QUOTE(wil-i-am @ Sep 25 2014, 08:50 AM)

Yeap, totally agree. While you're at it, might want to fix your keyboard too unless it's your intention to annoy everyone.ASN, ASN2, ASN3, ASG, ASB, ASW2020, ASM, ASD, AS1M, AMANAH SAHAM NASIONAL BERHAD V6

ASN, ASN2, ASN3, ASG, ASB, ASW2020, ASM, ASD, AS1M, AMANAH SAHAM NASIONAL BERHAD V6

|

|

Sep 25 2014, 09:08 AM Sep 25 2014, 09:08 AM

|

Senior Member

602 posts Joined: Mar 2013 |

|

|

|

|

|

|

Sep 25 2014, 09:32 AM Sep 25 2014, 09:32 AM

|

Senior Member

1,035 posts Joined: May 2010 |

QUOTE(plumberly @ Sep 23 2014, 01:09 PM) Ha ha, very insightful! Nestle caught my attention too Nestle is in my list to watch but it is now not at the right price to buy. Yes, some will say it will go even higher but the upside is getting smaller and harder to reach. My 2 cents. Don't dare to calculate what is the % of return rate if I purchase it then vs the % that I've received while holding the ASX... |

|

|

Sep 25 2014, 12:43 PM Sep 25 2014, 12:43 PM

|

All Stars

48,520 posts Joined: Sep 2014 From: REality |

QUOTE(hyelbaine @ Sep 25 2014, 08:04 AM) Housing loans, personal loans, ASB loans, etc2... Basically anything with a variable interest/financing rate will require margin call(s) whenever the OPR goes up. Margin call in its easiest explanation is topping up the balance due to the bank when the instalment amount increases due to rising interest rates. Normally the bank will advise you on the amount difference and you either have the option to either pay the new instalment amount or extend the tenure of your loan should you wish to stick with the previous instalment amount. okay. thanks for the explanation. Kinda confused with the term Margin call QUOTE(hyelbaine @ Sep 25 2014, 08:31 AM) Funny how arm-chair-keyboard-warrior-economic-experts so easily comment on something without knowing what they're doing. Sekali dapat reply lagi panjang than that's what you get for trying to show the world how smart you are woah, ASNB reply so long.. Kena Hentam kaw that guy [attachmentid=4147082] |

|

|

Sep 25 2014, 12:44 PM Sep 25 2014, 12:44 PM

|

Senior Member

4,761 posts Joined: Jun 2007 From: My house |

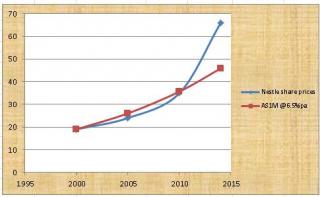

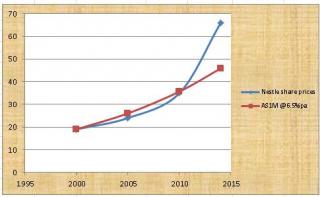

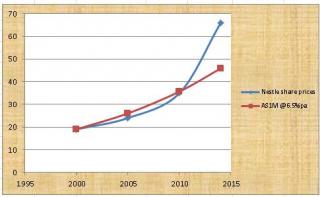

QUOTE(HJebat @ Sep 25 2014, 09:32 AM) Nestle caught my attention too I was curious and did a comparison.Don't dare to calculate what is the % of return rate if I purchase it then vs the % that I've received while holding the ASX...

I know AS1M only started recently but using the average 6.5% pa dividend, I plotted the returns since 2000 for AS1M & Nestle. Only in recent years, Nestle did better than AS1M. Nestle price trend seems to reach a flat line now, undecided whether to increase further or take a breather. Yes, I did not include Nestle's dividend in there. With Nestle, the profit is only on paper until you sell it. It may drop (small or big) in the coming recession. With AS1M, no worry, the amount is always there and cannot go down unless you withdraw. Cheerio. This post has been edited by plumberly: Sep 25 2014, 12:45 PM |

|

|

Sep 25 2014, 12:47 PM Sep 25 2014, 12:47 PM

|

All Stars

48,520 posts Joined: Sep 2014 From: REality |

QUOTE(jorgsacul @ Sep 25 2014, 08:47 AM) then ASNB fixed pricing fund are not for u.. better invest in UT where u get more than 10% on good year & loss over 36% on bad year. True story by one of our fellow forummer please don't type in all caps. It is rude. It is the equivalent of yelling.. This post has been edited by nexona88: Sep 25 2014, 01:05 PM |

|

|

Sep 25 2014, 12:49 PM Sep 25 2014, 12:49 PM

|

All Stars

48,520 posts Joined: Sep 2014 From: REality |

QUOTE(plumberly @ Sep 25 2014, 12:44 PM) I was curious and did a comparison. FYI ASx fund also invested in Nestle

I know AS1M only started recently but using the average 6.5% pa dividend, I plotted the returns since 2000 for AS1M & Nestle. Only in recent years, Nestle did better than AS1M. Nestle price trend seems to reach a flat line now, undecided whether to increase further or take a breather. Yes, I did not include Nestle's dividend in there. With Nestle, the profit is only on paper until you sell it. It may drop (small or big) in the coming recession. With AS1M, no worry, the amount is always there and cannot go down unless you withdraw. Cheerio. |

|

|

|

|

|

Sep 25 2014, 04:56 PM Sep 25 2014, 04:56 PM

|

Senior Member

1,377 posts Joined: Aug 2009 |

Not pro the way they revert. I doubt the guy understand.

