Public e-income fund

https://www.publicmutual.com.my/Menu/Campai...c-e-Income-Fund

Public Mutual Funds, version 0.0

|

|

Jul 9 2020, 06:43 PM Jul 9 2020, 06:43 PM

Return to original view | Post

#1

|

Senior Member

2,239 posts Joined: Aug 2009 |

who here investing in the new fund the just offer?

Public e-income fund https://www.publicmutual.com.my/Menu/Campai...c-e-Income-Fund  |

|

|

|

|

|

Jul 10 2020, 09:17 PM Jul 10 2020, 09:17 PM

Return to original view | Post

#2

|

Senior Member

2,239 posts Joined: Aug 2009 |

QUOTE(backspace66 @ Jul 10 2020, 10:28 AM) My epf-mis investment which I allocated 60% to public mutual fund underperfomed compared to the other 40% of the fund invested in FSM through kenanga, principal and rhb. Although not really a one to one comparison because of different market. then do full redemption - willit be cheaper than switching?0.5 sales charge prior to june and the loss of 0.5% through switching is also another reason, made multiple switch for the australia equity fund which finally eats up my profit. then again use EPF to reinvest on the fund u wanted does it work that way? |

|

|

Jul 11 2020, 12:55 PM Jul 11 2020, 12:55 PM

Return to original view | IPv6 | Post

#3

|

Senior Member

2,239 posts Joined: Aug 2009 |

QUOTE(backspace66 @ Jul 11 2020, 12:16 AM) Not that easy, the fund allowed to invest only reset or refresh every 3 month, if you intend to switch around 10 days before the refresh, that would be a good idea as the fund will be available again in next cycle. In other words , redeeming doesnt reset back the limit that is allowed for investment, it is time based instead. After redemption, that fund can no longer be invested until the next cycle. i am very sure if u decide to swtich it will swtich for 3 months or moreanyway i am still very new so dare not comment much |

|

|

Jul 12 2020, 01:27 PM Jul 12 2020, 01:27 PM

Return to original view | IPv6 | Post

#4

|

Senior Member

2,239 posts Joined: Aug 2009 |

i want to share my unit trust experience, not public bank but with CIMB which i think everyone should know and be aware

i start put into unit trust at 2015 and i waiting exactly 5 years or more to provide this review my conclusion is unit trust is only fund manager make money (short version) ok here comes the long version so 5 years ago May 2015 i go meet up with an agent and open account, sign some form, do some thumb print and only invested RM10,000 from my EPF. I buy into Fund Principal Titans Growth & Income Fund (one of the hot hot fund that time)  Now after 5 years my hard earn RM10,000 only got a total of 13.50% profit Then i ask myself why only 13.50% of profit since every year annual report show earn money most of the time except for 1 of the year where it is -10% Below chart show from May when i buy in till now in July  If 5 years ago i did not make such decision to put money into unit trust, you know how much the RM10,000 will become? The answer is RM13457.39 which is a 34% profit instead of now 13.5% profit  So i further investigate and dig deeper with FSM tool and the tool say i should earn around 16.5% so where the 3% go to?  Here is the answer, last time 5 years ago invest with EPF they will charge sales fee of around 3% so 16.5% - 3% become 13.5% Again all this is just estimate My conclusion is we take our money to let fund manager earn more money than we do only invest in UT if u have a good and reliable agent who can help u to manage |

|

|

Jul 12 2020, 01:51 PM Jul 12 2020, 01:51 PM

Return to original view | Post

#5

|

Senior Member

2,239 posts Joined: Aug 2009 |

QUOTE(backspace66 @ Jul 12 2020, 01:34 PM) Well, if u know how to self invest through FSM or even havr experience investing in the stock market, why would u even need an agent to begin with? I never use any agent while investing through epf-mis scheme and i have double(paper gain) my 2019 epf dividend thus far since the crash in march all the while controling my exposure and risk by limiting the amount invested and switching funds from equity to bond and back. I thought fsm is 0.5% cash scheme? Some might need agent but only for those who have no idea in investing as you know a lot of agent are just salesman. As for me i have been investing in stock market since 2008 and unit trust starting from this year, the only reason for me investing in unit trust is that the one allowed for epf-mis and because of the 0 to 0.5% fee prior to june 2020. Now it is even better at 0%, just for the record fsm sales charge is already at 0% prior to that I know epf is zero |

|

|

Jul 16 2020, 02:00 PM Jul 16 2020, 02:00 PM

Return to original view | Post

#6

|

Senior Member

2,239 posts Joined: Aug 2009 |

I think UT still need to monitor and take profit or enter at the right time. If want fix income buy fix income fund lo

