QUOTE(MakNok @ Aug 15 2018, 03:00 PM)

No worth buying Mutual fund lo.

sales charge will kill you lo...

tell me...how long should i invest in mutual fund in order to be in profitable level?

EPF yearly dividend roughly average 5.5%.

Buying Mutual fund with sale charges at 3% mean that Mutual fund need to make extra fund dividend of 8.5% within the 1st year to breakeven.

if not, might as well let it hibernate inside your EPF account mah.

I disagree, for short term yes it might not worth it but for long term you'll get more return than what you get keeping your money in the epf (if you are willing to take the risk la)sales charge will kill you lo...

tell me...how long should i invest in mutual fund in order to be in profitable level?

EPF yearly dividend roughly average 5.5%.

Buying Mutual fund with sale charges at 3% mean that Mutual fund need to make extra fund dividend of 8.5% within the 1st year to breakeven.

if not, might as well let it hibernate inside your EPF account mah.

Let's assume you have 100k

epf give you average 6% return and unit trust give you average 8% return

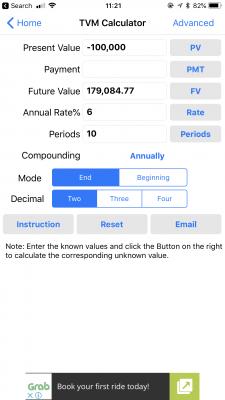

if you have the 100k in epf for 10 years with 6% return, your future value would be 179,084.77

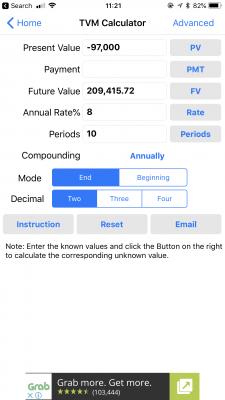

but if you have 100k minus 3% sales charge = 97k in unit trust for 10 years with 8% return, your future value would be 209,415.72

there is total 30,330.95 different,

in the end it's all about your time horizon and risk appetite

10 years (30,330.95 different)

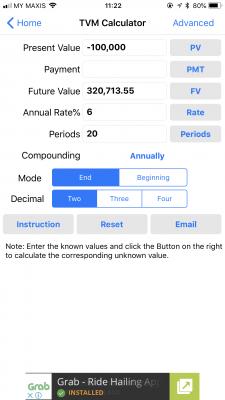

20 years (131,399.29 different)

Aug 17 2018, 11:41 AM

Aug 17 2018, 11:41 AM

Quote

Quote

0.1003sec

0.1003sec

0.76

0.76

7 queries

7 queries

GZIP Disabled

GZIP Disabled