Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.8, Please Read Post#1 and #2

|

McFD2R

|

Jan 21 2015, 04:20 PM Jan 21 2015, 04:20 PM

|

|

QUOTE(aeiou228 @ Jan 21 2015, 04:05 PM) What about the 15 mths 4.5%, got such promo ?? There is. But I didn't ask if got any other requirement. Since I am already a Priority Account holder, my RM just inform me. But I think this promo should be open to everyone. |

|

|

|

|

|

okuribito

|

Jan 21 2015, 04:28 PM Jan 21 2015, 04:28 PM

|

|

QUOTE(McFD2R @ Jan 21 2015, 03:58 PM) I just came back from SCB Bandar Puteri Puchong half hour ago. Placed an amount for 9 months 4.25%  Sounds like good news  Just to be sure, it's not one of those 80:20 casa deals, is it? Straight FD but must open savings acct for interest crediting? |

|

|

|

|

|

McFD2R

|

Jan 21 2015, 04:41 PM Jan 21 2015, 04:41 PM

|

|

QUOTE(okuribito @ Jan 21 2015, 04:28 PM) Sounds like good news  Just to be sure, it's not one of those 80:20 casa deals, is it? Straight FD but must open savings acct for interest crediting? Fully FD ... a/c opening is mere formality and can be zero balance whereby the interest will be credited to account when matured. |

|

|

|

|

|

okuribito

|

Jan 21 2015, 04:59 PM Jan 21 2015, 04:59 PM

|

|

QUOTE(McFD2R @ Jan 21 2015, 04:41 PM) Fully FD ... a/c opening is mere formality and can be zero balance whereby the interest will be credited to account when matured.    3 cheers to you and SCB |

|

|

|

|

|

??!!

|

Jan 21 2015, 05:09 PM Jan 21 2015, 05:09 PM

|

|

QUOTE(McFD2R @ Jan 21 2015, 03:58 PM) I just came back from SCB Bandar Puteri Puchong half hour ago. Placed an amount for 9 months 4.25%  Aahhh...maybe me $$ is not good enuf for them. The CS guy so sure ..i ask him go check. He left me hanging on the phone for a while n said arrhh... " i double confirm there is no such rate" Anyway, by way of update, CIMB manager called me n finally placed with them at CIMB islamic @ 4.25% for 12 months. She said this is their just announced promo rate. 3 months @ 4.05% This post has been edited by ??!!: Jan 21 2015, 05:12 PM |

|

|

|

|

|

robert82

|

Jan 21 2015, 07:51 PM Jan 21 2015, 07:51 PM

|

|

QUOTE(??!! @ Jan 21 2015, 05:09 PM) Aahhh...maybe me $$ is not good enuf for them. The CS guy so sure ..i ask him go check. He left me hanging on the phone for a while n said arrhh... " i double confirm there is no such rate" Anyway, by way of update, CIMB manager called me n finally placed with them at CIMB islamic @ 4.25% for 12 months. She said this is their just announced promo rate. 3 months @ 4.05% how did you get 4.25 rate? Placed online or go to bank? |

|

|

|

|

|

gsc

|

Jan 21 2015, 10:59 PM Jan 21 2015, 10:59 PM

|

|

QUOTE(kykit @ Jan 21 2015, 11:24 AM) I'm keeping some USD abroad 5yrs ago hv been earning 3.5%-8% FD interest. I think that time is 3.3 then going through roller coaster and now 3.6. Wondering shd I convert back to RM for local FD rate? 3.5-8% for FD? USA FD has been close to zero and that is why they are implementing the QE...the local bank US$ FD is not even 1%. |

|

|

|

|

|

aeiou228

|

Jan 21 2015, 11:48 PM Jan 21 2015, 11:48 PM

|

|

Indirect Swiss Franc deposit ....Rolex watches. The only way one can still travel back in time to pre 15th Jan 2015 MYR/CHF exchange rate to buy existing stock of Rolex watches at current price before price increase.

