QUOTE(engyr @ Jun 4 2019, 07:27 PM)

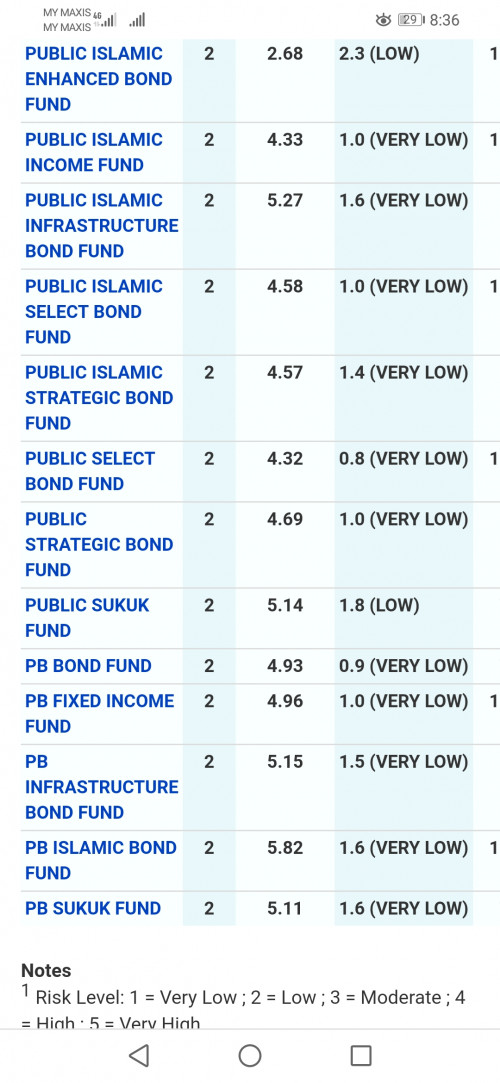

https://pictr.com/images/2019/06/04/5PFOJq.md.jpg

Many people recommend buy equity fund.

Change equity fund to bond fund when economic is bad.

Change bond fund to equity fund when economic is good.

From the screenshot, we need to pay sales charge when change from bond fund to equity.

My understanding is

You invest RM1000 to equity fund, sales charge 5.5%

When you change from equity fund to bond fund, you need to pay up to 0.75%.

When you change from bond fund to equity fund, you need to pay up to 5.5%.

Do you think it is better we redeem/sell the units when the market is bad, and buy back again when we want to invest again?

only do switching if your fund not performing for 3 years (my agent told me).

dont switch hastily because equity when down, its really down.

if past performance looks good (can fetch 8% and more), buy more units & dont sell.

Jun 28 2019, 06:44 PM

Jun 28 2019, 06:44 PM

Quote

Quote

0.0386sec

0.0386sec

0.42

0.42

7 queries

7 queries

GZIP Disabled

GZIP Disabled