Outline ·

[ Standard ] ·

Linear+

M Reits Version 7, Malaysia Real Estate Investment

|

dz91

|

Sep 29 2024, 05:29 PM Sep 29 2024, 05:29 PM

|

|

QUOTE(adele123 @ Sep 29 2024, 01:36 PM) reviving this topic. for the past 6months to 1 year, the reits has been rather exciting. at least the non-office reits... i myself has divested from sunreit though, few months ago, would have earned a little more if i divested this week. not sure about the rest here. but meh... it's fine... 7 years in sunreit and bye bye now. I'm still holding on to IGBREIT. want to know the sentiment of others who might want to chip in... The only reit I have currently is AME reit IMO this is currently the best reit low gearing , support by mother company 100% occupancy rate |

|

|

|

|

|

boyboycute

|

Oct 30 2024, 02:28 PM Oct 30 2024, 02:28 PM

|

|

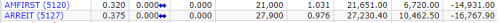

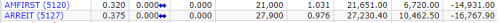

QUOTE(pisces88 @ Mar 21 2024, 12:35 PM) just wanna put this here so people can understand that reits are not as stable as you think, and malaysia reits in general is not to be held long term, with exception to Malls reits only. after about 10 years. this is the return.   Finally, somebody is thinking.... |

|

|

|

|

|

solstice818

|

Oct 30 2024, 02:39 PM Oct 30 2024, 02:39 PM

|

|

QUOTE(boyboycute @ Oct 30 2024, 02:28 PM) Finally, somebody is thinking.... Majority only looking at "dividend yield" without taking into consideration other factors  |

|

|

|

|

|

boyboycute

|

Oct 30 2024, 03:04 PM Oct 30 2024, 03:04 PM

|

|

QUOTE(solstice818 @ Oct 30 2024, 02:39 PM) Majority only looking at "dividend yield" without taking into consideration other factors  Unker used to rub shoulders with the big boys..... Unker advise young fellas to avoid Bursa stocks for your own financial health. With low public float, retailers have zero chance |

|

|

|

|

|

theevilman1909

|

Oct 30 2024, 04:07 PM Oct 30 2024, 04:07 PM

|

|

QUOTE(solstice818 @ Oct 30 2024, 02:39 PM) Majority only looking at "dividend yield" without taking into consideration other factors  mind sharing what others factors??    |

|

|

|

|

|

prdkancil

|

Oct 30 2024, 04:28 PM Oct 30 2024, 04:28 PM

|

Getting Started

|

Those ikan bilis REIT  Most ppl buy branded REIT which is IGBREIT , PAVREIT , SUNREIT and YTLREIT only . Check the performance of those branded REIT . |

|

|

|

|

|

ronnie

|

Oct 30 2024, 10:19 PM Oct 30 2024, 10:19 PM

|

|

buy all the M-REITs to diversify hahahaha

|

|

|

|

|

|

theevilman1909

|

Dec 6 2024, 01:32 PM Dec 6 2024, 01:32 PM

|

|

Analysts Optimistic About Pavilion REIT Acquisition Of Banyan Tree KL And Pavilion Hotel KL https://www.businesstoday.com.my/2024/12/06...c-acquisitions/Pavilion REIT has received BUY recommendations from MIDF Amanah Investment Bank (MIDF Research), RHB Investment Bank Bhd (RHB Research) and Maybank Investment Bank (Maybank IB), with target prices ranging between RM1.69 and RM1.74.  |

|

|

|

|

Sep 29 2024, 05:29 PM

Sep 29 2024, 05:29 PM

Quote

Quote

0.0318sec

0.0318sec

0.73

0.73

6 queries

6 queries

GZIP Disabled

GZIP Disabled