-

This post has been edited by TOS: Jan 18 2020, 11:04 PM

M Reits Version 7, Malaysia Real Estate Investment

M Reits Version 7, Malaysia Real Estate Investment

|

|

Jan 18 2020, 10:59 AM Jan 18 2020, 10:59 AM

Return to original view | Post

#1

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

-

This post has been edited by TOS: Jan 18 2020, 11:04 PM |

|

|

|

|

|

Feb 1 2020, 05:14 PM Feb 1 2020, 05:14 PM

Return to original view | Post

#2

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(cempedaklife @ Feb 1 2020, 02:25 PM) http://www.cmmt.com.my/sungei.htmlThe annex block of Sungei Wang. QUOTE In 2018, CMMT announced a major asset enhancement initiative to reconfigure the annex block of Sungei Wang and transform it into a vibrant and energetic lifestyle zone that complements the retail offerings in the BBKLCC (Bukit Bintang Kuala Lumpur City Centre) shopping belt. Named as Jumpa, the 170,000 sq ft annex will house more than 80 stores of trendy fashion, food and beverages, athleisure and family entertainment that cater to urbanites, tourists and working professionals. This post has been edited by TOS: Feb 1 2020, 05:15 PM |

|

|

Feb 2 2020, 09:01 PM Feb 2 2020, 09:01 PM

Return to original view | IPv6 | Post

#3

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

https://www.businesstimes.com.sg/asean-busi...ndling-interest

No mention about retail REITs though. Premium retail REITs should be fine. |

|

|

Feb 13 2020, 10:02 PM Feb 13 2020, 10:02 PM

Return to original view | IPv6 | Post

#4

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Sunway REIT's 2Q FY20 result coming in!

QUOTE Sunway Real Estate Investment Trust (Sunway REIT) reported a higher revenue in the second quarter ended Dec 31, 2019 on contribution from newly acquired Sunway university and college campus. Net property income expanded 11.9% to RM116.6mil from a year earlier, it said in a statement today. Proposed distribution per unit rose 8.9% to 2.45 sen a unit. "Annualizing 1H FY2020 distribution per unit of 4.95 sen, this translates into a distribution yield of 5.4%," it said. The retail segment remained resilient for the quarter ended Dec 31. Revenue rose by 1.3% to RM106.7mil, largely contributed by Sunway Pyramid Shopping Mall and Sunway Putra Mall. Total revenue was RM155.8mil, up 11.7% from a year ago. https://www.thestar.com.my/business/busines...igher-q2-income https://disclosure.bursamalaysia.com/FileAc..._FR_ATTACHMENTS This post has been edited by TOS: Feb 13 2020, 10:02 PM |

|

|

Feb 14 2020, 06:04 PM Feb 14 2020, 06:04 PM

Return to original view | IPv6 | Post

#5

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(moosset @ Feb 14 2020, 10:14 AM) but in December, Singapore's MNACT announced that it would borrow money to pay dividend, no? Same observation. I think Ramjade also posted this in SReit forum. Also, not to forget Lendlease (S-REIT) seems to be doing the same. https://www.reitsweek.com/2020/02/lendlease...u-forecast.html |

|

|

Jul 21 2020, 08:56 PM Jul 21 2020, 08:56 PM

Return to original view | IPv6 | Post

#6

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

CMMT earnings reported today:

https://links.sgx.com/1.0.0/corporate-annou...f7b43ddca3c7139 (Parent company. Capitaland's link from SGX) ICR only 1.7, terribly low. |

|

|

|

|

|

Jul 21 2020, 09:16 PM Jul 21 2020, 09:16 PM

Return to original view | IPv6 | Post

#7

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Havoc Knightmare @ Jul 19 2020, 12:40 PM) I only like Pavi KL, the others are crap, even Intermark. In contrary to your view on TRX, I expect TRX to depress the office market further with a flood of supply, which may result in falling occupancy rates of the office buildings above the mall and surrounding buildings. Menara Citibank next door is steadily worsening, refer to the link at the bottom. This will reduce the crowd patronising Intermark especially the vital lunch hour working crowd. Also, not far from the Twin Towers and TRX, PNB 118 tower is adding to more spaces in a few years time.* The oversupply of office spaces in Klang Valley is a known issue for quite some time. Perhaps sooner or later, SMEs can also afford to rent Grade A offices! I am worried that the REIT sponsor will treat this REIT like a dumpster and throw in unwanted assets, hoping that Pavi KL will continue to cover their sub par performance. The odds of the sponsor doing so increases as they struggle with cash flow issues. https://www.marc.com.my/index.php/marc-rati...gative-20190328 *As an ASNB shareholder, I sometimes question the rational behind building such a tall tower full of offices when the market is already in a state of oversupply. |

|

|

Jul 23 2020, 08:50 PM Jul 23 2020, 08:50 PM

Return to original view | IPv6 | Post

#8

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Pavillion REIT's earnings released today:

