QUOTE(boldsouljah @ Jan 10 2021, 07:22 PM)

Hey guys, just a quick to PM sifus here.

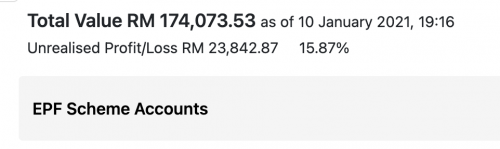

I have been investing my EPF $$ for about 5-7years now (some funds are 7 years old, some are 5). The agent is very much helpful and we did some switching last year due to low performing fund called Public Index Fund.

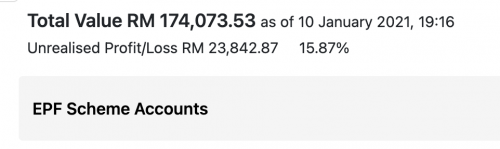

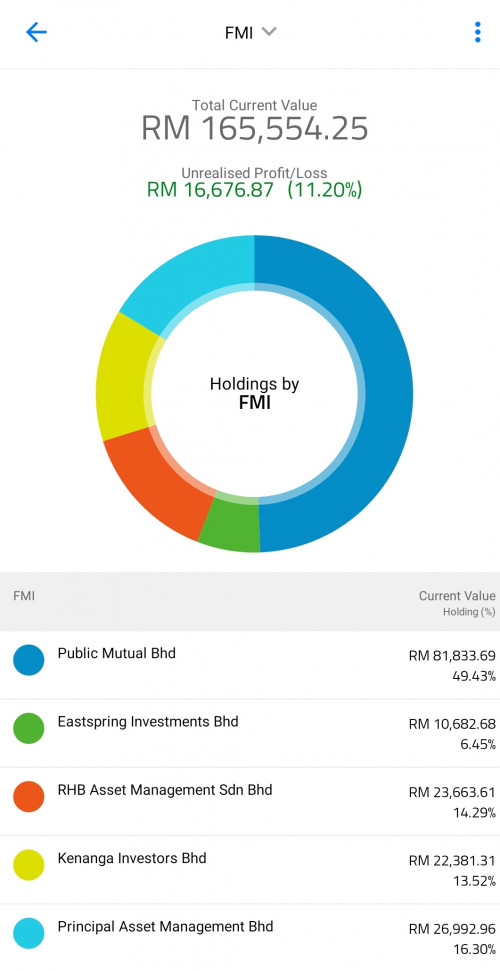

Below is my return.

So basically I invested RM 150,231 and got back RM23,842 profit.

My question is, would it have been better if I just left it in EPF?

How can I calculate how much I would have gotten if I left it in EPF?

I dont know the details on how u invest, but i am assuming you invest by lump sum 5 years ago. Even with that your return is around 3% per annum, if we take 7 years definitely it would be worse.I have been investing my EPF $$ for about 5-7years now (some funds are 7 years old, some are 5). The agent is very much helpful and we did some switching last year due to low performing fund called Public Index Fund.

Below is my return.

So basically I invested RM 150,231 and got back RM23,842 profit.

My question is, would it have been better if I just left it in EPF?

How can I calculate how much I would have gotten if I left it in EPF?

Btw, the last time epf give lower than 3% return is back in 1959. It never dip below 4% since 1960. Definitely much better if you left in EPF.

I believe it was the sales charge which is in part responsible of the poor return. Just fyi, starting from august 2018, there is epf i-invest which cut the sales charge to 0.5% for public mutual and 0% for many other fund house. ( Current promo is 0% for all until april 2021)

I started to invest last year, not in one lump sum and just ignore the unrealised profit since i am frequently switching between fund or to bond fund and realising the profit. Actual profit is actually much higher.

This post has been edited by backspace66: Jan 10 2021, 08:28 PM

Jan 10 2021, 08:21 PM

Jan 10 2021, 08:21 PM

Quote

Quote 0.0256sec

0.0256sec

1.03

1.03

6 queries

6 queries

GZIP Disabled

GZIP Disabled