QUOTE(HoPeLeSsLiNg @ May 2 2016, 05:40 PM)

nope Income Tax Issues v4, Scope: e-BE and eB only

Income Tax Issues v4, Scope: e-BE and eB only

|

|

May 2 2016, 05:41 PM May 2 2016, 05:41 PM

|

All Stars

48,448 posts Joined: Sep 2014 From: REality |

|

|

|

|

|

|

May 2 2016, 05:48 PM May 2 2016, 05:48 PM

|

Junior Member

119 posts Joined: May 2009 |

|

|

|

May 3 2016, 12:32 AM May 3 2016, 12:32 AM

|

Junior Member

477 posts Joined: Jan 2003 From: Klang |

Telah melupuskan syer dalam syarikat harta tanah dan/atau harta tanah di bawah Akta Cukai Keuntungan Harta Tanah 1976 <-----wat is this...tick ya atau tidak?

|

|

|

May 3 2016, 12:40 AM May 3 2016, 12:40 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(hickups @ May 3 2016, 12:32 AM) Telah melupuskan syer dalam syarikat harta tanah dan/atau harta tanah di bawah Akta Cukai Keuntungan Harta Tanah 1976 <-----wat is this...tick ya atau tidak? same question as per post 712, page 36 post 808, page 41 This post has been edited by T231H: May 3 2016, 12:57 AM Attached thumbnail(s)

|

|

|

May 3 2016, 11:01 AM May 3 2016, 11:01 AM

|

Junior Member

20 posts Joined: Jul 2012 |

sifus here....need some help...

i hav both full time and part time job... full time under employement and part time as insurance agent.... as previously im full time insurance agent hence i open my income tax file under Borang B, and last 2 years only start to convert insurance to part time... even though with full time and part time job, i remain to submit my income tax under Borang B.... now my part time job income is higher than full time (office job), and total income for both is above 100k (which i not granted personal relief of 2k), so my question is: - For assessment of 2015, can i declare under Borang BE (AS IF UNDER BORANG B, it seems i will incur so call buinsess tax in later part) - Anyway for me to submit vouluntary on my monthly tax deduction for my part time job instead of one short paying during assessment period? |

|

|

May 3 2016, 01:56 PM May 3 2016, 01:56 PM

|

Senior Member

1,648 posts Joined: Jan 2005 |

If that only me or everybody can't login into ez.hasil ?

|

|

|

|

|

|

May 3 2016, 02:53 PM May 3 2016, 02:53 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

|

|

|

May 4 2016, 08:17 AM May 4 2016, 08:17 AM

|

All Stars

10,314 posts Joined: Dec 2009 From: Malaysia |

still not refunded yet. submitted on 11th apr.

sob sob sob |

|

|

May 4 2016, 09:50 AM May 4 2016, 09:50 AM

|

Junior Member

285 posts Joined: Mar 2010 |

Greetings everyone,

If I didn't do the filing or declare my income, will there be punishment or something? Thanks in advance. |

|

|

May 4 2016, 01:25 PM May 4 2016, 01:25 PM

|

All Stars

14,888 posts Joined: Mar 2015 |

|

|

|

May 4 2016, 01:34 PM May 4 2016, 01:34 PM

|

Junior Member

285 posts Joined: Mar 2010 |

|

|

|

May 4 2016, 01:43 PM May 4 2016, 01:43 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

|

|

|

May 4 2016, 01:47 PM May 4 2016, 01:47 PM

|

Junior Member

285 posts Joined: Mar 2010 |

|

|

|

|

|

|

May 4 2016, 01:49 PM May 4 2016, 01:49 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

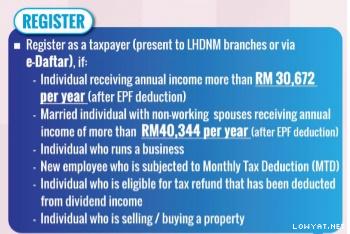

QUOTE(OldSchoolJoke @ May 4 2016, 01:34 PM) I'm working in Malaysia and my income is RM3k, which I checked is not within the taxable amount. see this,..hope it can provide some added infoHow about it? Still need to file it? http://www.hasil.gov.my/bt_goindex.php?bt_...nit=1&bt_sequ=1 http://www.hasil.gov.my/pdf/pdfam/RISALAH_R1_BI_15.pdf Attached image(s)  |

|

|

May 4 2016, 02:02 PM May 4 2016, 02:02 PM

|

Junior Member

285 posts Joined: Mar 2010 |

QUOTE(T231H @ May 4 2016, 01:49 PM) see this,..hope it can provide some added info Thanks alot for the info. Will read when I got the time.http://www.hasil.gov.my/bt_goindex.php?bt_...nit=1&bt_sequ=1 http://www.hasil.gov.my/pdf/pdfam/RISALAH_R1_BI_15.pdf |

|

|

May 4 2016, 07:34 PM May 4 2016, 07:34 PM

|

Senior Member

6,426 posts Joined: Jun 2005 |

QUOTE(cherroy @ May 4 2016, 01:43 PM) QUOTE(T231H @ May 4 2016, 01:49 PM) see this,..hope it can provide some added info I thought if u r not existing tax payer (especially for fresh grad) and ur income has not reach the taxable income level, u can choose not to do tax filing.. If u have yet to reach the taxable income level, y u want to put urself in trouble to report that every year.. Unless u have PCB paid that u want them to refund.. Correct me if my understanding is incorrect..http://www.hasil.gov.my/bt_goindex.php?bt_...nit=1&bt_sequ=1 http://www.hasil.gov.my/pdf/pdfam/RISALAH_R1_BI_15.pdf |

|

|

May 4 2016, 07:51 PM May 4 2016, 07:51 PM

|

Senior Member

10,001 posts Joined: May 2013 |

|

|

|

May 4 2016, 07:54 PM May 4 2016, 07:54 PM

Show posts by this member only | IPv6 | Post

#1078

|

Junior Member

285 posts Joined: Mar 2010 |

|

|

|

May 5 2016, 05:49 PM May 5 2016, 05:49 PM

|

Junior Member

20 posts Joined: Jul 2012 |

|

|

|

May 5 2016, 05:52 PM May 5 2016, 05:52 PM

|

Newbie

3 posts Joined: May 2016 |

Hi,

I have medical insurance so I can get tax relief of 3K for self. My husband has medical issues and does not have any personal medical insurance. Our child's medical insurance is under my name. Question: 1. How can I maximise the tax relief for the both of us for medical insurance? 2. Can I claim my child's insurance, and my husband claim for mine (meaning he pays for spouse)? 3. Or does the clause "self/spouse/child" is only applicable if it's a joint assessment or if the spouse is not working? 4. For YA2016, can I arrange for my insurance payment to be charge to my husband's credit card (and he claims medical insurance paid for spouse)? Thanks in advance to all the sifus! |

| Change to: |  0.0243sec 0.0243sec

0.20 0.20

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 12:21 AM |