Press Release: http://www.pavilion-reit.com/230_177_0_102...REIT/index.html Presentation Slides: http://www.pavilion-reit.com/230_177_0_102...REIT/index.html Income Distribution: http://www.pavilion-reit.com/230_177_0_102...REIT/index.html |

|

|

Jul 24 2020, 01:44 PM Jul 24 2020, 01:44 PM

Return to original view | IPv6 | Post

#9

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(clementtong @ Jul 24 2020, 12:09 PM) For Malaysia accounting standards, it should be MFRS (Malaysia Financial Reporting Standards), which follows IFRS.US GAAP is only for US reporting purposes. Some large US MNCs will publish non-GAAP accounting reports for international investors as well. |

|

|

Jul 26 2020, 08:26 PM Jul 26 2020, 08:26 PM

Return to original view | IPv6 | Post

#10

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Hohenheim @ Jul 26 2020, 07:33 PM) There are not many high quality REIT in malaysia like IGBREIT or PAVREIT, hope the more REIT is listed in MY. Not just quality issue, I notice that many are too narrow in geographical locations. They should consider overseas acquisitions, like their S-REITs counterparts. And not to mention the 10% withholding tax for Malaysia REITs. wongmunkeong liked this post

|

|

|

Jul 26 2020, 08:59 PM Jul 26 2020, 08:59 PM

Return to original view | IPv6 | Post

#11

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(nexona88 @ Jul 26 2020, 08:49 PM) Well, I say many, not all. There are M-REITs with overseas properties, but these are the "exceptions rather than the norm". There are good retail and office properties in many countries. Pavillion, Sunway REIT for example can consider those properties. Axis REIT can consider logistics properties outside of Malaysia too. Factor in the fact that MYR will depreciate in the long run, overseas acquisition will actually bring a lot to the table. Not qualified to comment much on M-REITs as I don't invest directly in Malaysia, but looking at what their Singapore counterparts have accomplished, I feel that M-REITs can do better. This post has been edited by TOS: Jul 26 2020, 09:12 PM |

|

|

Aug 12 2020, 04:39 PM Aug 12 2020, 04:39 PM

Return to original view | IPv6 | Post

#12

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

M-REITs gearing limit raised to 60%, until Dec 31, 2022.

https://www.thestar.com.my/business/busines...r-m-reits-to-60 |

|

|

Aug 13 2020, 10:28 AM Aug 13 2020, 10:28 AM

Return to original view | IPv6 | Post

#13

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(ronnie @ Aug 13 2020, 08:08 AM) Not qualified to comment as I don't directly invest in M-REITs (just reporting news). But since you asked me, for REITs like CMMT, this may be a lifesaver. For other more stable ones like Pavillion, Sunway etc., I hope they would take this opportunity to refinance debt at lower interest rates. Good for long term or not really depends on management, prospects of their respective sectors (retail vs office vs hospitality vs logistics/industrial), and sponsor's pipeline and support, in my opinion, given that the increment is just a tentative measure to alleviate "stress" for the REIT manager. |

|

|

|

|

|

Aug 13 2020, 03:14 PM Aug 13 2020, 03:14 PM

Return to original view | IPv6 | Post

#14

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Analyst's views: https://www.theedgemarkets.com/article/anal...arily-raised-60

