such a vehicle company, and 2. How much the costs (per year) are we looking at compliance costs, to maintain such a company legally, like secretary, accountant, returns, etc.? 3. What are the typical daily expenses we can take advantage of by using the company, like buying a car under company name, eating out, etc etc to maximise the use of the company for tax optimisation purpose? I am asking on the basis that one is being employed full time and all income are derived from the employment only. Since the personal income tax for taxable income ranging RM70k+ above will get 21%-28%, while company tax starts at 18% for first RM500k, it seems going Sdn Bhd for tax accounting purposes is sensible when we make more than say ~RM100k or so per year? |

|

|

Mar 29 2019, 05:50 AM Mar 29 2019, 05:50 AM

Show posts by this member only | IPv6 | Post

#4883

|

All Stars

52,874 posts Joined: Jan 2003 |

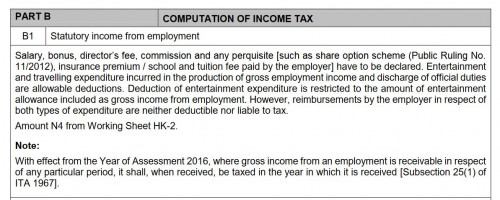

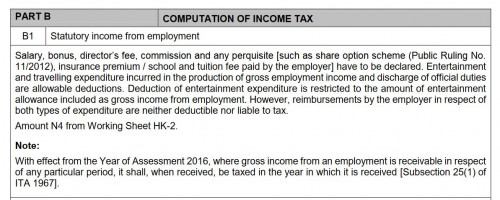

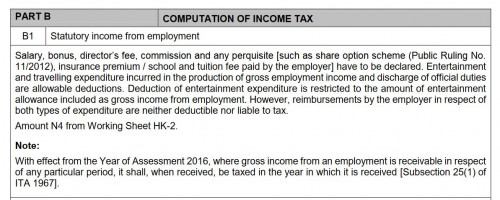

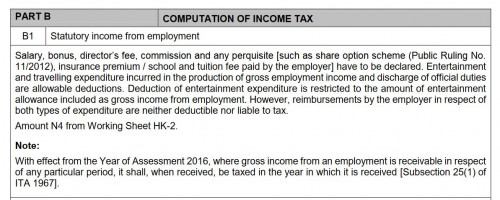

Company allowance can be two kinds:perquisite or benefits in kind (BIK)

BIK is normally tax exempted and will be listed under Section G of your EA form and subject to the annual limit per category as enlisted in the tables at Page 3 & 4 of the Note Penerangan BE. QUOTE Benefits In Kind (BIK) – Annual value of the benefits in kind provided by the employer such as motorcars, petrol, driver, household furnishings, apparatus and appliances, hand phones, asset(s) provided for the purpose of entertainment and recreation. Refer to the Working Sheet HK-2.4, Appendix B3, and Public Ruling No. 3/2013 on computation. For those listed under Section G no action required. If your company listed them under Section B, it is treated as taxable perquisite. If you have ambiguity, please clarify with your company HR or accounts payable who prepared your EA form. QUOTE However, reimbursements by the employer in respect of both types of expenditure are neither deductible nor liable to tax. As far as I know, reimbursable expenses such as business travel expenses are not taxable nor deductible; you pay first, claim per receipt and employer pays back later. This post has been edited by David83: Mar 29 2019, 05:53 AM |

|

|

Mar 29 2019, 09:24 AM Mar 29 2019, 09:24 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(2387581 @ Mar 29 2019, 03:59 AM) .... Paying you full RM5000, the company will have RM5000 as expenses I understand that there are people who, after an increase in their income, continue drawing a similar amount of salary from the company, and by a separate agreement invoice their employer using a company registered under the employee's name, so the additional income would go into the company. In this way the employee's personal income will remain at a lower bracket, while the company, as the income is low, will get taxed less. Understandably with a registered Sdn Bhd, you ought to pay a certain amount to maintain the company's registration, accounts, returns, etc. .......... I am asking on the basis that one is being employed full time and all income are derived from the employment only. ..... vs Paying you RM2000 for employment and RM3000 for "services offered" to you company, the company will still have RM 5000 expenses unless you are a family members of that company,....i doubt that the company would do that to "help" you.... for it may affect their existing direct and indirect costing calculation for product pricing if any. and having the possiblity of being "blackmailed" by you in future i may be wrong, though. |

