Outline ·

[ Standard ] ·

Linear+

Fundsupermart.com v8, The MS Excel Masterclass version!

|

SUSPink Spider

|

Jan 16 2015, 11:00 PM Jan 16 2015, 11:00 PM

|

|

QUOTE(xuzen @ Jan 16 2015, 10:54 PM) it is Bolehland deliver beta, not alpha lar! I don't know, maybe my beloved Ms Lee on leave or something coz her fund is koyak liao... tak boleh pakai for the time being. Xuzen Aiya, whatever lar, I'm not good with all these Greek words!  Ppl say...Ms Lee is taking over the throne of an empire built by Mr Chen... Now that Mr Chen is gone, Ms Lee's regime dunno how to handle catastrophes  |

|

|

|

|

|

SUSyklooi

|

Jan 16 2015, 11:10 PM Jan 16 2015, 11:10 PM

|

|

QUOTE(Pink Spider @ Jan 16 2015, 10:56 PM) My reasoning (could be just me) - If one day I were to migrate, the nearest and most probable destination would be Kiasuland Don't take my words for it, u think yourself   think think.... woi!! this really deserves "A Second Look". in kiasuland many things CANNOT do leh. Money not enough in here,....   anyway will keep that fund and US focused EQ in KIV list....waiting for guts and opportunity to come....now cash is 25% in portfolio This post has been edited by yklooi: Jan 16 2015, 11:14 PM Attached thumbnail(s)

|

|

|

|

|

|

SUSPink Spider

|

Jan 16 2015, 11:14 PM Jan 16 2015, 11:14 PM

|

|

QUOTE(yklooi @ Jan 16 2015, 11:10 PM)  think think.... woi!! this really deserves "A Second Look". in kiasuland many things CANNOT do leh. Money not enough in here,....   anyway will keep that fund and US focused EQ in KIV list....waiting for guts and opportunity to come....now cash is 25% in portfolio Oi! Recently u guys really very naughty ar!  I even worse...my UT + stocks portfolio...cash at 37%  But, with CMF at 3.75% yield, little to complain  This post has been edited by Pink Spider: Jan 16 2015, 11:16 PM This post has been edited by Pink Spider: Jan 16 2015, 11:16 PM |

|

|

|

|

|

kucingfight

|

Jan 16 2015, 11:20 PM Jan 16 2015, 11:20 PM

|

Look at all my stars!!

|

any recommendations tomorrow?

how about REITS?

i'm heavy on bonds (AMB income trust) as usual..

|

|

|

|

|

|

SUSyklooi

|

Jan 16 2015, 11:22 PM Jan 16 2015, 11:22 PM

|

|

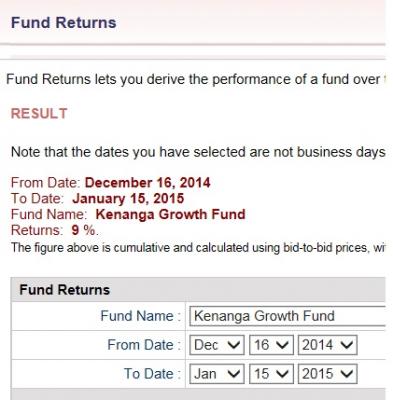

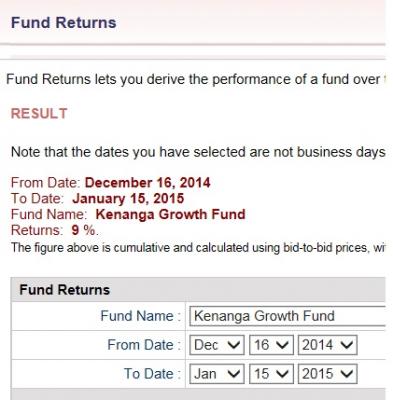

QUOTE(Pink Spider @ Jan 16 2015, 11:00 PM) Aiya, whatever lar, I'm not good with all these Greek words!  Ppl say...Ms Lee is taking over the throne of an empire built by Mr Chen... Now that Mr Chen is gone, Ms Lee's regime dunno how to handle catastrophes   1 month return 9%...wor. still NOT Happy meh?  I Never Try Ms Lee before....now after having tried her.....I think I will continue the RIDE...   This post has been edited by yklooi: Jan 16 2015, 11:25 PM Attached thumbnail(s) This post has been edited by yklooi: Jan 16 2015, 11:25 PM Attached thumbnail(s)

