i want to share my unit trust experience, not public bank but with CIMB which i think everyone should know and be aware

i start put into unit trust at 2015 and i waiting exactly 5 years or more to provide this review

my conclusion is unit trust is only fund manager make money (short version)

ok here comes the long version

so 5 years ago May 2015 i go meet up with an agent and open account, sign some form, do some thumb print and only invested RM10,000 from my EPF.

I buy into Fund Principal Titans Growth & Income Fund (one of the hot hot fund that time)

Now after 5 years my hard earn RM10,000 only got a total of 13.50% profit

Then i ask myself why only 13.50% of profit since every year annual report show earn money most of the time except for 1 of the year where it is -10%

Below chart show from May when i buy in till now in July

If 5 years ago i did not make such decision to put money into unit trust, you know how much the RM10,000 will become?

The answer is RM13457.39 which is a 34% profit instead of now 13.5% profit

So i further investigate and dig deeper with FSM tool and the tool say i should earn around 16.5% so where the 3% go to?

Here is the answer, last time 5 years ago invest with EPF they will charge sales fee of around 3% so 16.5% - 3% become 13.5%

Again all this is just estimate

My conclusion is we take our money to let fund manager earn more money than we do

only invest in UT if u have a good and reliable agent who can help u to manage

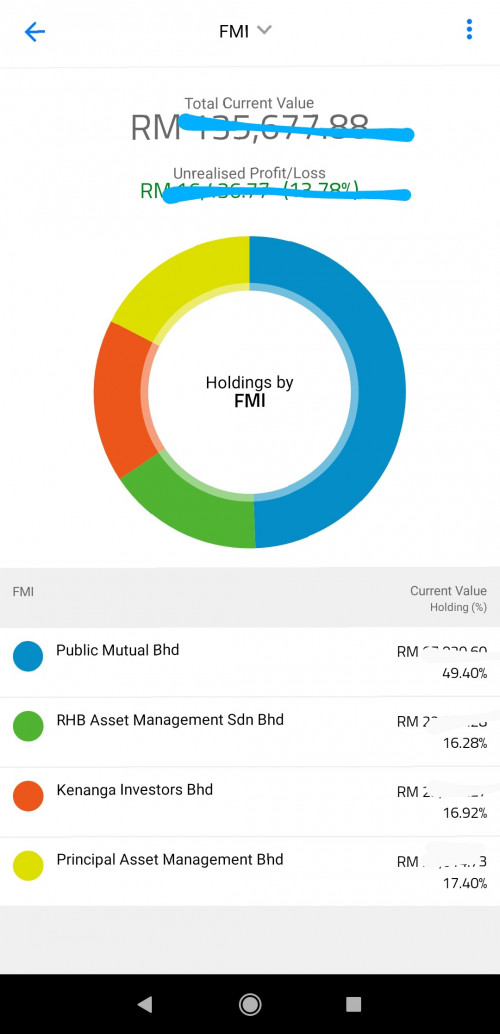

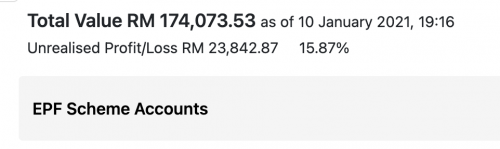

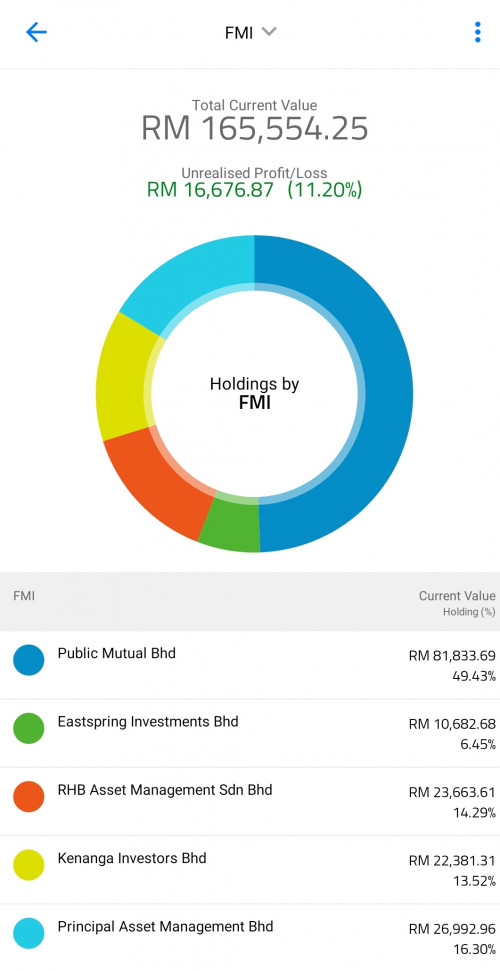

Well, if u know how to self invest through FSM or even havr experience investing in the stock market, why would u even need an agent to begin with? I never use any agent while investing through epf-mis scheme and i have double(paper gain) my 2019 epf dividend thus far since the crash in march all the while controling my exposure and risk by limiting the amount invested and switching funds from equity to bond and back.

Some might need agent but only for those who have no idea in investing as you know a lot of agent are just salesman. As for me i have been investing in stock market since 2008 and unit trust starting from this year, the only reason for me investing in unit trust is that the one allowed for epf-mis and because of the 0 to 0.5% fee prior to june 2020. Now it is even better at 0%, just for the record fsm sales charge is already at 0% prior to that

Jun 12 2020, 11:08 AM

Jun 12 2020, 11:08 AM

Quote

Quote

0.0857sec

0.0857sec

0.57

0.57

7 queries

7 queries

GZIP Disabled

GZIP Disabled