MAY I KNOW WHAT IS MEANING " CASA required"?

Fixed Deposit Rates In Malaysia V. No.8, Please Read Post#1 and #2

Fixed Deposit Rates In Malaysia V. No.8, Please Read Post#1 and #2

|

|

Jan 23 2015, 11:10 AM Jan 23 2015, 11:10 AM

|

Junior Member

239 posts Joined: Nov 2007 |

MAY I KNOW WHAT IS MEANING " CASA required"?

|

|

|

|

|

|

Jan 23 2015, 11:14 AM Jan 23 2015, 11:14 AM

|

Junior Member

75 posts Joined: Apr 2009 |

CA - Current Acc

SA - Saving Acc |

|

|

Jan 23 2015, 11:21 AM Jan 23 2015, 11:21 AM

|

Junior Member

239 posts Joined: Nov 2007 |

ANYBODY PUT IN AFFIN BANK?

|

|

|

Jan 23 2015, 11:29 AM Jan 23 2015, 11:29 AM

|

Senior Member

2,548 posts Joined: May 2005 |

QUOTE(sylille @ Jan 22 2015, 05:53 PM) Just called my CIMB RM n she said these r special rates fo Preferred Customers with ONE MILLION RINGGIT The $*@! CS guy at SC call centre ought to be sacked...give wrong info. This is the issue with CS staff who give wrong info.Aiyah...anyway, no loss for me, I got the same rate altho for 12 months at CIMB. I sure no have RM1M I was a preferred customer at CIMB but due to musical chair game had shifted funds and officially not a preferred customer. * But the staff so familiar with my face, see me, oto give me Q no for preferred customer..I suspect they din know I no longer preferred customer Actually , was on the way to OCBC when the RM called. I said, Can u beat OCBC's 4.2%? Then she said ok - 4.25%; their new promo rate. She din say if it's for preferred customer or need certain amount. Now I am "preferred" again. My experience with some banks is that depending on their position, some of their TnC can be varied. This post has been edited by ??!!: Jan 23 2015, 11:44 AM |

|

|

Jan 23 2015, 11:35 AM Jan 23 2015, 11:35 AM

|

Junior Member

277 posts Joined: Jan 2010 |

Can I know if I open an FD account with a particular bank - I would also need to open a SA to have the interest and FD amount to be credited when it matures (lets say 12 months) - and after that i withdraw all and want to close the account.. will I have to pay to close?

|

|

|

Jan 23 2015, 11:41 AM Jan 23 2015, 11:41 AM

|

Junior Member

239 posts Joined: Nov 2007 |

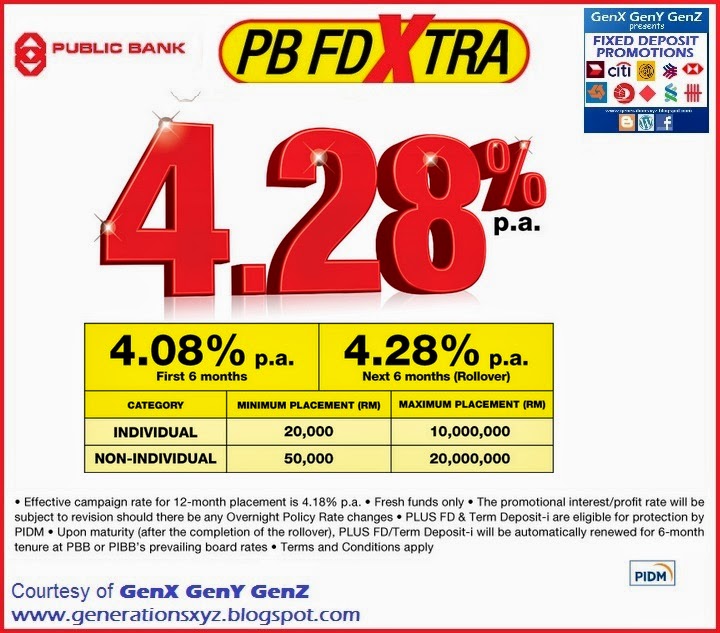

QUOTE(AVFAN @ Jan 13 2015, 04:51 PM) u definitely need to learn how to read ads with fine prints better... Individual type can put joint name?the big numbers in red says 4.28% with small print p.a.= per annum = per year. below, 4.08% p.a. first 6 months, 4.28% p.a. next 6 mths. now, go further below and read small print: effective campaign rate for 12 months placement is 4.18%. it means this promotion is ONLY for 12 months, cannot do 1 or 3 or 6 or 9 months. months 1-6, it is 4.08% p.a., so u get 6/12x4.08% = 2.04%. months 7-12, it is 4.28% p.a., u get 6/12x4.28%=2.14. add the 2 periods, you get 2.04+2.14=4.18% which is what is stated too. that's the way it is done. ads with big and small prints are meant to attract attention but qualified in case they get sued for misleading public. if u ever read any ad and think it is 4 or 5% for 6 months or 10% for a year, u know it is wrong. no bank is offering that much at this time.  |

