Is it a good time to invest in REIT since I notice the composite index is dropping so might be buy low now.

M Reits Version 7, Malaysia Real Estate Investment

M Reits Version 7, Malaysia Real Estate Investment

|

|

Jan 11 2020, 04:06 PM Jan 11 2020, 04:06 PM

Return to original view | IPv6 | Post

#1

|

Senior Member

1,627 posts Joined: May 2013 |

Is it a good time to invest in REIT since I notice the composite index is dropping so might be buy low now.

|

|

|

|

|

|

Jan 11 2020, 04:44 PM Jan 11 2020, 04:44 PM

Return to original view | IPv6 | Post

#2

|

Senior Member

1,627 posts Joined: May 2013 |

|

|

|

Jan 11 2020, 05:18 PM Jan 11 2020, 05:18 PM

Return to original view | IPv6 | Post

#3

|

Senior Member

1,627 posts Joined: May 2013 |

QUOTE(Cubalagi @ Jan 11 2020, 06:01 PM) The Bursa Malaysia composite index KLCI is close to 5 year low. However the KLCI is not representative of MReit performance. There is only 1 reit (KLCC) in the 30 stocks that makes up the KLCI. Thanks for your explanation.The Bursa Reit index meanwhile is still holding up quite well, but it has dropped a bit since peaking in Aug 2019. Im hoping it drop some more in 2020. https://www.tradingview.com/symbols/MYX-REIT/ If the REIT index drop, does this means that majority of the REIT also showing decrease in price thus it will be worth to buy at this time, while the dividend (if any) will not affect by the increase/decrease in the REIT price, it is based on company management discretion to distribute how many dividend to its shareholder. Is this right? |

|

|

Jan 12 2020, 09:13 AM Jan 12 2020, 09:13 AM

Return to original view | IPv6 | Post

#4

|

Senior Member

1,627 posts Joined: May 2013 |

QUOTE(Cubalagi @ Jan 11 2020, 07:06 PM) 1. Yes. If an index drops, it generally means the majority of the components prices have dropped. I say generally because the Index is market cap based. Means the larger reits carry more weight in the index then the smaller ones. So, you could have a case where all the small Reits go up in price but a few big ones drop, the the index will still fall. Thanks for the detail explanation.Whether it's worth to buy.. Well that's an investment outlook and is never a straightforward decision. 2. Dividends will be based on the Reit actual profits. Under the law, a reit must distribute 90% of its profits in order to benefit from 0 corporate tax. So they always pay 90%. What are the indicators that we should look for when choosing which REIT to invest? I am using Rakuten so they have some summary report of the REIT. From the report, they will suggest which to invest like whether it is outperform or underperform. To be save what indicators that we should look for? |

|

|

Jan 13 2020, 08:53 AM Jan 13 2020, 08:53 AM

Return to original view | IPv6 | Post

#5

|

Senior Member

1,627 posts Joined: May 2013 |

QUOTE(Cubalagi @ Jan 12 2020, 07:45 PM) You will need to study the Reits property portfolio. Look at the website and annual reports for info. Read analyst reports, if there is, on prospects. Visit if you can esp if it's a shopping mall reit. Oh, nice info. But how to determine whether a REIT is traded at premium or discount. What are the parameter to use to determine?After that look at the Reit price. One thing you will discover is that Reits with good properties are trading at a premium. Reits with poor performing assets are trading at a discount. Then it will be the tricky part.. Choosing which one.. |

|

|

Jan 13 2020, 07:18 PM Jan 13 2020, 07:18 PM

Return to original view | IPv6 | Post

#6

|

Senior Member

1,627 posts Joined: May 2013 |

QUOTE(Cubalagi @ Jan 13 2020, 02:30 PM) U can look at the net assets per share which is published together with the quarterly financials. Thanks for the sharing Sifu.Eg the solid Sunway Reit (5176) Net Asset per share: RM1.49 Closing price yesterday: RM1. 84 U are paying more for the assets. Compare with Amanah Raya Reit (5127) Net asset per share: RM1. 34 Closing price yesterday: RM0.74 Big discount! Cheap sale. |

|

|

|

|

|

Jun 23 2020, 11:18 PM Jun 23 2020, 11:18 PM

Return to original view | IPv6 | Post

#7

|

Senior Member

1,627 posts Joined: May 2013 |

May I know is it true that Reits in Malaysia after deducted the withholding tax (actual unit holder received) is lower than the return of other stock, for example, Sunway Reits vs Sunway Bhd or YTLreit vs YTL.