|

|

|

|

|

|

kykit

|

Jan 22 2015, 04:52 AM Jan 22 2015, 04:52 AM

|

New Member

|

QUOTE(gsc @ Jan 21 2015, 10:59 PM) 3.5-8% for FD? USA FD has been close to zero and that is why they are implementing the QE...the local bank US$ FD is not even 1%. is a least developed country no PIDM thingy there  anyway amt not big lowest 3.5% is our local bank (awarded Best Foreign Bank) & highest 8% is their local micro finance institution |

|

|

|

|

|

familyfirst

|

Jan 22 2015, 08:59 AM Jan 22 2015, 08:59 AM

|

|

I wish we could place a FD over the counter at one branch and uplift it at any other branch nearby us. So mah fan sometimes to go back to that branch esp if I placed it near work place and the following year, my work place sudah pindah lain tempat.

|

|

|

|

|

|

McFD2R

|

Jan 22 2015, 09:17 AM Jan 22 2015, 09:17 AM

|

|

QUOTE(familyfirst @ Jan 22 2015, 08:59 AM) I wish we could place a FD over the counter at one branch and uplift it at any other branch nearby us. So mah fan sometimes to go back to that branch esp if I placed it near work place and the following year, my work place sudah pindah lain tempat. Every branch has a quota to meet. You place RM10k in branch A, then take out in branch B, rugi lah branch B. They didn't get to use your RM10k to give out loan to make money but instead have to give you money  |

|

|

|

|

|

??!!

|

Jan 22 2015, 10:41 AM Jan 22 2015, 10:41 AM

|

|

QUOTE(robert82 @ Jan 21 2015, 07:51 PM) how did you get 4.25 rate? Placed online or go to bank? went to the branch |

|

|

|

|

|

Human Nature

|

Jan 22 2015, 11:11 AM Jan 22 2015, 11:11 AM

|

|

QUOTE(familyfirst @ Jan 22 2015, 08:59 AM) I wish we could place a FD over the counter at one branch and uplift it at any other branch nearby us. So mah fan sometimes to go back to that branch esp if I placed it near work place and the following year, my work place sudah pindah lain tempat. QUOTE(McFD2R @ Jan 22 2015, 09:17 AM) Every branch has a quota to meet. You place RM10k in branch A, then take out in branch B, rugi lah branch B. They didn't get to use your RM10k to give out loan to make money but instead have to give you money  Ambank customer service told me that it is possible to do so at their branches but I have yet to test it myself. |

|

|

|

|

|

??!!

|

Jan 22 2015, 11:23 AM Jan 22 2015, 11:23 AM

|

|

For info:

Banks that pay interest for non-working days -

Alliance Bank

Kuwait Finance House

AmBank used to pay also-From my experience few years back. Not sure about current position, as I noticed it's listed as them not paying interest for non-working days

Also to add:-

Bank Rakyat is quite good when you do a premature withdrawal. They will pay interest based on rate of tenure that FD was held instead of the rate for intended tenure. Other banks will usually pay 50% of the interest earned till withdrawal date, if it's held for more than 3 months. Less than 3 months, 0 interest paid.

eg

FD placed at 4% for 12 months.

FD premature withdrawal at month 9. Interest will be given based on 9 months rate ,say 3.7%

