Outline ·

[ Standard ] ·

Linear+

All about ETFs / Foreign Brokers, Exchange traded funds

|

hyperzz

|

Jan 19 2018, 11:24 PM Jan 19 2018, 11:24 PM

|

Getting Started

|

I came across this thread by accident. It seems that many people want to open account with IB but could not do so because: 1) could not afford the initial deposit of $10K. 2) not willing to pay $10/month inactivity fee Here's the good news. IB offers white branding to other brokers: https://www.interactivebrokers.com/en/index.php?f=14322 Basically, a white label (WL) broker of IB charges slightly higher commission than IB but requires less initial deposit. Some of them waive the $10/month inactivity fee. WL brokers might not offer the full range of products offered by IB. An account with WL brokers is fully held at IB and you can also login to IB's website and trading platform (TWS) with the same username. Some of the WL brokers that I know: 1) Zackstrade - US based. 2) Placetrade - US based 3) Captrader - Germany based 4) Prorealtime - France based You can google to find out more about them. Personally, I have only used Zackstrade. I can confirm the following for Zackstrade: 1) Initial deposit of $2500 2) No inactivity fee of $10/month. Here is the link: https://www.zackstrade.com/commissions-fees/Disclaimer: I do not work for Zackstrade, just a customer with them. |

|

|

|

|

|

hyperzz

|

Aug 28 2018, 02:24 AM Aug 28 2018, 02:24 AM

|

Getting Started

|

It's a waste of time to argue with this banker. Maybe you should transfer a portion of your money to another bank, where you have an account and initiate the transfer from there.

|

|

|

|

|

|

hyperzz

|

Aug 28 2018, 04:32 PM Aug 28 2018, 04:32 PM

|

Getting Started

|

QUOTE(sukhwin79 @ Aug 28 2018, 01:13 PM) The problem is that my USD account is with HSBC. I'm gonna go back there again today to talk about it. I see. That's unfortunate. Could you go to another branch of HSBC and talk to a different staff? Some staff are more lenient. I notice that HSBC gives 2.6% p.a for 3-month USD FD. That's higher than the US Fed's interest rate and this means HSBC desperately need USD now. As a last resort, you can open a USD account at another bank and initiate a TT to transfer your USD over to your new account. But first make sure that this bank will not bar you from transferring fund to IB. Attached thumbnail(s)

|

|

|

|

|

|

hyperzz

|

Sep 11 2018, 05:38 AM Sep 11 2018, 05:38 AM

|

Getting Started

|

If you ever wonder how free brokerages (i.e. 8 Securities, Robinhood, etc) earn their profit, you should read the book Flash Boys: A Wall Street Revolt. Another famous book by the same author is The Big Short. While I am not totally against free brokerage, you should know what happens behind the scene. Basically, a free lunch is not really free. This post has been edited by hyperzz: Sep 11 2018, 05:44 AM |

|

|

|

|

|

hyperzz

|

Sep 13 2018, 03:11 AM Sep 13 2018, 03:11 AM

|

Getting Started

|

QUOTE(apathen @ Sep 12 2018, 06:03 PM) pardon me, after reading your link I still don't understand what the threats are, mind sharing? It is highly suspected that free brokerages engage in front-running their customers to earn their profit. This article explains the concept of front-running very well: How Traders Use Front-Running to Profit From Client OrdersNowadays, front-running is made easier with the help of High Frequency Trading (HFT), dark pools, etc. Here are more articles to help you understand these financial stuff: RobinHood 1 : A very long article. Read from paragraph 8 onwards. "Robinhood answers this exact question on their website, ..." RobinHood 2If you the buy-and-hold type, free brokerages might still work for you. However, if you are a frequent trader, please investigate more on your own. |