This post has been edited by rocketm: Jun 25 2020, 01:05 AM |

|

|

Jan 12 2021, 05:27 PM Jan 12 2021, 05:27 PM

Return to original view | IPv6 | Post

#8

|

Senior Member

1,627 posts Joined: May 2013 |

QUOTE(adele123 @ Jan 12 2021, 06:20 PM) Managed to grab some igbreit at 1.62 although should have been able to grab at 1.6 easily today. I am holding IGB reit but not Sunreit. While sunreit has been quite depressed. Still hopeful on general retail as vaccine to arrive 2021. Sunreit has been mostly in downtrend in few weeks. Have you consider YTL reit? |

|

|

Jan 21 2021, 02:11 AM Jan 21 2021, 02:11 AM

Return to original view | IPv6 | Post

#9

|

Senior Member

1,627 posts Joined: May 2013 |

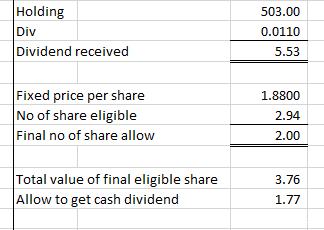

I want to confirm with you guys for the recent announcement for Axis reit.

This is about the DRIP.

Is it if take all in cash dividend form, the dividend rate is RM0.0142 (non-taxable).

If opt to DRIP, the dividend rate is RM0.0110 (non-taxable) to calculate the dividend amount then this will divide with the new share price at RM1.8800? This is my example to illustrate my understanding.  Does my understanding correct? The DRIP does not reduce my average price. I hope to buy more to achieve this but the market price does not reach below my holding price. Anyone can advise me? Attached thumbnail(s)

|

|

|

Jan 21 2021, 11:58 AM Jan 21 2021, 11:58 AM

Return to original view | IPv6 | Post

#10

|

Senior Member

1,627 posts Joined: May 2013 |

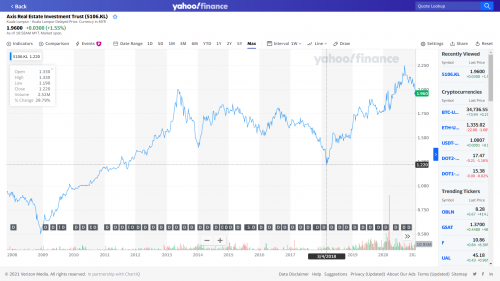

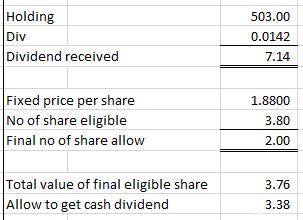

QUOTE(TOS @ Jan 21 2021, 12:10 PM) I think your calculations are correct. Just make sure to add up the other 0.0032 cents per unit non-taxable portion and the 0.0083 cents per unit * 90% taxable portion (10% WHT) in your cash dividend part. Thank you for your reply firstly.As for the failure to go below your holding price, it might be because your holding price is lower than 1.88. You may have bought earlier at a low price, so even after the discount of 10% VWAP, you still end up increasing your holding price. Buying more may not necessarily reduce your holding price, especially if the REIT is doing well in share price performance, buying more will end up increasing your holding price instead.  Looking at this graph, if you buy more after early March 2018, it is very likely that your holding price is on an upward trend. Sorry I forgot to attach another picture in the "If opt to DRIP, the dividend ....." This is the picture for opt to DRIP