Buy bond lo I also not sure is it a right choice to buy into e income fund offer by public bank recently Want to give it a try a dump some money inside for 3 to 5 years see how Now FD really sucks ----- just spoken to a PBM consultant ask him about both the new e-income fund what is the projection? so his respond is not sure as it is new fund we cannot be sure <-- he is correct i ask him possible to gain 4%? so his respond is that is a little too high, maybe a 2% to 3% but nothing is confirm <-- he is again not wrong I think he talk that way is because this is e-income meaning to buy through online and maybe he wont earn my commission since the sales charges for this is ZERO but his attitude damn beh tahan lo, financial consultant - puih!!! so i decided to invest some of my mature FD in this fund and give it a 5 year period and see how will review this after 5 years btw i am a very conservative investor, i only like FD, BOND and some UT as i am very old, half leg inside coffin  This post has been edited by majorarmstrong: Jul 16 2020, 05:05 PM |

|

|

|

|

|

Jul 16 2020, 09:18 PM Jul 16 2020, 09:18 PM

Return to original view | Post

#7

|

Senior Member

2,239 posts Joined: Aug 2009 |

|

|

|

Jul 16 2020, 09:27 PM Jul 16 2020, 09:27 PM

Return to original view | Post

#8

|

Senior Member

2,239 posts Joined: Aug 2009 |

|

|

|

Jul 16 2020, 09:33 PM Jul 16 2020, 09:33 PM

Return to original view | Post

#9

|

Senior Member

2,239 posts Joined: Aug 2009 |

take a look at the bond/fix income performance

so that stupid consultant tell me 2% to 3% saja really lie to me le but again he might be right as there is no guarantee return again he should not say 2% to 3% ma.. really low le  |

|

|

Jul 16 2020, 09:36 PM Jul 16 2020, 09:36 PM

Return to original view | Post

#10

|

Senior Member

2,239 posts Joined: Aug 2009 |

|

|

|

Jul 16 2020, 09:47 PM Jul 16 2020, 09:47 PM

Return to original view | Post

#11

|

Senior Member

2,239 posts Joined: Aug 2009 |

QUOTE(GrumpyNooby @ Jul 16 2020, 09:43 PM) Personally I think this is just an enhanced MMF like Opus Money Plus Fund. i hope for 5% next year enough lo dont care how they package it Just that Public Mutual is flexing the mandate of this fund to allocate up to 50% into low-risk fixed income investment vehicle like MGS, MGII and Triple A debt papers. janji ada profit yklooi liked this post

|

|

|

Jul 16 2020, 11:54 PM Jul 16 2020, 11:54 PM

Return to original view | Post

#12

|

Senior Member

2,239 posts Joined: Aug 2009 |

|

|

|

Jul 17 2020, 08:54 PM Jul 17 2020, 08:54 PM

Return to original view | Post

#13

|

Senior Member

2,239 posts Joined: Aug 2009 |

|

|

|

|

|

|

Jul 17 2020, 10:28 PM Jul 17 2020, 10:28 PM

Return to original view | Post

#14

|

Senior Member

2,239 posts Joined: Aug 2009 |

QUOTE(ironman16 @ Jul 17 2020, 09:39 PM) i think u mean bond fund is 0% (but some come with platform fee or redeem fee ) i baru sign up but i dont know how to see which one got processing or which one dont have inside this FSMbut Bond in FSM got processing charge n platform fee let me go over that side to ask |

|

|

Jul 22 2020, 11:48 PM Jul 22 2020, 11:48 PM

Return to original view | Post

#15

|

Senior Member

2,239 posts Joined: Aug 2009 |

hi all - who here got e-income fund?