|

|

|

|

|

hyperzz

|

Sep 15 2018, 11:31 PM Sep 15 2018, 11:31 PM

|

Getting Started

|

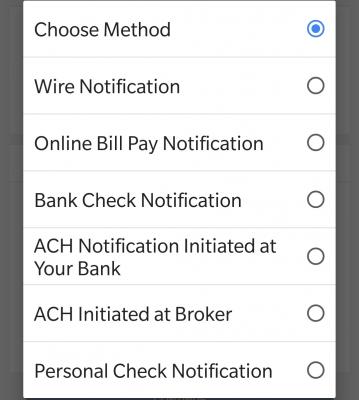

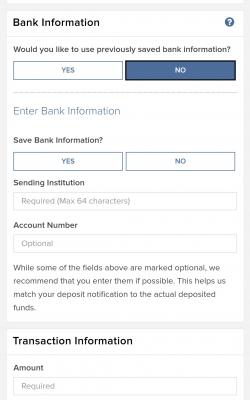

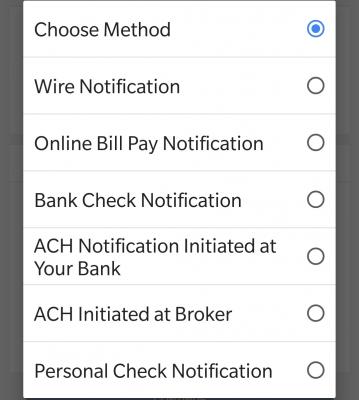

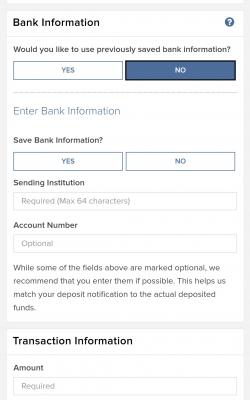

QUOTE(MNet @ Sep 15 2018, 10:23 PM) wait do u mean if i have USD at transferwise, the only option that i can send USD to my IB broker is using the ACH option? Yes, use ACH. When depositing USD, choose "ACH Notification Initiated at Your Bank". If you have a real US bank account, you can choose "ACH Initiated at Broker". On the next step, put "Community Federal Saving Bank" as the Sending Institution. You must leave the bank account number blank. When sending USD, TW uses a different account number from your borderless account but your name will appear as the sender. I only tried once but the transfer was rejected, probably because I filled in my borderless account number. The full amount was returned to my TW account later. Please let us know if you succeed in your transfer. This post has been edited by hyperzz: Sep 15 2018, 11:39 PM Attached thumbnail(s)

|

|

|

|

|

|

hyperzz

|

Sep 15 2018, 11:34 PM Sep 15 2018, 11:34 PM

|

Getting Started

|

QUOTE(Ramjade @ Sep 15 2018, 10:25 PM) Yes. Unless you can find some other way. From what I read, their ACH is like our IBFT. IBFT transfer is executed instantly but ACH usually takes 2 - 3 days. At least 1 day if you're lucky. |

|

|

|

|

|

hyperzz

|

Sep 17 2018, 07:49 PM Sep 17 2018, 07:49 PM

|

Getting Started

|

QUOTE(apathen @ Sep 17 2018, 05:49 PM) thank you for the pointers. But for ikan bilis trader like me i doubt would be affected much by front running (when my order to buy and sell stock execute at the price i ask or bid) except sacrify privacy if they share their API. Just like we use google for free but they use our activities to show us advertisement. Just be mindful that if privacy is a concern then can use other paid brokers. The choice is yours. No debate on this. I post this solely for educational purposes, so that people can make an informed decision. QUOTE Turns out, Robinhood doesn't perform all their customers' trades on their own platform, but instead, they sell the trading orders to 5 high-frequency trading companies; they are Apex Clearing Corporation, Citadel Securities, Two Sigma Securities, Wolverine Securities, and Virtu Financial. From there, they will choose which trading platform to use to run the transactions on behalf of their customers.

Those companies pay Robinhood between USD 0.00008 and USD 0.00026 for each USD sold in a trading transaction. While it may seem insignificant, Robinhood actually makes a decent amount of income from such system. In fact, compared to companies, such as E*Trade that makes USD 47 million and TD Ameritrade that makes USD 119 million per quarter, Robinhood is said to generate 10 times more in profit.