Just to check whether I am correct: 1. Does the taxable and non-taxable of RM0.0142 and RM0.083, respectively only applicable to those want cash dividend. 2. If want to opt for DRIP, then only RM0.0110 and RM1.8800 is applicable for the calculation of number of new share. Does the RM0.0110 is also need to consider for taxable and non-taxable in the calculation? |

|

|

Jan 22 2021, 02:53 AM Jan 22 2021, 02:53 AM

Return to original view | IPv6 | Post

#11

|

Senior Member

1,627 posts Joined: May 2013 |

QUOTE(TOS @ Jan 21 2021, 01:10 PM) Ya, I saw the picture, it's attached in your last post. Thank you for the explanation.Basically the same distribution is made for both investor who opt for reinvestment and do not opt for investment, the amount is the same: Non-taxable: 0.0142 cents per unit taxable: 0.0083 cents per unit The only catch is that for those who choose to reinvest, out of the 0.0142 cents per unit non-taxable portion, Axis REIT "extracted" 0.0110 cents per unit for reinvestment, so you have 2 components for non-taxable dividend in the reinvestment case, but they are the same as before because the leftover 0.0032 cents per unit is distributed too. To answer your 2 questions: 1. Yes but you stated the amounts in the opposite, non-taxable is 0.0142 cents per unit, taxable is 0.083 cents per unit; this is the quoted rate for those who do not wish to reinvest their dividends. For case 1, you receive the distributions, a. 0.0142 center per unit non-taxable b. 0.00083 cents per unit taxable portion, Both a and b in cash. --------------------------------------------------------------------------------------------------------------- 2. As stated before, 3 components now, 2 non-taxable, 1 taxable, for those who wish to reinvest. The 2 non-taxable ones are: a. 0.0110 cents per unit for reinvestment at 1.88 MYR per unit b. 0.0032 cents per unit for distribution a+b = 0.0142 cents per unit, exactly the same as the case when you choose not to reinvest dividends. The taxable one is: a. 0.0083 cents per unit, no change from the first case (1) above. The 0.0110 cents per unit is now used to buy the 2 new shares (for your case, assuming originally 503 units) with the leftover distributed as cash similar to case 2a above. And they are all non-taxable. So, for case 2, you receive: a. 2 new shares (priced at 1.88 MYR each), b. 0.0032 cents per unit non-taxable distributions c. Leftover non-taxable distributions from the truncated shares (2.94-2) shares d. 0.0083 cents per units taxable distributions. a are shares, b,c and d are all in cash To add the dividend calculation that I have left out RM0.0032, the calculation should be like this as below, it is correct?  |

|

|

Jan 22 2021, 01:45 PM Jan 22 2021, 01:45 PM

Return to original view | IPv6 | Post

#12

|

Senior Member

1,627 posts Joined: May 2013 |

QUOTE(TOS @ Jan 22 2021, 10:26 AM) Just realized that I made a mistake in my earlier post, it should be in units of RM rather than cents, I have changed that. I thought taxable is the portion that the company will pay to income tax as it is a withholding tax thus shareholder will not receive this portion as their dividend. Yes, your calculation is correct overall, considering the non-taxable part. You forgot the taxable part though, I think. Non-taxable: 0.0032 * 503 (= 1.6096) + (503*0.011 - 2*1.88 = 1.773) = RM 3.3826 (which is the "Allow to get cash dividend" column you found in the last row of the spreadsheet) Taxable: 0.0083 * 503 * 0.9 = RM 3.75741 (times 90% because of 10% WHT) Total cash from both parts would be RM 7.14. If this is correct, we should not take into account the taxable portion into calculation. Welcome to comment on this. |

