Has anyone done or come across with comprehensive comparison between Etoro and other more established international brokers like Captrader, Ameritrade or Interactive Brokers.

Comparison like user friendliness, fee, commission, charges, maintenance charges, annual fee, requirement to trade like once a month, CS support, other pros and cons?

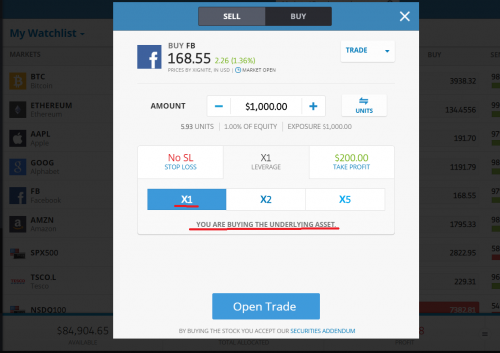

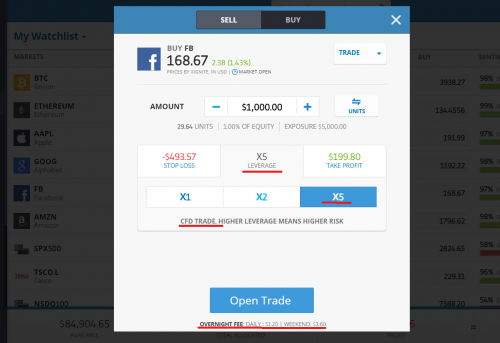

Generally i understand Etoro spread or charges is on the high side. But for retail investor with not much Capital, it might be one of the best option.

All about ETFs / Foreign Brokers, Exchange traded funds

Mar 24 2019, 04:17 PM

Mar 24 2019, 04:17 PM

Quote

Quote

0.0902sec

0.0902sec

0.17

0.17

7 queries

7 queries

GZIP Disabled

GZIP Disabled