QUOTE(rocketm @ Jan 22 2021, 01:45 PM)

I thought taxable is the portion that the company will pay to income tax as it is a withholding tax thus shareholder will not receive this portion as their dividend.

If this is correct, we should not take into account the taxable portion into calculation.

Welcome to comment on this.

This is a very good question. If this is correct, we should not take into account the taxable portion into calculation.

Welcome to comment on this.

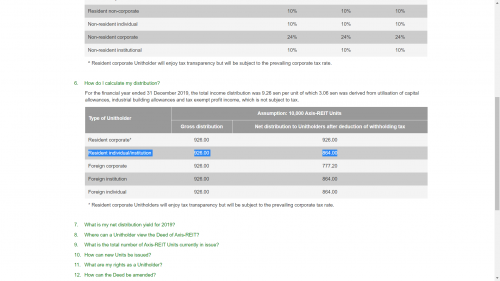

https://www.axis-reit.com.my/reits-faq.php

Kindly refer to item 5 and 6.

From item 6, you can clearly see that, with the assumption of 10k units, total gross distribution is RM 926 of which RM 306 is non-taxable. The taxable portion is thus RM 620.

With a WHT of 10%, the net distribution paid out (the cash one would receive) is 306 + 620*0.9 = 864, which agrees with the number quoted in the page.

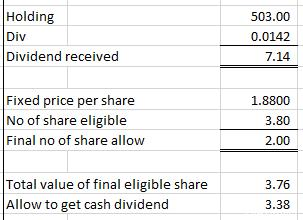

So, coming back to your question, I think I got my numbers right. The declared taxable distribution of RM 0.0083 per unit has to multiply by 90% (since WHT is 10%), times 503 units which you hold, and you get the taxed distribution of RM 3.75741.

And no, "taxable" here means distributions that can be taxed because they are not derived from utilisation of capital allowances, industrial building allowances and tax exempt profit income, so by law they are liable to tax. From this "taxable" distribution, Axis REIT will deduct 10% and pay that to the Inland Revenue Board of Malaysia (IRB, better known as LHDN). "Taxable" does not mean you won't get the money stated. You misunderstood something there.

And thus you should take into account the taxable portion in your cash dividend calculation. It's real cash that you will get, just that you minus 10% WHT off the stated figure.

*I don't invest in M-REITs, I only invest in S-REITs, but you inadvertently taught me something today. Thanks.

This post has been edited by TOS: Jan 22 2021, 02:16 PM

Jan 22 2021, 02:04 PM

Jan 22 2021, 02:04 PM

Quote

Quote

0.0422sec

0.0422sec

0.60

0.60

6 queries

6 queries

GZIP Disabled

GZIP Disabled