QUOTE(wong_86 @ Mar 1 2021, 08:56 AM)

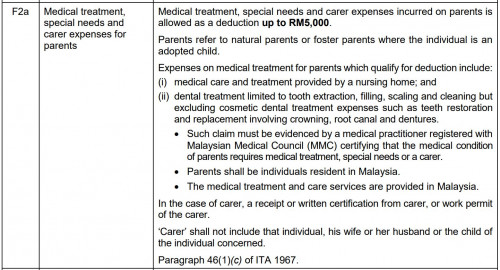

Not sure if it qualifies as medical expenses:

Income Tax Issues v4, Scope: e-BE and eB only

|

|

Mar 1 2021, 09:01 AM Mar 1 2021, 09:01 AM

Return to original view | IPv6 | Post

#241

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Mar 1 2021, 09:07 AM Mar 1 2021, 09:07 AM

Return to original view | IPv6 | Post

#242

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(speedo @ Mar 1 2021, 08:57 AM) hi, want to ask. anak angkat ,can get rebate? officially anak angkat. couldnt find answer in nota penerangan.tq Yes if you got legal document to support:(9) In this section “child”, in relation to an individual or his wife, means a legitimate child or step-child of his or his wife, or a child proved to the satisfaction of the Director General to have been adopted by the individual or his wife in accordance with any law http://www.agc.gov.my/agcportal/uploads/fi...2011%202017.pdf speedo liked this post

|

|

|

Mar 1 2021, 11:21 AM Mar 1 2021, 11:21 AM

Return to original view | IPv6 | Post

#243

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(mytaffeta @ Mar 1 2021, 10:38 AM) lol i dont understand this new interface.. can someone guide which to click to start fill in wages details etc? Login into https://mytax.hasil.gov.my/Click on e-Filing under Perkhidmatan Pilihan or from side tahb under Perkhidmatan ezHail Select e-BE Tahun Taksiran 2020 Start to fill in section by section:  WaNaWe900 liked this post

|

|

|

Mar 1 2021, 07:21 PM Mar 1 2021, 07:21 PM

Return to original view | IPv6 | Post

#244

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Human Nature @ Mar 1 2021, 07:12 PM) Isn't the medical cost has increased which means that the premium paid (eligible for tax relief) for medical coverage portion may not be the same as last year?This post has been edited by GrumpyNooby: Mar 1 2021, 07:22 PM |

|

|

Mar 1 2021, 07:49 PM Mar 1 2021, 07:49 PM

Return to original view | IPv6 | Post

#245

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(coolguy_0925 @ Mar 1 2021, 07:47 PM) Yes you're right I'm not able to validate this portion as I had signed up for premium increase last year. Mine although total same as last YA but the portion between life and medical changed where medical gets higher now Luckily my EA is holding me back otherwise... Thanks for the confirmation. |

|

|

Mar 1 2021, 09:24 PM Mar 1 2021, 09:24 PM

Return to original view | IPv6 | Post

#246

|

All Stars

12,387 posts Joined: Feb 2020 |

I'm very curious due to the spike of interest in the F19 Payment for accommodation at premises registered with the Commissioner of Tourism and entrance fee to a tourist attraction.

Just wondering how much tax saving are you guys getting for just filing this tax relief? Is it very significant compared to the tax paid? Let's say one did utilize fully by paying RM 1000 for either or both accommodation and entrance fee. Given the average tax bracket of an average M40 with taxable income of RM 100k to RM 250k, the tax rate is 24%. Expected tax saving (refund due to excess) is RM 240. RM 240 vs total paid tax of RM 46.9k |

|

|

|

|

|

Mar 1 2021, 09:33 PM Mar 1 2021, 09:33 PM

Return to original view | IPv6 | Post

#247

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(lee82gx @ Mar 1 2021, 09:32 PM) No, because in some way or another, i think it is norm for hotel to just precharge you during booking without receipt and when you actually stay and check out, only then do they issue you a final receipt.... When you're at 24% to 24.5% tax rate, you have no more eyes on McD meals.RM240 is not a lot to many, but it is still equivalent to 15 McDonald meals. 24% tax rate -> Chargeable income is RM 100k to 250k 24.5% tax rate -> Chargeable income is RM 250k to 400k Note: It's chargeable income not gross income. This post has been edited by GrumpyNooby: Mar 1 2021, 09:35 PM |