|

|

Mar 29 2019, 10:00 AM Mar 29 2019, 10:00 AM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(David83 @ Mar 29 2019, 05:50 AM) Company allowance can be two kinds:perquisite or benefits in kind (BIK) Just to correct or precise, just in case some misunderstood. BIK is normally tax exempted and will be listed under Section G of your EA form and subject to the annual limit per category as enlisted in the tables at Page 3 & 4 of the Note Penerangan BE. For those listed under Section G no action required. If your company listed them under Section B, it is treated as taxable perquisite. If you have ambiguity, please clarify with your company HR or accounts payable who prepared your EA form. As far as I know, reimbursable expenses such as business travel expenses are not taxable nor deductible; you pay first, claim per receipt and employer pays back later. BIK is not normally tax exempted. In fact BIK is stated as taxable across except those BIK that listed under Paragraph 9 on the Public Ruling No 3/2013. If one is receiving BIK that not under the tax exemption list and fulling the tax exempted condition, then those BIK is taxable. So, it depends on the nature of the BIK, type of BIK, and situation of the BIK. It is advisable to refer the ruling guidelines. |

|

|

Mar 29 2019, 10:03 AM Mar 29 2019, 10:03 AM

|

All Stars

52,874 posts Joined: Jan 2003 |

To understand more about BIK and perquisite, go read the Public Ruling:

No.3/2013 Benefits In Kind No.2/2013 Perquisites From Employment URL: http://www.hasil.gov.my/bt_goindex.php?bt_...sequ=1&bt_lgv=2 This post has been edited by David83: Mar 29 2019, 10:04 AM |

|

|

|

|

|

Mar 29 2019, 10:27 AM Mar 29 2019, 10:27 AM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(2387581 @ Mar 29 2019, 03:59 AM) Recently I was filing my own income tax for 2018, and I begin to realise the negative effects the progressive income tax has on myself. One needs to realise that personal tax is progressive or step up, while company tax rate is flat across.As my gross income increased over the years, I got taxed much more that I am basically taking home about the same amount between and after an increase in my salary. It appears that the current tax regime demotivates Malaysians to earn more for a better living. It doesn't help when the costs of living is getting higher day by day. I understand that there are people who, after an increase in their income, continue drawing a similar amount of salary from the company, and by a separate agreement invoice their employer using a company registered under the employee's name, so the additional income would go into the company. In this way the employee's personal income will remain at a lower bracket, while the company, as the income is low, will get taxed less. Understandably with a registered Sdn Bhd, you ought to pay a certain amount to maintain the company's registration, accounts, returns, etc. So here my question is: 1. At what gross income range it is sensible to create such a vehicle company, and 2. How much the costs (per year) are we looking at compliance costs, to maintain such a company legally, like secretary, accountant, returns, etc.? 3. What are the typical daily expenses we can take advantage of by using the company, like buying a car under company name, eating out, etc etc to maximise the use of the company for tax optimisation purpose? I am asking on the basis that one is being employed full time and all income are derived from the employment only. Since the personal income tax for taxable income ranging RM70k+ above will get 21%-28%, while company tax starts at 18% for first RM500k, it seems going Sdn Bhd for tax accounting purposes is sensible when we make more than say ~RM100k or so per year? Eg. Personal Income 100K, max tax needs to pay max is 10,900, 10,900/100k = 10.9% (not yet deducted for personal relief, so should be lesser) Income 250k, max tax needs to pay is 46,900, 18.76% (as above if deduct for personal relief, should be lesser) Company 100K income straight away 18% = 18K needs to be paid. While as company you have many compliance things to do, range from SSM, accounting/auditing, potential extra tax form submission, EPF, Socso etc. Also, if the company is not running business, then those expenses like car purchase/petrol etc are not eligible for tax deduction. Even for those company with business, those expenses may be tax deductible, but it is still adding back into personal taxable income in the form of BIK, so still the same. |

|

|

Mar 29 2019, 12:13 PM Mar 29 2019, 12:13 PM

Show posts by this member only | IPv6 | Post

#4888

|

Junior Member

96 posts Joined: Feb 2011 |

Hi, I have some questions.