NAV 1 day can go up to 0.0001? so fast the NAV can go up? what more surprising is fund size is empty hahaha i totally dont get it  This post has been edited by majorarmstrong: Jul 22 2020, 11:49 PM |

|

|

Jul 23 2020, 10:57 PM Jul 23 2020, 10:57 PM

Return to original view | Post

#16

|

Senior Member

2,239 posts Joined: Aug 2009 |

fund size kosong lagi

ada orang invest ka? maybe less than 1 million that is why kosong  |

|

|

Jul 24 2020, 08:58 AM Jul 24 2020, 08:58 AM

Return to original view | IPv6 | Post

#17

|

Senior Member

2,239 posts Joined: Aug 2009 |

|

|

|

Jul 24 2020, 04:04 PM Jul 24 2020, 04:04 PM

Return to original view | Post

#18

|

Senior Member

2,239 posts Joined: Aug 2009 |

i no longer believe in equity be it by Public Bank or CIMB Principal

so i just invest in Bond / FI i do have Samy, Wahed and Raiz which has some elements of equity but the amount is small at least this 3 is at my hand that i can see on a daily basis This post has been edited by majorarmstrong: Jul 24 2020, 04:05 PM |

|

|

Jul 24 2020, 10:22 PM Jul 24 2020, 10:22 PM

Return to original view | Post

#19

|

Senior Member

2,239 posts Joined: Aug 2009 |

selamat malam semua

i check my income fund still not much movement still all empty  |

|

|

Jul 25 2020, 12:40 PM Jul 25 2020, 12:40 PM

Return to original view | IPv6 | Post

#20

|

Senior Member

2,239 posts Joined: Aug 2009 |

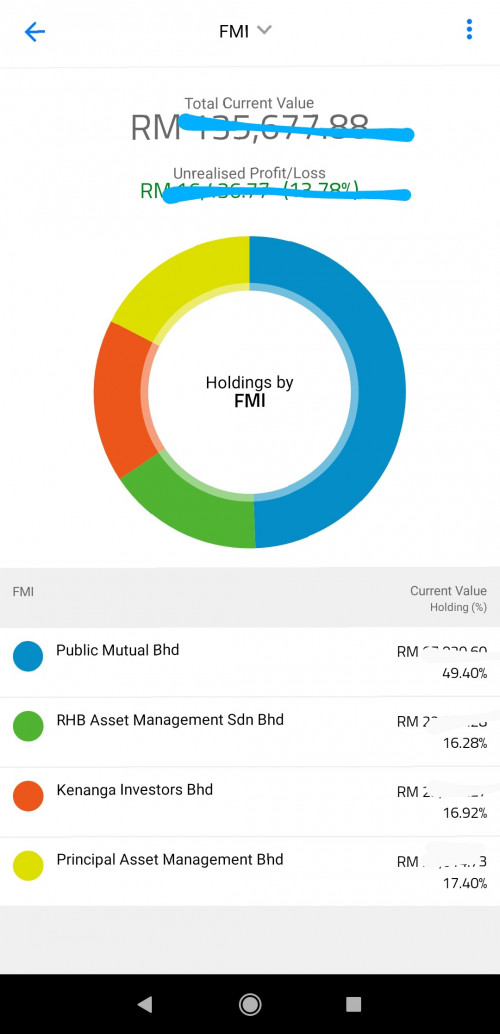

QUOTE(backspace66 @ Jul 25 2020, 08:23 AM) Started with almost 60% allocation in public mutual fund but now has become less than 50%. My other investment in FSM perform so much better. But still have to mention i did make a decent amount in PGSF. Btw the profit in epf app does not show net profit but only unrealized profit, if you redeem or switch to another fund then it will not be considered as it is already "realized". when you can withdraw that time gonna be really nice 100k and over nice you take everything out from EPF to put into investment? |

| Change to: |  0.1124sec 0.1124sec

0.58 0.58

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 05:10 AM |