QUOTE(j.passing.by @ Nov 29 2020, 03:18 AM)

Are you sure you are asking what you want to know?

Maybe I'm reading it wrong, but anyway, below is copy and paste from previous posts...

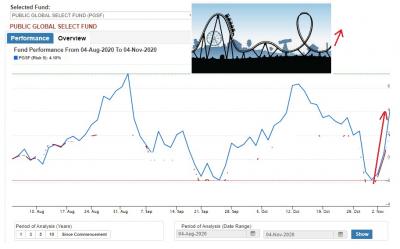

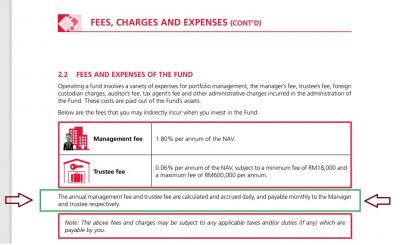

"As for the annual management fee and trustee fee, I don’t really pay much attention to them.. What we should understand is that the reported return on any funds is the net return..."

"As mentioned in an earlier post, a variable priced mutual fund is re-priced at the end of every business day; and its NAV/unit price is then made known latter at night or the following working day. NAV means NET Asset Value; meaning the value is a net figure and already taken into account its management & trustee fee..."Lastly, we don't pay any annual fee in Public Mutual funds. We only pay the one time sales charge, which is a sales commission.

Some online investment platform or online fund agents may have annual fee for using them to purchase funds indirectly from the fund companies, but their sales charge or commission is very much lower... as low as 1.5% or lower.

EPF i-invest has 0% service charge (effective from 1.05.2020 to 30.04.2021)... and no annual platform fee.

(But if you are referring to and interested in the above stated fund, it is sold only by PM and its agents... cannot buy it elsewhere. Open your wallet, and pay the commission.)

Net return minus off sales charge to be exact.

Annual fee is already factored inside. means it has annual fee. statement is there. no matter how someone twist it, one still cannot deny the fact that the management fee is 1.8% per annum.

to make it more clearly, if annual management fee is 1.8%, it also means that they charge their customer 0.00493% daily

say, if you have invested RM10k (take off sales charge of 5.5% will leave you RM9.45K. everyday they will minus off 46 sen (assuming the NAV stays constant).

so if the UT consultant say, our fund can perform an average of 8% per annum. you will have to expect the investment return is 10% in order to offset the management cost to give you 8% return per annum

Oct 20 2020, 12:18 PM

Oct 20 2020, 12:18 PM

Quote

Quote

0.0311sec

0.0311sec

0.43

0.43

6 queries

6 queries

GZIP Disabled

GZIP Disabled