QUOTE(j.passing.by @ Jul 19 2017, 03:08 PM)

Things are looking bright this year, most of the equity funds are giving good YTD returns so far... and as usual when things are going well, a new fund is being launched by Public Mutual.

Capitalise on Public e-Flexi Allocation Fund for higher potential growth:

- Only RM100 to start the investment.

- Up to 98% in equity or fixed income securities.

- Up to 30% in foreign markets.

- Up to 3.75% sales charge.

- Initial Issue Price: RM0.25 per unit during Offer Period (14 July to 3 August 2017).

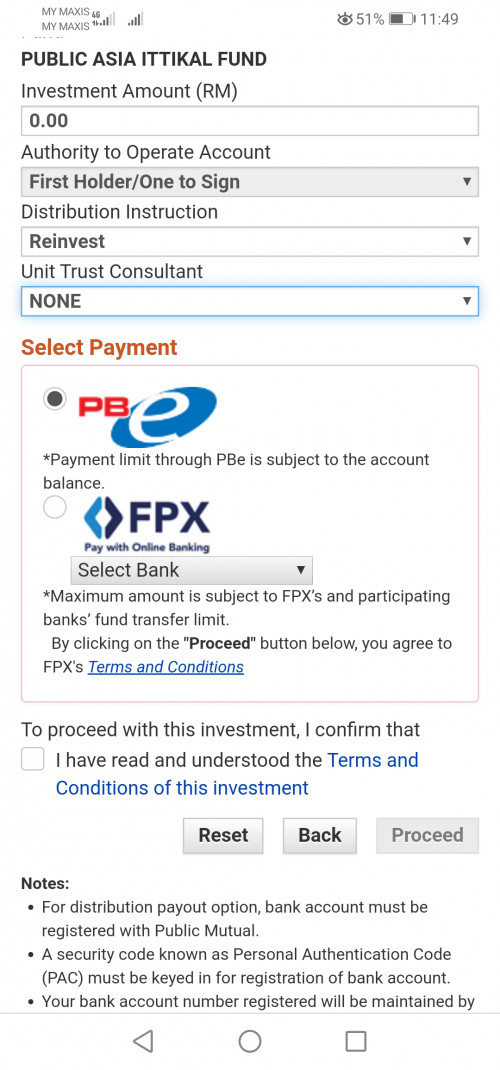

- Invest via Public Mutual Online

Comments:

- This is a active allocation fund which can swings from totally from equity to fixed income securities... the other permanent 2% of the fund is in liquid assets.

- This is the only fund in Public Mutual that has redemption charges. If it is redeem within 2 years, there is a 2% charge.

- It is mainly a local fund investing into the local Bursa, and it is allowed to invest up to 30% into foreign equities.

- As stated above (in blue), it has a lower sales charge than usual as it is via its online service.

=================

Far East and China funds were going great last week, and they are still maintaining their tempo this week. Most of you UT investors would be having portfolios at all time high.

PB Asia Emerging Growth Fund yesterday's daily increase was 2.40%, which is quite unbelievable and it could maybe a typo or a mistake! Let's see whether the price will be re-adjusted tomorrow...

Cheers.

🙄 anyone invest in Public e-Flexi Allocation Fund? No body mention? Seen like not popular.Capitalise on Public e-Flexi Allocation Fund for higher potential growth:

- Only RM100 to start the investment.

- Up to 98% in equity or fixed income securities.

- Up to 30% in foreign markets.

- Up to 3.75% sales charge.

- Initial Issue Price: RM0.25 per unit during Offer Period (14 July to 3 August 2017).

- Invest via Public Mutual Online

Comments:

- This is a active allocation fund which can swings from totally from equity to fixed income securities... the other permanent 2% of the fund is in liquid assets.

- This is the only fund in Public Mutual that has redemption charges. If it is redeem within 2 years, there is a 2% charge.

- It is mainly a local fund investing into the local Bursa, and it is allowed to invest up to 30% into foreign equities.

- As stated above (in blue), it has a lower sales charge than usual as it is via its online service.

=================

Far East and China funds were going great last week, and they are still maintaining their tempo this week. Most of you UT investors would be having portfolios at all time high.

PB Asia Emerging Growth Fund yesterday's daily increase was 2.40%, which is quite unbelievable and it could maybe a typo or a mistake! Let's see whether the price will be re-adjusted tomorrow...

Cheers.

Aug 19 2017, 02:54 PM

Aug 19 2017, 02:54 PM

Quote

Quote

0.1031sec

0.1031sec

0.65

0.65

7 queries

7 queries

GZIP Disabled

GZIP Disabled