QUOTE(j.passing.by @ Aug 14 2018, 04:12 PM)

The returns in the main page tracked back all the previous transactions on the same fund, and totaled up all the values bought/switched-in and sold/switched-out. The returns is the difference between this total value and the current value.

The total value previously bought and sold is inclusive of any fees and service charges and taxes incurred.

(The same fund but under different account numbers, due to using multiple UTCs, will also be combined together.)

===========

I usually ignore the main page showing the value of the funds and only use it to counter check the total current value of the entire portfolio against my own Excel spreadsheet. My calculations treated the values differently.

PMO:

Total Bought: RM10,000

Total Sold: RM5000

Current value: RM5500

Total Returns of the fund = 10,000 - 5000 + 5500 = 500

My own calculations showing the current returns:

Total Units Bought: RM10,000 @ 0.2500 per unit = 40,000 units

Total Units Sold: 20,000 units

Remaining Units = 40,000 - 20,000 = 20,000

Current value: 0.2650 per unit

Total Returns of the fund = (0.2650 - 0.2500) x 20,000 = 300

Actually, the workings in the spreadsheet is a bit more complex than the simplified example shown above. The main page in my excel file would show the current active funds, their current returns and their CAGR (Compounded Annual Growth Rate).

Thank you very much! You explained it well.The total value previously bought and sold is inclusive of any fees and service charges and taxes incurred.

(The same fund but under different account numbers, due to using multiple UTCs, will also be combined together.)

===========

I usually ignore the main page showing the value of the funds and only use it to counter check the total current value of the entire portfolio against my own Excel spreadsheet. My calculations treated the values differently.

PMO:

Total Bought: RM10,000

Total Sold: RM5000

Current value: RM5500

Total Returns of the fund = 10,000 - 5000 + 5500 = 500

My own calculations showing the current returns:

Total Units Bought: RM10,000 @ 0.2500 per unit = 40,000 units

Total Units Sold: 20,000 units

Remaining Units = 40,000 - 20,000 = 20,000

Current value: 0.2650 per unit

Total Returns of the fund = (0.2650 - 0.2500) x 20,000 = 300

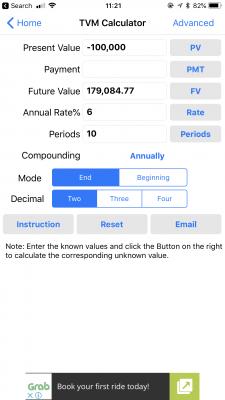

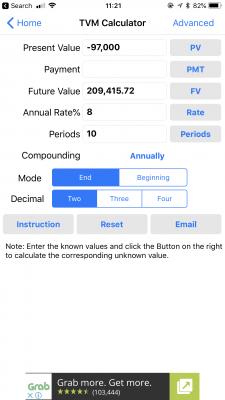

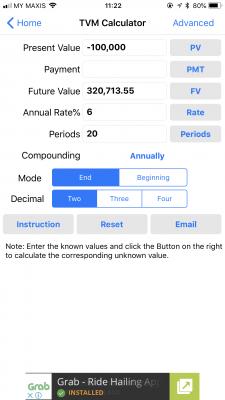

Actually, the workings in the spreadsheet is a bit more complex than the simplified example shown above. The main page in my excel file would show the current active funds, their current returns and their CAGR (Compounded Annual Growth Rate).

So both calculations are correct, only that one referring to total returns (since the inception of the fund) whereas your calculation look at current returns. Am I right?

But there is no function in PMO to show all previous transactions, isnt there?

Aug 15 2018, 01:34 PM

Aug 15 2018, 01:34 PM

Quote

Quote

0.0314sec

0.0314sec

0.49

0.49

6 queries

6 queries

GZIP Disabled

GZIP Disabled