Looking at this, it can be said that Robinhood's "clients" are actually the high-frequency trading companies, and their "products" are actually the customers who use their investment services.

According to Bitcoinnews, the high-frequency trading companies make hefty profit from Robinhood's customers, whereas the customers don't really pay attention to the unoptimized deals they get from Robinhood, probably due to the "Invest for Free" marketing campaign run by the company. Robinhood's pofitThis post has been edited by hyperzz: Sep 18 2018, 02:13 AM |

|

|

|

|

|

hyperzz

|

Oct 28 2018, 02:32 AM Oct 28 2018, 02:32 AM

|

Getting Started

|

QUOTE(wt_vinci @ Oct 27 2018, 10:43 PM) Anyone using Zackstrade here? I can hardly find anything much about them. https://www.zackstrade.com/commissions-fees/Looks pretty good for buy and hold long term (10 years). Thinking about buying Vanguard ETFs (VTI+VXUS) from them instead of CIMB iTrade due to lower overall cost (including wire fees). Probably going to buy once a year for 10 years of around USD 10k each time. Zackstrade is OK if you are only interested in the US market. It is a white label of IB. If you want to trade in other markets like Europe, HK and Japan, I would recommend Captrader (also a white label of IB) which has lower commissions for non-US markets. |

|

|

|

|

|

hyperzz

|

Oct 29 2018, 06:08 AM Oct 29 2018, 06:08 AM

|

Getting Started

|

QUOTE(Ramjade @ Oct 28 2018, 09:16 PM) For UK, Canada and AU market? You can find Captrader's fee and commissions here: Captrader |

|

|

|

|

|

hyperzz

|

Nov 21 2018, 10:13 PM Nov 21 2018, 10:13 PM

|

Getting Started

|

QUOTE(wt_vinci @ Nov 21 2018, 09:47 AM) @ramjade thanks to your sharing, i have managed to transfer MYR to USD at TransferWise via Instarem with a loss of 0.275% (instarem fee plus forex loss). apparently, the cost of transferring my USD from TW to IB (US account) is USD1 fixed via wire transfer but it is slow; my first ever transfer will take one week. i will then be converting my USD to Euro via IB to purchase some VWRL ETF. TW also gives EUR borderless account that you can deposit. In this way, you don't have to convert twice. You can fund your IB account in EUR from your TW borderless account. Just remember to leave the account number blank when you fill up the IB deposit form. |

|

|

|

|

|

hyperzz

|

Nov 22 2018, 04:18 PM Nov 22 2018, 04:18 PM

|

Getting Started

|

QUOTE(wt_vinci @ Nov 22 2018, 10:02 AM) TW charges 0.63% if i convert my usd to euro then transfer to IB. converting at usb to euro at IB is cheaper and fixed cost. correct me if i'm wrong. my deposits path is as follows: MYR -> USD via Instarem -> TW TW -> USD to IB -> IB converts USD to Euro this is the most cost optimised path that i can figure out. please correct me if i'm wrong. Have you considered this path? MYR -> EUR via Instarem -> TW TW -> EUR to IB [no conversion, just a small fee (< €1) for withdrawal ] |

|

|

|

|

|

hyperzz

|

Nov 23 2018, 03:25 PM Nov 23 2018, 03:25 PM

|

Getting Started

|

QUOTE(wt_vinci @ Nov 23 2018, 10:35 AM) instarem doesn't support MYR to Euro at the moment else it would be perfect. I see. Haven't used Instarem before. |

|

|

|

|

|

hyperzz

|

Dec 2 2018, 11:11 PM Dec 2 2018, 11:11 PM

|

Getting Started

|

QUOTE(Ramjade @ Dec 2 2018, 10:41 AM) I would like to confirm if I have say USD2000 inside, but not buying anything, will kena charged? Nope, you won't be charged inactivity fee. Captrader has answered this in their FAQ section. Captrader FAQQUOTE Is there a monthly minimum turnover or fixed account and deposit fees?