|

|

Jan 22 2021, 02:53 PM Jan 22 2021, 02:53 PM

Return to original view | IPv6 | Post

#13

|

Senior Member

1,627 posts Joined: May 2013 |

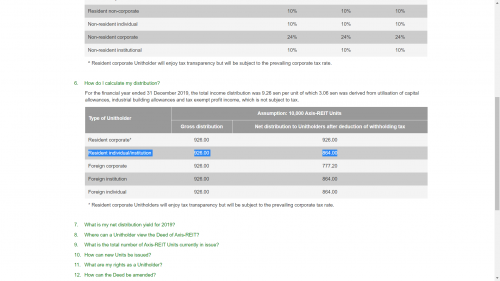

QUOTE(TOS @ Jan 22 2021, 03:04 PM) This is a very good question. Thank you for spending some time to explain to me. Now I am able to understand it.https://www.axis-reit.com.my/reits-faq.php Kindly refer to item 5 and 6.  From item 6, you can clearly see that, with the assumption of 10k units, total gross distribution is RM 926 of which RM 306 is non-taxable. The taxable portion is thus RM 620. With a WHT of 10%, the net distribution paid out (the cash one would receive) is 306 + 620*0.9 = 864, which agrees with the number quoted in the page. So, coming back to your question, I think I got my numbers right. The declared taxable distribution of RM 0.0083 per unit has to multiply by 90% (since WHT is 10%), times 503 units which you hold, and you get the taxed distribution of RM 3.75741. And no, "taxable" here means distributions that can be taxed because they are not derived from utilisation of capital allowances, industrial building allowances and tax exempt profit income, so by law they are liable to tax. From this "taxable" distribution, Axis REIT will deduct 10% and pay that to the Inland Revenue Board of Malaysia (IRB, better known as LHDN). "Taxable" does not mean you won't get the money stated. You misunderstood something there. And thus you should take into account the taxable portion in your cash dividend calculation. It's real cash that you will get, just that you minus 10% WHT off the stated figure. *I don't invest in M-REITs, I only invest in S-REITs, but you inadvertently taught me something today. Thanks. The new share is 5, I have done some mistake in previous calculation, which is not 2. After taking into account the 90% of the taxable portion, this should be the final one.  By the way, I also learnt new things from you. Singapore reit is also better in Reit due to less capital, I started off to invest in Malaysia Reit then I venture into other Malaysian stock. Last year, I invest into Reit ETF launched by Affin Hwang. Most of the counters are in Singpore Reit. You may study it and include into your portfolio if it is suitable to you but holding individual Reit counter will have full control in buying/selling and return. |

|

|

|

|

|

Apr 28 2021, 10:45 PM Apr 28 2021, 10:45 PM

Return to original view | IPv6 | Post

#14

|

Senior Member

1,627 posts Joined: May 2013 |

|

|

|

Apr 28 2021, 11:00 PM Apr 28 2021, 11:00 PM

Return to original view | IPv6 | Post

#15

|

Senior Member

1,627 posts Joined: May 2013 |

|

|

|

Apr 28 2021, 11:09 PM Apr 28 2021, 11:09 PM

Return to original view | IPv6 | Post

#16

|

Senior Member

1,627 posts Joined: May 2013 |

|

|

|

Apr 30 2021, 11:26 AM Apr 30 2021, 11:26 AM

Return to original view | IPv6 | Post

#17

|

Senior Member

1,627 posts Joined: May 2013 |

Between Axis and Atrium. Which one is better?

|

|

|

Jun 10 2021, 12:42 PM Jun 10 2021, 12:42 PM

Return to original view | IPv6 | Post

#18

|

Senior Member

1,627 posts Joined: May 2013 |

https://www.theedgemarkets.com/article/igb-...4LSSO8.facebook

IGB commercial trust reit is going to IPO. Anyone has prospectus willing to share? |

|

|

Jun 10 2021, 05:10 PM Jun 10 2021, 05:10 PM

Return to original view | IPv6 | Post

#19

|

Senior Member

1,627 posts Joined: May 2013 |

QUOTE(Smurfs @ Jun 10 2021, 03:17 PM) Both prospectus and IPO timetable can be found on Bursa's company announcement page. Thanks for the info.Look for IGB Commercial REIT. https://www.bursamalaysia.com/market_information/announcements/company_announcement?keyword=&cat=&sub_type=&company=5299&mkt=&alph=&sec=&subsec=&dt_ht=&dt_lt=#/?category=all A pureplay office REIT. Some info that can be found inside the prospectus :    Is it worth? Office reit. Occupancy rate is ok-ok. Only 1 building is consider new. |

|

|

Jun 10 2021, 07:33 PM Jun 10 2021, 07:33 PM

Return to original view | IPv6 | Post

#20

|

Senior Member

1,627 posts Joined: May 2013 |

QUOTE(LoTek @ Jun 10 2021, 06:52 PM) My humble opinion. Office space is extremely oversupplied even before covid. Now with many, especially large corps, realising they can wfh, and the new mega skyscrapers 118 and trx throwing, its no wonder igb is listing their offices... I also have the same opinion. WFH and office space is oversupply. Similar office reit like AMfirst reit share price is long term downtrend. Not sure whether this new reit will have similar pattern. If performance is average then DPU to shareholder might be so so only. Then it may not worth to invest. |

| Change to: |  0.0941sec 0.0941sec

0.51 0.51

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 02:21 AM |