|

|

Mar 1 2021, 10:26 PM Mar 1 2021, 10:26 PM

Return to original view | IPv6 | Post

#248

|

All Stars

12,387 posts Joined: Feb 2020 |

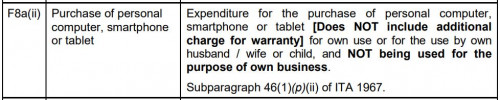

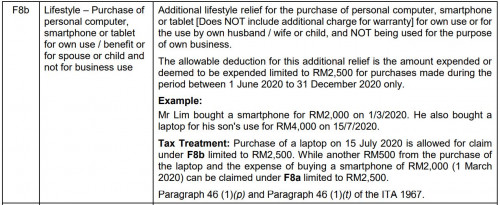

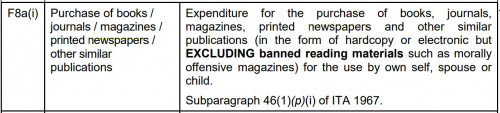

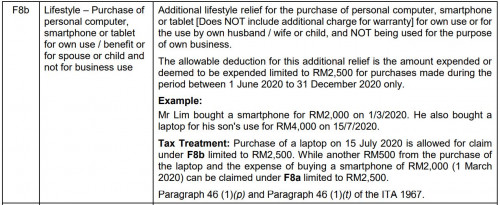

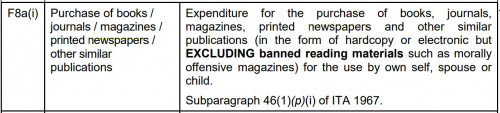

QUOTE(Humorboy @ Mar 1 2021, 10:25 PM) Lifestyle - Expenses for the use / benefit of self, spouse or child Graphic cards only is not qualified for tax relief under both sections.Lifestyle – Purchase of personal computer, smartphone or tablet for self, spouse or child use / benefit and not for business use hi all i buy my graphic card on Dec 2020 means i can put the same figure in both column? cause the 2nd lifestyle is additional relief for comp purchase from June 2020 to Dec 2020   F8a(ii) - must be fully functioning computer system (desktop), laptop, smartphone and tablet F8b - must be either laptop, smartphone or tablet This post has been edited by GrumpyNooby: Mar 1 2021, 10:29 PM WaNaWe900 liked this post

|

|

|

Mar 2 2021, 09:17 AM Mar 2 2021, 09:17 AM

Return to original view | IPv6 | Post

#249

|

All Stars

12,387 posts Joined: Feb 2020 |

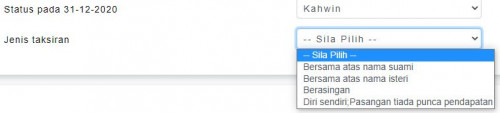

QUOTE(neko_azusa @ Mar 2 2021, 09:09 AM) Hi. Can anyone confirm on this? If my husband did not work throughout 2020, I can claim a tax relief for this as a wife? Where in the BE form is this deduction section? Did you update Section 1 Profil Individu?From Income Tax Act 1967:   You also need to key in Tarikh Kahwin in order to save the details on this page. This post has been edited by GrumpyNooby: Mar 2 2021, 09:18 AM neko_azusa liked this post

|

|

|

Mar 2 2021, 09:48 AM Mar 2 2021, 09:48 AM

Return to original view | IPv6 | Post

#250

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(neko_azusa @ Mar 2 2021, 09:46 AM) This section i'm actually confused which to select. So in my case, as husband did not work, I choose "diri sendiri, pasangan tiada punca pendapatan" right? It depends how you want to work on the tax saving advantage.If in future once he worked, should i choose berasingan or bersama atas nama suami? Read more from the shared link: https://www.imoney.my/articles/i-do-tax-returns This post has been edited by GrumpyNooby: Mar 2 2021, 09:48 AM |

