QUOTE(silverbolt143 @ Aug 17 2018, 10:12 AM)

Hi, im newbie here... just started withdrwing my EPF last March 2018 to invest in PB...also subscribe to PMO to monitor my fund and need some guidance....

My inception date as follows:

1) RM72,160 on 26/03/2018

2) add on RM53,939 on 16/08/2018

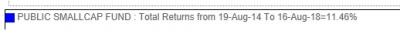

My question, is it normal to see my return in negative at this point of time? Overall is about -6.5% (minus 3% sales charges hence net -3.5% margin) upon inception..appreciate some advise....my current funds as per below:

In times where the market is volatile, it is best stay put with the monies on your epf. Now its too late as the funds have been invested and you just have to leave them alone. If you want, you can compare these against these amount of monies you have invested against EPF declared dividend next year to judge for yourself.My inception date as follows:

1) RM72,160 on 26/03/2018

2) add on RM53,939 on 16/08/2018

My question, is it normal to see my return in negative at this point of time? Overall is about -6.5% (minus 3% sales charges hence net -3.5% margin) upon inception..appreciate some advise....my current funds as per below:

You can minimise your invested amount by 1)careful selection of funds coupled with 2)spreading the amount into smaller investment sums via DCA on quarterly basis perhaps rather than one big lump sum. By DCA, you could have average out the ups and downs of the market.

Two of your biggest funds happened to be high volatility in risk level i.e. Public Asia Ittikal and Public Asia Dividend, with foreign exposure of up to 98%

On the other hand, Public Ittikal Sequel which has moderate volatility risk level with only up to 30% foreign exposure, which is more reasonable selection in times of market uncertanities is only less than RM20K. You could have increase the amount here rather than too much of the two funds above.

Aug 17 2018, 02:06 PM

Aug 17 2018, 02:06 PM

Quote

Quote

0.0316sec

0.0316sec

0.72

0.72

6 queries

6 queries

GZIP Disabled

GZIP Disabled