|

|

|

|

|

Jan 23 2015, 11:45 AM Jan 23 2015, 11:45 AM

|

Senior Member

2,548 posts Joined: May 2005 |

|

|

|

Jan 23 2015, 12:58 PM Jan 23 2015, 12:58 PM

|

Senior Member

2,337 posts Joined: Oct 2014 |

|

|

|

Jan 23 2015, 03:15 PM Jan 23 2015, 03:15 PM

|

Junior Member

239 posts Joined: Nov 2007 |

|

|

|

Jan 23 2015, 04:06 PM Jan 23 2015, 04:06 PM

|

All Stars

65,283 posts Joined: Jan 2003 |

|

|

|

Jan 23 2015, 04:08 PM Jan 23 2015, 04:08 PM

|

Senior Member

5,867 posts Joined: Feb 2006 |

|

|

|

Jan 23 2015, 05:15 PM Jan 23 2015, 05:15 PM

Show posts by this member only | IPv6 | Post

#392

|

Senior Member

1,074 posts Joined: Sep 2013 |

QUOTE(joeaverage @ Jan 23 2015, 11:35 AM) Can I know if I open an FD account with a particular bank - I would also need to open a SA to have the interest and FD amount to be credited when it matures (lets say 12 months) - and after that i withdraw all and want to close the account.. will I have to pay to close? CASA is not necessary for some banks. I opened with Ambank for their 6 months @ 4% promo with no account opened. Just an FD cert. When matured, you can close that FD, the principal + interest shall be paid to you. Some banks charge for the bank draft if I'm not mistaken. |

|

|

Jan 23 2015, 05:23 PM Jan 23 2015, 05:23 PM

|

Junior Member

239 posts Joined: Nov 2007 |

QUOTE(McFD2R @ Jan 23 2015, 05:15 PM) CASA is not necessary for some banks. I opened with Ambank for their 6 months @ 4% promo with no account opened. Just an FD cert. When matured, you can close that FD, the principal + interest shall be paid to you. Some banks charge for the bank draft if I'm not mistaken. CASA is necessary for public bank FD or not ? |

|

|

|

|

|

Jan 23 2015, 05:47 PM Jan 23 2015, 05:47 PM

|

Junior Member

239 posts Joined: Feb 2013 |

QUOTE(muncee @ Jan 22 2015, 01:07 PM) Only for new customer without any account with SCB. Just park extras into FD here today hehe... Need to open an account and deposit RM1500. But next day can transfer out. [attachmentid=4311847] Not need 1500 deposit. Not for new customer only. Require CASA - for interest deposition upon maturity. Tho spent quite some time for processing, but worth it |

|

|

Jan 23 2015, 07:53 PM Jan 23 2015, 07:53 PM

|

Senior Member

1,021 posts Joined: Mar 2010 |

|

|

|

Jan 23 2015, 08:20 PM Jan 23 2015, 08:20 PM

|

Senior Member

6,614 posts Joined: Mar 2011 |

QUOTE(muncee @ Jan 22 2015, 01:07 PM) Only for new customer without any account with SCB. Not true, please see below explanation.Need to open an account and deposit RM1500. But next day can transfer out. [attachmentid=4311847] QUOTE(bbgoat @ Jan 22 2015, 02:41 PM) For "old" customer, it needs fresh fund. So old customer still eligible. As to the deposit requirement mentioned, that one is a bit doubtful. Last year I opened a JustOne acct as a requirement for the FD promo, no need a single cent there. QUOTE(bbgoat @ Jan 23 2015, 09:31 AM) Talked to SCB leng lui again. Current customer still eligible for the promo. As the brochure shown earlier said, fresh fund needed. Going to SCB this morning to place the 4.5% FD. OK, reporting on this SCB promo:Met the SCB leng lui. As mentioned before, the FD promo is for new & existing customer. But if using "old" fund (matured FD), need to deposit 10% into CASA and hold, as shown in the leaflet. Placed FD with new fund for 15 mths at 4.5% !! However CANNOT split into multiple FD for this promo. Also one time placement only !! Meaning next working day you cannot place another FD to get this promo rate. BUT was told can get KL approval. It is a new promo. First customer for the leng lui on this promo. She even asked me how did I get to know this promo. Thanks for the info given on this promo by McFD2R. There are 3 sheets of T & C. So I asked some questions which the leng lui need to call even KL for the answer (one time placement). Went to their PB office to sign up for PB. Saw 2 more leng lui there. This post has been edited by bbgoat: Jan 23 2015, 08:24 PM |

|

|

Jan 23 2015, 08:51 PM Jan 23 2015, 08:51 PM

|

Junior Member

239 posts Joined: Nov 2007 |

|

|

|

Jan 23 2015, 09:18 PM Jan 23 2015, 09:18 PM

|

Senior Member

1,074 posts Joined: Sep 2013 |

|

|

|

Jan 23 2015, 09:25 PM Jan 23 2015, 09:25 PM

|

Junior Member

239 posts Joined: Nov 2007 |

|

|

|

Jan 23 2015, 09:27 PM Jan 23 2015, 09:27 PM

|

Senior Member

1,074 posts Joined: Sep 2013 |

|

|

Topic ClosedOptions

|

| Change to: |  0.0268sec 0.0268sec

0.43 0.43

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 11:04 AM |