Scenario: I am working with government as a full time pharmacist. For this employment income, i have no issue as I know the transportation cannot be claimed because we have elaun sara hidup etc. I am also working as locum in retail pharmacy. I have to spend Rm300 to get license to practice in the pharmacy. I took grab to and from work. Sometimes driving. Is the expenses (travelling and license) can be deducted from the locum gross income? I called to LHDN care line. I was informed that locum is penggajian and we cannot deduct expenses compared to those doing grab business. May I know any sifu here have any comment on this? Thanks in advance If based on this nota penerangan, it sounds like yes, i can deduct for my expenses?  This post has been edited by :XO: Mar 29 2019, 12:19 PM |

|

|

Mar 29 2019, 12:36 PM Mar 29 2019, 12:36 PM

|

All Stars

14,932 posts Joined: Mar 2015 |

QUOTE(:XO @ Mar 29 2019, 12:13 PM) Hi, I have some questions. that nota penerangan is same as posted in the top page...thus there are some comment about it...Scenario: I am working with government as a full time pharmacist. For this employment income, i have no issue as I know the transportation cannot be claimed because we have elaun sara hidup etc. I am also working as locum in retail pharmacy. I have to spend Rm300 to get license to practice in the pharmacy. I took grab to and from work. Sometimes driving. Is the expenses (travelling and license) can be deducted from the locum gross income? I called to LHDN care line. I was informed that locum is penggajian and we cannot deduct expenses compared to those doing grab business. May I know any sifu here have any comment on this? Thanks in advance If based on this nota penerangan, it sounds like yes, i can deduct for my expenses?  not an expert in this...but I think travelling expenses to work cannot be deducted from gross income for personal tax...i think YES for business tax but about the license fees...... Q 17, page 4 http://lampiran1.hasil.gov.my/pdf/pdfam/FA..._01042011_1.pdf just that I am not sure about yours..... |

|

|

Mar 29 2019, 03:11 PM Mar 29 2019, 03:11 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(:XO @ Mar 29 2019, 12:13 PM) Hi, I have some questions. Only if you register a business and receive those income through the business entity.Scenario: I am working with government as a full time pharmacist. For this employment income, i have no issue as I know the transportation cannot be claimed because we have elaun sara hidup etc. I am also working as locum in retail pharmacy. I have to spend Rm300 to get license to practice in the pharmacy. I took grab to and from work. Sometimes driving. Is the expenses (travelling and license) can be deducted from the locum gross income? I called to LHDN care line. I was informed that locum is penggajian and we cannot deduct expenses compared to those doing grab business. May I know any sifu here have any comment on this? Thanks in advance If based on this nota penerangan, it sounds like yes, i can deduct for my expenses?  Personal employment income whether full time or part time, it is the same. If full time job cannot claim those expenses, then it is same for part time. Those deductibles stated eg. Your employer pay your an amount of travel allowances because you are need to travel to perform your job. Then specific amount of travel allowance is tax deductible. Doing grab is a business, not employment. |

|

|

Mar 29 2019, 10:14 PM Mar 29 2019, 10:14 PM

Show posts by this member only | IPv6 | Post

#4891

|

Junior Member

96 posts Joined: Feb 2011 |

QUOTE(MUM @ Mar 29 2019, 12:36 PM) that nota penerangan is same as posted in the top page...thus there are some comment about it... not an expert in this...but I think travelling expenses to work cannot be deducted from gross income for personal tax...i think YES for business tax but about the license fees...... Q 17, page 4 http://lampiran1.hasil.gov.my/pdf/pdfam/FA..._01042011_1.pdf just that I am not sure about yours..... QUOTE(cherroy @ Mar 29 2019, 03:11 PM) Only if you register a business and receive those income through the business entity. I have FOUND the answer!Personal employment income whether full time or part time, it is the same. If full time job cannot claim those expenses, then it is same for part time. Those deductibles stated eg. Your employer pay your an amount of travel allowances because you are need to travel to perform your job. Then specific amount of travel allowance is tax deductible. Doing grab is a business, not employment. http://lampiran1.hasil.gov.my/pdf/pdfam/BE...Guidebook_2.pdf HK-2 : COMPUTATION OF STATUTORY INCOME FROM EMPLOYMENT Below F. TOTAL GROSS EMPLOYMENT INCOME (A to E) LESS: G. Subscriptions to professional bodies H. Entertainment expenditure (restricted—section 38A) J. Travelling expenditure QUOTE Subscriptions Compulsory membership subscriptions paid to professional - - to professional bodies to ensure the continuance of a professional standing bodies and practice such as those paid by those in the medical and legal profession. QUOTE Travelling Travelling expenditure wholly and exclusively incurred in the - - expenditure production of gross employment income is deductible. 1. The full amount of allowance must be included in the gross employment income irrespective of whether this expenditure is wholly or partly deductible. 2. Reimbursements received from the employer in respect of travelling is neither liable to tax nor deductible. 3. Travelling expenditure is not deductible if incurred in travelling to and from the house and place of work. Example : Annual salary RM30,000 Annual travelling allowance RM 6,000 Amount expended on travelling in the discharge of official duties is RM5,000. Amount of deduction allowed is RM5,000. |