This post has been edited by ??!!: Jan 22 2015, 11:25 AM

|

|

|

|

|

|

bbgoat

|

Jan 22 2015, 11:27 AM Jan 22 2015, 11:27 AM

|

|

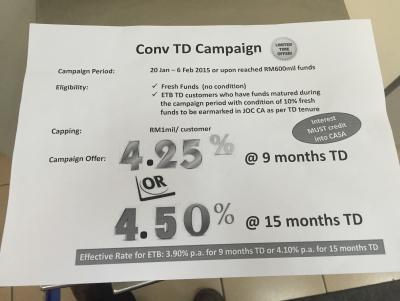

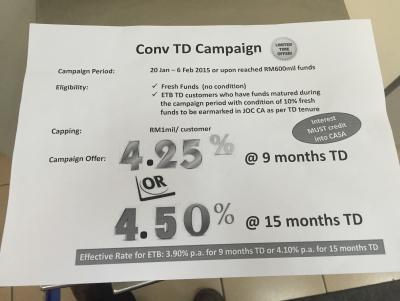

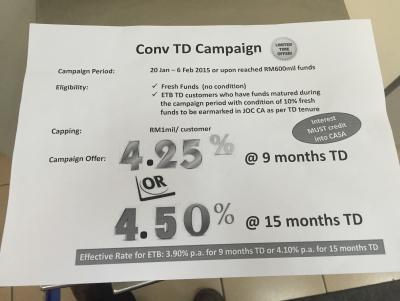

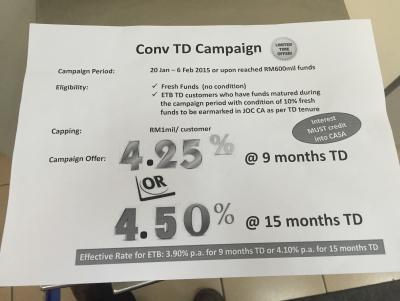

QUOTE(McFD2R @ Jan 20 2015, 04:39 PM) SCB RM just texted me, 9 months 4.25%, 15 mths 4.5% ... until 6 Feb 2015 or RM600 mil quota. Min RM5k but with CASA required. Called SCB leng lui and confirmed above NEW FD promo. If you open Justone acct, no need to put anything in it like myself and Ah Boom has done last year. Wow, this is the biggest deal now !! So the AmBank 3 yr 4.5% is pale in comparison !!  Instead of putting more into AmBank 3 yrs, now going to go for SCB 15 mths !!  This post has been edited by bbgoat: Jan 22 2015, 11:28 AM This post has been edited by bbgoat: Jan 22 2015, 11:28 AM |

|

|

|

|

|

McFD2R

|

Jan 22 2015, 12:04 PM Jan 22 2015, 12:04 PM

|

|

QUOTE(bbgoat @ Jan 22 2015, 11:27 AM) Called SCB leng lui and confirmed above NEW FD promo. If you open Justone acct, no need to put anything in it like myself and Ah Boom has done last year. Wow, this is the biggest deal now !! So the AmBank 3 yr 4.5% is pale in comparison !!  Instead of putting more into AmBank 3 yrs, now going to go for SCB 15 mths !!   MY SCB is chai, not even leng chai ..... Yes, so far, this is one of the best for the 9-15 month period  |

|

|

|

|

|

muncee

|

Jan 22 2015, 01:07 PM Jan 22 2015, 01:07 PM

|

Getting Started

|

Only for new customer without any account with SCB. Need to open an account and deposit RM1500. But next day can transfer out.

|

|

|

|

|

|

bbgoat

|

Jan 22 2015, 01:08 PM Jan 22 2015, 01:08 PM

|

|

QUOTE(McFD2R @ Jan 22 2015, 12:04 PM)  MY SCB is chai, not even leng chai ..... Yes, so far, this is one of the best for the 9-15 month period  You and Ah Boom can shake hand. His also a chai. Not sure same chai or not. Ha ha ha !  In AmBank just now. Told the ABM SCB promo. She (a lui but no leng lui  ) told me they are going to have a new FD promo of 9 mths at 4.08%. She will SMS me once it is formally announced.  |

|

|

|

|

|

familyfirst

|

Jan 22 2015, 02:19 PM Jan 22 2015, 02:19 PM

|

|

QUOTE(muncee @ Jan 22 2015, 01:07 PM) Only for new customer without any account with SCB. Need to open an account and deposit RM1500. But next day can transfer out.

Open a few account in diff bank .. a bit mah fan for me. Some more nearby no SCB. Wasted lor this good deal. |

|

|

|

|

|

guna96

|

Jan 22 2015, 02:32 PM Jan 22 2015, 02:32 PM

|

New Member

|

QUOTE(muncee @ Jan 22 2015, 01:07 PM) Only for new customer without any account with SCB. Need to open an account and deposit RM1500. But next day can transfer out.

Can someone explain why the effective rate drop to 3.9% for 9 months and 4.1% for 15 months? |

|

|

|

|

Jan 21 2015, 04:20 PM

Jan 21 2015, 04:20 PM

Quote

Quote

0.0297sec

0.0297sec

0.50

0.50

6 queries

6 queries

GZIP Disabled

GZIP Disabled