|

|

|

|

|

|

xuzen

|

Jan 16 2015, 11:22 PM Jan 16 2015, 11:22 PM

|

|

QUOTE(Pink Spider @ Jan 16 2015, 11:00 PM) Aiya, whatever lar, I'm not good with all these Greek words!  Ppl say...Ms Lee is taking over the throne of an empire built by Mr Chen... Now that Mr Chen is gone, Ms Lee's regime dunno how to handle catastrophes  Let me educate you: Alpha: absolute return. To layman that is the ROI. Beta: measure of risk usually use one standard deviation although some smart-Alec at Morgan Stanley Investment bank used only downside risk and hence called it semi-deviation. Delta: the related coefficient of the derivative product against the mother or underlying asset it is derived from Gamma: The rate of change of the derivative product price against the underlying asset price movement. Xuzen |

|

|

|

|

|

SUSPink Spider

|

Jan 16 2015, 11:22 PM Jan 16 2015, 11:22 PM

|

|

QUOTE(kucingfight @ Jan 16 2015, 11:20 PM) any recommendations tomorrow? how about REITS? i'm heavy on bonds (AMB income trust) as usual.. STILL???  How many rallies u have missed  Why not take the 0.5% SC promo and recent market volatility to build a proper portfolio? |

|

|

|

|

|

SUSPink Spider

|

Jan 16 2015, 11:26 PM Jan 16 2015, 11:26 PM

|

|

QUOTE(xuzen @ Jan 16 2015, 11:22 PM) Let me educate you: Alpha: absolute return. To layman that is the ROI. Beta: measure of risk usually use one standard deviation although some smart-Alec at Morgan Stanley Investment bank used only downside risk and hence called it semi-deviation. Delta: the related coefficient of the derivative product against the mother or underlying asset it is derived from Gamma: The rate of change of the derivative product price against the underlying asset price movement. Xuzen  Investopedia: Alpha: A measure of performance on a risk-adjusted basis. Alpha takes the volatility (price risk) of a mutual fund and compares its risk-adjusted performance to a benchmark index. The excess return of the fund relative to the return of the benchmark index is a fund's alpha. In simple term - OutperformanceBeta: Beta is calculated using regression analysis, and you can think of beta as the tendency of a security's returns to respond to swings in the market. A beta of 1 indicates that the security's price will move with the market. A beta of less than 1 means that the security will be less volatile than the market. A beta of greater than 1 indicates that the security's price will be more volatile than the market. For example, if a stock's beta is 1.2, it's theoretically 20% more volatile than the market. In simple term - Correlation to marketTarak betul?  |

|

|

|

|

|

techie.opinion

|

Jan 16 2015, 11:32 PM Jan 16 2015, 11:32 PM

|

|

QUOTE(yklooi @ Jan 16 2015, 10:55 PM) bought into KGF in early Dec...dropped to -6% I think....now is abt +1%. Yup... most MY fund recovering now. |

|

|

|

|

|

yck1987

|

Jan 16 2015, 11:46 PM Jan 16 2015, 11:46 PM

|

|

QUOTE(yklooi @ Jan 16 2015, 10:34 PM) Resources / energy fund? Anyone. ?  |

|

|

|

|

|

SUSyklooi

|

Jan 16 2015, 11:55 PM Jan 16 2015, 11:55 PM

|

|

QUOTE(yck1987 @ Jan 16 2015, 11:46 PM) Resources / energy fund? Anyone. ?  sector specific?? too risky for an old man  ...later heart attack  |

|

|

|

|

|

SUSPink Spider

|

Jan 16 2015, 11:59 PM Jan 16 2015, 11:59 PM

|

|

QUOTE(yck1987 @ Jan 16 2015, 11:46 PM) Resources / energy fund? Anyone. ?  AmCommodities? Buy in RM1K and wait 3 years  |