|

|

Mar 30 2019, 07:10 AM Mar 30 2019, 07:10 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(:XO @ Mar 29 2019, 12:13 PM) ......... I took grab to and from work. Sometimes driving. Is the expenses (travelling and license) can be deducted from the locum gross income? ........ QUOTE |

|

|

Mar 30 2019, 10:19 AM Mar 30 2019, 10:19 AM

|

Junior Member

299 posts Joined: Jun 2006 |

QUOTE(spreeeee @ Mar 25 2019, 04:18 PM) called, and they asked to download form and then submitted to counter.. forgot to ask what form.. the line so difficult to get thru till now.. any idea what form? QUOTE(David83 @ Mar 25 2019, 04:20 PM) How To Claim For A Tax Refund Just to update everyone here, I finally got the excess amount in my e lejar. I called on the 15th and the amount was credited to my account on 29th. I didnt fill in any forms, just called LHDN and instructed them to credit the excess to my account.Tax Refund will be credited into the account automatically to the taxpayer within 30 working days after the submission of Income Tax Return Forms (ITRF). However, if you do not receive your refund, you can forward your application to the Collections Unit of the branch where your file is located or complete and submit via our Feedback Form http://maklumbalas.hasil.gov.my/ or by calling Hasil Care Line at toll free number 1-800-88-5436 (LHDN). URL: http://www.hasil.gov.my/bt_goindex.php?bt_...5000&bt_sequ=10 A quick check on my e lejar still shows the excess amount though. I guess its not updated yet. |

|

|

|

|

|

Mar 31 2019, 09:58 AM Mar 31 2019, 09:58 AM

Show posts by this member only | IPv6 | Post

#4894

|

Senior Member

5,901 posts Joined: Sep 2009 |

QUOTE(2387581 @ Mar 29 2019, 03:59 AM) Recently I was filing my own income tax for 2018, and I begin to realise the negative effects the progressive income tax has on myself. Yes, using a Sdn Bhd to receive income in excess of RM250k pa, would save you about at least RM30k+/- tax a yearAs my gross income increased over the years, I got taxed much more that I am basically taking home about the same amount between and after an increase in my salary. It appears that the current tax regime demotivates Malaysians to earn more for a better living. It doesn't help when the costs of living is getting higher day by day. I understand that there are people who, after an increase in their income, continue drawing a similar amount of salary from the company, and by a separate agreement invoice their employer using a company registered under the employee's name, so the additional income would go into the company. In this way the employee's personal income will remain at a lower bracket, while the company, as the income is low, will get taxed less. Understandably with a registered Sdn Bhd, you ought to pay a certain amount to maintain the company's registration, accounts, returns, etc. So here my question is: 1. At what gross income range it is sensible to create such a vehicle company, and 2. How much the costs (per year) are we looking at compliance costs, to maintain such a company legally, like secretary, accountant, returns, etc.? 3. What are the typical daily expenses we can take advantage of by using the company, like buying a car under company name, eating out, etc etc to maximise the use of the company for tax optimisation purpose? I am asking on the basis that one is being employed full time and all income are derived from the employment only. Since the personal income tax for taxable income ranging RM70k+ above will get 21%-28%, while company tax starts at 18% for first RM500k, it seems going Sdn Bhd for tax accounting purposes is sensible when we make more than say ~RM100k or so per year? If you have enough people as directors in your own created Sdn Bhd to "distribute income" in directors fees , tax saving can be even more. is like you have income eg RM300k, you only want to pay tax on 120k, remainder 180k you distribute to others to pay tax individually at lower brackets. And quite alot of things can claim with Sdn Bhd. Start a Sdn Bhd is easy, cost around RM2-3k, can buy from the shelf also. Maintain it may cost RM3-5k, depending on how active is the accounts But to close a Sdn Bhd is not easy, can cost you upto RM5k or more. |