|

|

Mar 2 2021, 09:50 AM Mar 2 2021, 09:50 AM

Return to original view | IPv6 | Post

#251

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(neko_azusa @ Mar 2 2021, 09:48 AM) With my reply above to GrumpyNooby, so i should be choosing "bersama atas nama isteri" or "sendiri, pasangan tiada punca pendapatan"? It is all about tax saving advantage as there's not simple strategy for it. Omg. Confused. If both working spouses chooses for separate assessment vs joint assessment. This post has been edited by GrumpyNooby: Mar 2 2021, 09:52 AM |

|

|

Mar 2 2021, 02:11 PM Mar 2 2021, 02:11 PM

Return to original view | IPv6 | Post

#252

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Mar 2 2021, 04:17 PM Mar 2 2021, 04:17 PM

Return to original view | IPv6 | Post

#253

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(jian5481 @ Mar 2 2021, 04:13 PM) For medical and education insurance, I'm aware that we can claim for spouse and child as well. What about life insurance? Only self? Self and/or spouse for life insurance policyThis post has been edited by GrumpyNooby: Mar 2 2021, 04:18 PM |

|

|

|

|

|

Mar 2 2021, 05:29 PM Mar 2 2021, 05:29 PM

Return to original view | IPv6 | Post

#254

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Mar 2 2021, 06:45 PM Mar 2 2021, 06:45 PM

Return to original view | IPv6 | Post

#255

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(kenloh7 @ Mar 2 2021, 06:41 PM) for the purchase of newspaper subscription, can i claim it under lifestyle tax if it's under my mum's name? Receipt under whose name claims under that tax return filer as evidenced by receipts issued in respect of the purchase or payment, as the case may be, and the total deduction under this paragraph is subject to a maximum amount of two thousand five hundred ringgit; This post has been edited by GrumpyNooby: Mar 2 2021, 06:45 PM |

|

|

Mar 2 2021, 08:33 PM Mar 2 2021, 08:33 PM

Return to original view | IPv6 | Post

#256

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(mostwanted82 @ Mar 2 2021, 08:32 PM) For the lifestyle and special additional lifestyle tax relief, if I purchased a laptop worth RM 5k, can I fill 2.5k each in the 2 buckets? Yes, provided laptop purchased after 1/6/2020 This post has been edited by GrumpyNooby: Mar 2 2021, 08:34 PM mostwanted82 liked this post

|

|

|

Mar 2 2021, 08:41 PM Mar 2 2021, 08:41 PM

Return to original view | IPv6 | Post

#257

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Mar 2 2021, 10:12 PM Mar 2 2021, 10:12 PM

Return to original view | IPv6 | Post

#258

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Stormfury @ Mar 2 2021, 10:11 PM) Yes Stormfury liked this post

|

|

|

Mar 2 2021, 10:16 PM Mar 2 2021, 10:16 PM

Return to original view | IPv6 | Post

#259

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Stormfury @ Mar 2 2021, 10:15 PM) Nota Penerangan BE 2020 or BE 2020 Explanatory Noteshttp://www.hasil.gov.my/pdf/pdfam/Explanat...es_BE2020_2.pdf This post has been edited by GrumpyNooby: Mar 2 2021, 10:17 PM Stormfury liked this post

|

|

|

Mar 3 2021, 04:08 AM Mar 3 2021, 04:08 AM

Return to original view | IPv6 | Post

#260

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Thalmes @ Mar 2 2021, 11:08 PM) Hey guys - need help and can't find a clear answer on this -- Section F is tax exempted BIK. No need to put into BE form and therefore no action required if it is still within the eligible annual limit.I have 2 EA forms as I switched job mid-year. Form 1 - got section F clearly outlines "TOTAL TAX EXEMPT" Form 2 - does not have "F" but it does say "TOTAL TAX EXEMPT" at the end of the form To fill this correctly - do we take the gross income (plus all fees / tips) and minus F (since it's tax exempted) -- we will then put the final number as declaration? This is really confusing! Thanks in advance. It's employers responsibility to report and list out BIK. |

| Change to: |  0.2332sec 0.2332sec

0.91 0.91

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 10:43 AM |