QUOTE(rjb123 @ Nov 18 2018, 09:03 PM)

I used TDAM originally because of the fee free ETFs, but since that changed to TD Ameritrade Asia In SG I don’t think that exists anymore.

IB has access to basically all markets worldwide and lower fees. But higher minimums and inactivity fees

I think AT still has the fee free EPF from what I read last week (not any ETF you like but the selected 300 ETF). I don't like the general impression I get so far from reading these USA brokers' web infor. Said A but they meant B. Have to be careful in reading their docs. Eg 300 free fee EPF is not really the case, stated somewhere else that need to buy x amount to qualify and also must be within x weeks after opening ac. Also, one page says account deposit of US$x k while another page says US$0! First impression is indeed misleading!

This is contrary to the impression I have on the USA as a highly developed country with everything in near perfect order. Ha.

Back to ETF topic.

As a rookie in ETF, going through the learning steps. Appreciate your help (and other friends here as well). Compiling my learning points and I plan to share it here so that other beginners will have an easier time to get walking and then running on ETF.

Please PM me pointers and I will compile them in a decision flowchart for sharing later.

Many thanks.

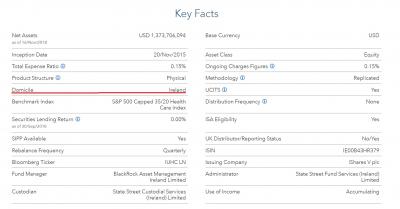

P/S On expense ratio, is that set for the life of the fund or can that be changed later?

PP/S Question on ETF dividends. Say ETF AA has companies X, Y & Z which give dividends of 1, 2 & 3 million for ETF AA.

(1) ETF AA will then distribute the 1+2+3 million dividends to the ETF AA shareholders?

(2) Can ETF AA itself give dividend (not from companies X, Y & Z)?

(3) If ETF AA allows dividend reinvestment, this will be after the 30% dividend tax deduction?

(4) Say I terminate this ETF AA after 10 years, any fees I should be aware of? Capital gain tax, sell fee, etc?

Nov 15 2018, 07:41 PM

Nov 15 2018, 07:41 PM

Quote

Quote

0.0672sec

0.0672sec

0.42

0.42

6 queries

6 queries

GZIP Disabled

GZIP Disabled