|

|

Mar 31 2019, 10:08 AM Mar 31 2019, 10:08 AM

Show posts by this member only | IPv6 | Post

#4895

|

Senior Member

5,901 posts Joined: Sep 2009 |

QUOTE(:XO @ Mar 29 2019, 12:13 PM) Hi, I have some questions. Locum income is "employment" category but you can convert it to "business" category if you ask the pharmacy to sign an agreementScenario: I am working with government as a full time pharmacist. For this employment income, i have no issue as I know the transportation cannot be claimed because we have elaun sara hidup etc. I am also working as locum in retail pharmacy. I have to spend Rm300 to get license to practice in the pharmacy. I took grab to and from work. Sometimes driving. Is the expenses (travelling and license) can be deducted from the locum gross income? I called to LHDN care line. I was informed that locum is penggajian and we cannot deduct expenses compared to those doing grab business. May I know any sifu here have any comment on this? Thanks in advance If based on this nota penerangan, it sounds like yes, i can deduct for my expenses?  taking you as independent Pharmacist being paid professional fees each time you work for them and include all those fees payable by you as a requirement to be employed. However looks like the amount you can deduct is only RM300, probably not worth the hassle. |

|

|

Mar 31 2019, 12:07 PM Mar 31 2019, 12:07 PM

|

Senior Member

1,757 posts Joined: May 2011 |

QUOTE(guy3288 @ Mar 31 2019, 09:58 AM) Yes, using a Sdn Bhd to receive income in excess of RM250k pa, would save you about at least RM30k+/- tax a year What do u mean can buy from the shelf also?If you have enough people as directors in your own created Sdn Bhd to "distribute income" in directors fees , tax saving can be even more. is like you have income eg RM300k, you only want to pay tax on 120k, remainder 180k you distribute to others to pay tax individually at lower brackets. And quite alot of things can claim with Sdn Bhd. Start a Sdn Bhd is easy, cost around RM2-3k, can buy from the shelf also. Maintain it may cost RM3-5k, depending on how active is the accounts But to close a Sdn Bhd is not easy, can cost you upto RM5k or more. This post has been edited by drbone: Mar 31 2019, 12:07 PM |

|

|

Mar 31 2019, 12:11 PM Mar 31 2019, 12:11 PM

|

All Stars

14,932 posts Joined: Mar 2015 |

QUOTE(drbone @ Mar 31 2019, 12:07 PM) while waiting for his clarification response.....I think, think only ....some company secretaries has on hand registered ready companies which would make the need to have registered company quickly but those who needed them in a hurry...they just transfer the ownership. |

|

|

Mar 31 2019, 12:35 PM Mar 31 2019, 12:35 PM

|

Senior Member

1,757 posts Joined: May 2011 |

QUOTE(MUM @ Mar 31 2019, 12:11 PM) while waiting for his clarification response..... Thanks for that info. I think, think only ....some company secretaries has on hand registered ready companies which would make the need to have registered company quickly but those who needed them in a hurry...they just transfer the ownership. |

|

|

Mar 31 2019, 01:11 PM Mar 31 2019, 01:11 PM

|

Senior Member

756 posts Joined: Dec 2016 |

QUOTE(guy3288 @ Mar 31 2019, 09:58 AM) Yes, using a Sdn Bhd to receive income in excess of RM250k pa, would save you about at least RM30k+/- tax a year Thanks for your reply which answers what I asked!If you have enough people as directors in your own created Sdn Bhd to "distribute income" in directors fees , tax saving can be even more. is like you have income eg RM300k, you only want to pay tax on 120k, remainder 180k you distribute to others to pay tax individually at lower brackets. And quite alot of things can claim with Sdn Bhd. Start a Sdn Bhd is easy, cost around RM2-3k, can buy from the shelf also. Maintain it may cost RM3-5k, depending on how active is the accounts But to close a Sdn Bhd is not easy, can cost you upto RM5k or more. |

|

|

Mar 31 2019, 04:56 PM Mar 31 2019, 04:56 PM

Show posts by this member only | IPv6 | Post

#4900

|

Junior Member

642 posts Joined: Jul 2006 |

Hi, may i know what can be put under "Skim persaraan swasta dan anuiti tertangguh" tax relief ?

thanks |

| Change to: |  0.0248sec 0.0248sec

0.52 0.52

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 12:14 PM |