|

|

|

Dec 30 2020, 09:39 PM Dec 30 2020, 09:39 PM

Return to original view | IPv6 | Post

#15

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Cubalagi @ Dec 29 2020, 10:21 PM) Petronas rents nearly 75% of klcc office space. Last month, Petronas renewed the lease to 2041/42. Thereafter, earlier this month, Petronas sold a big block of their Klccs shares (reportedly to pay government dividends) to ASB. I dont think the timing of lease renewal was a coincidence. Likely something insisted upon by ASB. From the annual report, Petronas rents the whole of both towers, no? The tenant is solely Petrolium Nasional. Mind sharing where you get the info about 75% from? Not that I'm aware of. Maybe because we have fewer Reits n Mreits tend to have low leverage but now with the pendemic maybe this will change. KLCCS, being the strongest, still has less than 20% gearing. As for the "transfer to ASB" thing, in the end, they are using our money to finance themselves... then money flows back to us. Sounds like some sort of circular economy. |

|

|

Jan 12 2021, 09:44 PM Jan 12 2021, 09:44 PM

Return to original view | IPv6 | Post

#16

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Jan 19 2021, 03:03 PM Jan 19 2021, 03:03 PM

Return to original view | IPv6 | Post

#17

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Didn't know MRCB Quill has changed its name to Sentral REIT.

Here's the Q4 earnings result. Financial Report: http://mqreit.irplc.com/new-announcement.h...001&Symbol=5123 Press Release: http://mqreit.irplc.com/medianews.htm?file...204Q%202020.pdf Presentation Slides: https://www.insage.com.my/Upload/Docs/MQREI...204Q%202020.pdf This post has been edited by TOS: Jan 19 2021, 03:03 PM |

|

|

Jan 19 2021, 08:48 PM Jan 19 2021, 08:48 PM

Return to original view | IPv6 | Post

#18

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

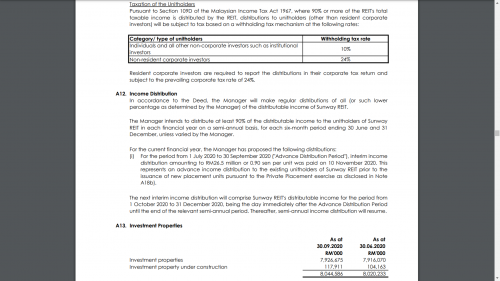

QUOTE(johnnyenglish123 @ Jan 19 2021, 06:09 PM) Hi You need to check the distribution announcement, usually stated in the financial report for the particular quarter or period. How does the dividend come about yeah? EG sunway previous div is 0.90 per unit right? so assuming i have myr 10k in sunway reit @ 1.40.. How much div am i entitle? and one year 4 times right?? Considering to consolidate one of my prop and transfer to reit.. For Sunway's case, the most recent announcement was in November last year. https://disclosure.bursamalaysia.com/FileAc..._FR_ATTACHMENTS That distribution was a one-off advanced distribution of 0.9 cents per unit for those who hold Sunway REIT's stocks before the ex-date for the private placement of the new units thereafter. Notwithstanding that, from page 15 of the PDF file,  QUOTE The Manager intends to distribute at least 90% of the distributable income to the unitholders of Sunway REIT in each financial year on a semi-annual basis, for each six-month period ending 30 June and 31 December, unless varied by the Manager. So, it is semi-annual distribution. Twice a year and the distribution details such as date and amount should be stipulated during the result announcement. As for dividend calculation, it should be fairly accurate. Just multiply the dividend rate and the number of units you hold, then you will know how much you receive. So for your case, 10k investment at a price of 1.40 means 10000/1.40 = 7142.9 units (I don't think you would buy odd lots, so you should check the actual amount you paid for the units, usually a board lot should be 100, for Bursa, so either you hold 7000 or 7100 units, somewhere around that figure, you need to check.) Then assuming 7000 units and a distribution rate of 0.9 cents a unit, your advanced distribution paid last year should be 7000 units * 0.009 MYR per unit = 63 MYR. Bear in mind that there is a withholding tax of 10% for M-REITs distributions, so you would only get 90% of the payable amount, or 63 - 6.3 = 56.7 MYR The same applies to Sentral REIT, with different figures and dates. This post has been edited by TOS: Jan 19 2021, 08:57 PM |