|

|

|

|

|

yck1987

|

Jan 17 2015, 12:12 AM Jan 17 2015, 12:12 AM

|

|

QUOTE(Pink Spider @ Jan 16 2015, 11:59 PM) AmCommodities? Buy in RM1K and wait 3 years  Ya , I'm considering this. But won't go for big LS purchase. , later  |

|

|

|

|

|

yck1987

|

Jan 17 2015, 12:16 AM Jan 17 2015, 12:16 AM

|

|

QUOTE(Pink Spider @ Jan 16 2015, 10:56 PM) My reasoning (could be just me) - If one day I were to migrate, the nearest and most probable destination would be Kiasuland - close distance, similar culture. And, over time, Kiasuland has proven itself to be the most competitive among SEA nations. So, u probably won't go too far wrong with SGD as Ringgit/inflation hedge. Don't take my words for it, u think yourself  The recent forex gain helps me to have additional $$ just like increase in salary indirectly  |

|

|

|

|

|

SUSDavid83

|

Jan 17 2015, 07:13 AM Jan 17 2015, 07:13 AM

|

|

Topping up anything today?

|

|

|

|

|

|

kswee

|

Jan 17 2015, 07:25 AM Jan 17 2015, 07:25 AM

|

|

RHB energy fund .

|

|

|

|

|

|

SUSDavid83

|

Jan 17 2015, 08:00 AM Jan 17 2015, 08:00 AM

|

|

2014 Top And Bottom Fixed Income Funds: Malaysian Bond Funds Hurt On Exposure To EquitiesONCLUSION Despite our suggestion to underweight fixed income for the past few years, we maintain that fixed income remains an integral and relevant part in investors’ portfolio. While uncertainty surrounds the actual timing of Fed rate hikes in 2015, we expect muted inflation to contribute to a more gradual rate hike cycle, which could contribute to more stability in bond yields in 2015. Locally, we believe the negative impact of the rising yields might be milder on local bonds especially corporate debts, because of the higher credit spread over Malaysia government bonds. Typically, Malaysia bond funds have substantial allocation in local corporate debts. Apart from investing in local general bond funds, investors with higher risk appetite can consider some local bond funds with equity exposure or foreign bond exposure to enhance the potential return of the portfolio. Likewise, investors can also opt for fixed income funds that invest in Asian and EM debt as they are likely to fare fairly well under our expectations of an improving global economy. URL: http://www.fundsupermart.com.my/main/resea...?articleNo=5427

|

|

|

|

|

|

jutamind

|

Jan 17 2015, 09:04 AM Jan 17 2015, 09:04 AM

|

|

All these discussions about MY funds reminds me of the discussions about bond fund, especially on amdynamic fund 3-6 months back.

Those who stay the course would have been rewarded as amdynamic performance has since rebounded. I believe it will be similar case for MY funds well.

|

|

|

|

|

|

edwardSL

|

Jan 17 2015, 09:46 AM Jan 17 2015, 09:46 AM

|

New Member

|

Now cannot buy Aberdeen fund? LOL I thought wanna buy 1 =.=

|

|

|

|

|

|

jedibakat

|

Jan 17 2015, 09:52 AM Jan 17 2015, 09:52 AM

|

New Member

|

Stopped topping up on FSM since 6 months ago because been using eUnitrust instead due to their frequent 0% promo SC. Today...... maybe go take brochure and see see and place order for CIMB funds which are not available on eUnitrust. MV parking is a nightmare tho and many CIMB (& most other) funds are far from their recent dip T.T

FSM platform still best in terms of user friendliness.

In separate strategy:

IFCA 400% returns over last 6 months. HUAT AH!

|

|

|

|

|

Jan 16 2015, 11:00 PM

Jan 16 2015, 11:00 PM

Quote

Quote

0.0243sec

0.0243sec

0.28

0.28

6 queries

6 queries

GZIP Disabled

GZIP Disabled