In general there are no monthly minimum turnover fees or other running fees with CapTrader. Reverting monthly costs will only be charged if you have chosen Realtime packages (real-time course subscriptions).

An inactivity fee will only be charged if your total value of your account-balance is less than $ 1,000 (or equivalent) and you are not trading actively / leave your account "resting". This fee is 1 USD per calendar month according to the above criteria. Therefore, you will be charged inactivity fee of $1/month only if you fulfill both conditions: 1) Account balance is less than $1000 AND2) No trading activity in that particular month. This requirement is way more lenient than the similar requirement imposed by IB. This post has been edited by hyperzz: Dec 3 2018, 07:26 AM |

|

|

|

|

|

hyperzz

|

Dec 3 2018, 04:25 PM Dec 3 2018, 04:25 PM

|

Getting Started

|

QUOTE(wt_vinci @ Dec 3 2018, 09:40 AM) i'd like to contribute my share to this awesome topic that i have successfully transferred funds from MYR to USD to Euro to IB's account in Germany via Instarem->TransferWise. i tried transferring my USD in TW to IB's US account but failed due to TW not accepting Further Credit Payments https://transferwise.com/help/article/20768...credit-payments. hope this helps others cheers Congrats! But I think you should be able to deposit into IB's USD account with Citibank in New York too. Further Credit Payments is not required. Maybe I will try it out later. |

|

|

|

|

|

hyperzz

|

Dec 12 2018, 08:29 PM Dec 12 2018, 08:29 PM

|

Getting Started

|

TW sent ACH wire from Wells Fargo bank, according to their CS.

Tried a few times to deposit USD into IB's account with Citibank but unfortunately all transfers bounced back. Seems like this way is not workable.

|

|

|

|

|

|

hyperzz

|

Dec 13 2018, 11:41 AM Dec 13 2018, 11:41 AM

|

Getting Started

|

QUOTE(wt_vinci @ Dec 13 2018, 10:22 AM) I found another way which might help you. Instarem MYR->SGD transfer to IB's account in SG. Convert SGD-> Euro in IB. DONE Cheers Thanks but I don't really need this, already have bank accounts oversea. Just sharing experience, hopefully it will be beneficial. Does Instarem send SGD in the name of its customers? If not, the transfer will bounce back. I can see that ACH wires sent by TW are in the name of its customers but still not acceptable to IB. This post has been edited by hyperzz: Dec 13 2018, 12:45 PM |

|

|

|

|

|

hyperzz

|

Dec 14 2018, 03:28 PM Dec 14 2018, 03:28 PM

|

Getting Started

|

QUOTE(wt_vinci @ Dec 14 2018, 09:43 AM) I believe so but not sure though mine went through without fail a few times. TW doesn't support the ACH transfer that IB's account in US required: for further credit. You can still put a reference in the transfer if you do it through TW's app instead of its website. The IB USD account for deposit is a virtual account unique to every customer. Even without the "further credit info", IB can still know whom the fund is meant for. But in this case, IB is not accepting the source of the funding as coming from a customer directly. |

|

|

|

|

|

hyperzz

|

Dec 14 2018, 04:00 PM Dec 14 2018, 04:00 PM

|

Getting Started

|

QUOTE(MNet @ Dec 13 2018, 09:53 PM) How much they charge for bounced back? There's no charges, even the $1 withdrawal fee is refunded. |

|

|

|

|

|

hyperzz

|

Jan 14 2019, 01:52 AM Jan 14 2019, 01:52 AM

|

Getting Started

|

Ramjade, I am not aware of any IB white labels based in the UK. Why would you want it based in the UK? Whether you open the account directly with IB or through its white labels, almost everything you get, besides the fee and some requirements/conditions, is the same.

|

|

|

|

|

Jan 19 2018, 11:24 PM

Jan 19 2018, 11:24 PM

Quote

Quote

0.1021sec

0.1021sec

0.23

0.23

7 queries

7 queries

GZIP Disabled

GZIP Disabled