|

|

Jan 21 2021, 11:10 AM Jan 21 2021, 11:10 AM

Return to original view | IPv6 | Post

#19

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

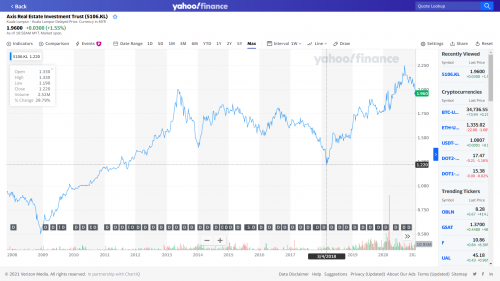

QUOTE(rocketm @ Jan 21 2021, 02:11 AM) I want to confirm with you guys for the recent announcement for Axis reit. I think your calculations are correct. Just make sure to add up the other 0.0032 cents per unit non-taxable portion and the 0.0083 cents per unit * 90% taxable portion (10% WHT) in your cash dividend part. This is about the DRIP. [attachmentid=10761861] Is it if take all in cash dividend form, the dividend rate is RM0.0142 (non-taxable). [attachmentid=10761862] If opt to DRIP, the dividend rate is RM0.0110 (non-taxable) to calculate the dividend amount then this will divide with the new share price at RM1.8800? This is my example to illustrate my understanding. [attachmentid=10761865] Does my understanding correct? The DRIP does not reduce my average price. I hope to buy more to achieve this but the market price does not reach below my holding price. Anyone can advise me? As for the failure to go below your holding price, it might be because your holding price is lower than 1.88. You may have bought earlier at a low price, so even after the discount of 10% VWAP, you still end up increasing your holding price. Buying more may not necessarily reduce your holding price, especially if the REIT is doing well in share price performance, buying more will end up increasing your holding price instead.  Looking at this graph, if you had bought more after early March 2018, it is very likely that your holding price is on an upward trend. This post has been edited by TOS: Jan 22 2021, 07:57 AM |

|

|

Jan 21 2021, 12:10 PM Jan 21 2021, 12:10 PM

Return to original view | IPv6 | Post

#20

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(rocketm @ Jan 21 2021, 11:58 AM) Thank you for your reply firstly. Ya, I saw the picture, it's attached in your last post. Sorry I forgot to attach another picture in the "If opt to DRIP, the dividend ....." This is the picture for opt to DRIP [attachmentid=10762118] Just to check whether I am correct: 1. Does the taxable and non-taxable of RM0.0142 and RM0.083, respectively only applicable to those want cash dividend. 2. If want to opt for DRIP, then only RM0.0110 and RM1.8800 is applicable for the calculation of number of new share. Does the RM0.0110 is also need to consider for taxable and non-taxable in the calculation? Basically the same distribution is made for both investor who opt for reinvestment and do not opt for investment, the amount is the same: Non-taxable: RM 0.0142 per unit taxable: RM 0.0083 per unit The only catch is that for those who choose to reinvest, out of the 0.0142 cents per unit non-taxable portion, Axis REIT "extracted" RM 0.0110 per unit for reinvestment, so you have 2 components for non-taxable dividend in the reinvestment case, but they are the same as before because the leftover RM 0.0032 per unit is distributed too. To answer your 2 questions: 1. Yes but you stated the amounts in the opposite, non-taxable is 0.0142 cents per unit, taxable is 0.083 cents per unit; this is the quoted rate for those who do not wish to reinvest their dividends. For case 1, you receive the distributions, a. RM 0.0142 per unit non-taxable b. RM 0.00083 per unit taxable portion, Both a and b in cash. --------------------------------------------------------------------------------------------------------------- 2. As stated before, 3 components now, 2 non-taxable, 1 taxable, for those who wish to reinvest. The 2 non-taxable ones are: a. RM 0.0110 per unit for reinvestment at 1.88 MYR per unit b. RM 0.0032 per unit for distribution a+b = RM 0.0142 per unit, exactly the same as the case when you choose not to reinvest dividends. The taxable one is: a. RM 0.0083 per unit, no change from the first case (1) above. The RM 0.0110 per unit is now used to buy the 2 new shares (for your case, assuming originally 503 units) with the leftover distributed as cash similar to case 2a above. And they are all non-taxable. So, for case 2, you receive: a. 2 new shares (priced at 1.88 MYR each), b. RM 0.0032 per unit non-taxable distributions c. Leftover non-taxable distributions from the truncated shares (2.94-2) shares d. RM 0.0083 per units taxable distributions. a are shares, b,c and d are all in cash This post has been edited by TOS: Jan 22 2021, 09:19 AM |

| Change to: |  0.1897sec 0.1897sec

0.74 0.74

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 01:35 AM |