QUOTE(aspartame @ Jul 25 2019, 10:24 AM)

Oh u mean deposit using SGD and convert vice versa into USD as and when needed will not incur charges right? But is the forex exchange internally favourable??

Yup. Spot rate. What more can you ask? Rate is even lower than Google's.

QUOTE(Hansel @ Jul 25 2019, 11:10 AM)

I salute people like kimjiwon who are willing to take risks investing into ETFs. At least he is not the type of investor who will wait till the prices reach near zero before investing. NO need for hard words.... look t the other side of things always. Why say uncommon ETFs ???

I don't invest into ETFs, but I have knowledge of Inverse ETFs and Leverage ETFs,... what is so uncommon abt them ?

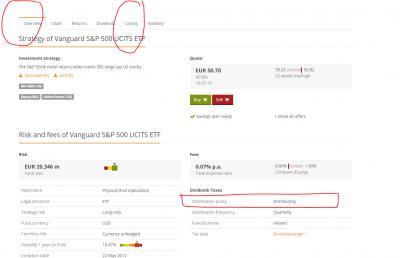

Normal people go with common ETF like those which track the S&P 500. If you invest in S&P500, there's no way to lose money if you hold for long term.

Uncommon cause you need to know what you are buying. Is not for common folks.

QUOTE(Hansel @ Jul 25 2019, 11:17 AM)

It is exactly words like the above in bold that make brokerages start to charge Platform Fees.

Sure, then you say, if they charge, then I change to another brokerage,... so, how many times do you want to run away ??? Wait till all brokerages blacklist your name, and all don't allow you to open accounts anymore.

I would rather let my brokerage earn something,... you have never experienced what the clients of SCB SG experienced few years go when SCB were toying abt closing down their equity trading business.

Let people earn something-lar,... especially if the service is good and the people have quality and attitude for work. Otherwise,... don't invest in that country if you have negative thinking abt the brokerages earning something.

Edited by adding this : you see,... now the SG brokerages are starting to toy with charging dividend-handling fees,...the pattern is there,...becuse if investors like you,....

An International Financial Centre that welcomes most worldwide investors. Facility is there, currency keeps strengthening, continuously-improving regulation for the investing public to protect their interest,... what more do you want ? You don't pay tax on your investment returns, you know ???

Let people earn a bit-lar,.... It's worth it,....

No point I pay them if their service no good right? Why pay them for them to charge me more fees (in dividend fees, quarterly management fees, higher commision) if they cannot even provide me service for US, UK, Canada market at cheap price? Is business. Does the broker give me anything in return for the money I paid them? No right? May the best broker wins. They want my money simple only. Make change. Be on par with interactive broker. They are no where at that level. Spot exchange rate, multiple market access at cheap price

Short story: SG brokers do not have quality features and yet they wish to get away with charging more than what they deserve. Is like TV vs Maxis FIBRE. Why pay more for Streamyx 1mbps (RM110) when you can get Maxis fibre (RM89) 30mbps? That's exactly how SG brokers are.

QUOTE(Krv23490 @ Jul 25 2019, 12:01 PM)

I use FSM SG but I transfer in via CIMB SG so I don't got any transfer charges. I buy HK ETFs and some occasional US stocks.

No complaints, I am aware of witholding tax but happy with it so far. I don't trade often anyways, mostly buy and hold

That's one trick of bypassing the SGD25 TT fee.

This post has been edited by Ramjade: Jul 25 2019, 05:04 PM

Jul 21 2019, 11:58 PM

Jul 21 2019, 11:58 PM

Quote

Quote

0.0222sec

0.0222sec

0.73

0.73

6 queries

6 queries

GZIP Disabled

GZIP Disabled