One sentence "i like i give, i don;t like i don;t give. U don;t like you invest other" |

|

|

Sep 25 2014, 04:57 PM Sep 25 2014, 04:57 PM

|

Senior Member

1,377 posts Joined: Aug 2009 |

|

|

|

Sep 25 2014, 05:14 PM Sep 25 2014, 05:14 PM

|

All Stars

48,520 posts Joined: Sep 2014 From: REality |

|

|

|

Sep 25 2014, 10:02 PM Sep 25 2014, 10:02 PM

|

Senior Member

5,379 posts Joined: Jul 2009 |

This thread become blue chip stocks discussion?

|

|

|

Sep 25 2014, 10:15 PM Sep 25 2014, 10:15 PM

|

All Stars

48,520 posts Joined: Sep 2014 From: REality |

|

|

|

Sep 25 2014, 11:19 PM Sep 25 2014, 11:19 PM

|

Senior Member

5,752 posts Joined: Jan 2012 |

QUOTE(nexona88 @ Sep 25 2014, 10:15 PM) You, are you trying to spam post. I noticed quite long time already. And the thing you posted is already mentioned. |

|

|

Sep 26 2014, 09:51 AM Sep 26 2014, 09:51 AM

|

Junior Member

242 posts Joined: Jan 2014 |

QUOTE(Ancient-XinG- @ Sep 24 2014, 04:37 PM) Do you completely understand the story of these two? Better read it and know how its work. Don't keep whining like those aunty and uncle after seeing the value in hand is much more lesser than what you paid .... Thanks for the reminder, so I assume these funds are not fixed price? I'm still on the fence on this |

|

|

|

|

|

Sep 26 2014, 10:46 AM Sep 26 2014, 10:46 AM

|

Senior Member

5,752 posts Joined: Jan 2012 |

|

|

|

Sep 26 2014, 10:57 AM Sep 26 2014, 10:57 AM

Show posts by this member only | IPv6 | Post

#335

|

Junior Member

242 posts Joined: Jan 2014 |

|

|

|

Sep 26 2014, 11:38 AM Sep 26 2014, 11:38 AM

|

All Stars

48,520 posts Joined: Sep 2014 From: REality |

QUOTE(Ancient-XinG- @ Sep 25 2014, 11:19 PM) You, are you trying to spam post. I noticed quite long time already. then what about those posting common / noob / already mention question likeAnd the thing you posted is already mentioned. 1. is there any fund available for non-bumi 2. can open new account 3. where to open 4. min & max we can invest 5. if ASB already max, will they calculate only 200k or all the balance in the account 6. difference betwen ASG & ASN3, which is better 7. how ASNB calculate the dividend 8. why need to pay 5% SC & lot more |

|

|

Sep 26 2014, 11:47 AM Sep 26 2014, 11:47 AM

|

Senior Member

5,752 posts Joined: Jan 2012 |

QUOTE(nexona88 @ Sep 26 2014, 11:38 AM) then what about those posting common / noob / already mention question like So, don't you tell me you want to be part of them? Most of us know that why FNF posts didn't make the count. You want the history repeat in FBAINH?1. is there any fund available for non-bumi 2. can open new account 3. where to open 4. min & max we can invest 5. if ASB already max, will they calculate only 200k or all the balance in the account 6. difference betwen ASG & ASN3, which is better 7. how ASNB calculate the dividend 8. why need to pay 5% SC & lot more |

|

|

Sep 26 2014, 11:58 AM Sep 26 2014, 11:58 AM

|

All Stars

48,520 posts Joined: Sep 2014 From: REality |

|

|

|

Sep 27 2014, 11:19 AM Sep 27 2014, 11:19 AM

|

Senior Member

1,035 posts Joined: May 2010 |

QUOTE(plumberly @ Sep 25 2014, 12:44 PM) I was curious and did a comparison. Yes, I see your point. But I share the same belief with one wise apek that prefers company that sells consumer staples with strong brand names

I know AS1M only started recently but using the average 6.5% pa dividend, I plotted the returns since 2000 for AS1M & Nestle. Only in recent years, Nestle did better than AS1M. Nestle price trend seems to reach a flat line now, undecided whether to increase further or take a breather. Yes, I did not include Nestle's dividend in there. With Nestle, the profit is only on paper until you sell it. It may drop (small or big) in the coming recession. With AS1M, no worry, the amount is always there and cannot go down unless you withdraw. Cheerio. With ASx (especially the fixed-price fund), either market bloom or doom, the RM1 is always there. We wouldn't know the exact figure when the economy is good or bad because PNB controls the the price (maybe to enable the funds to have adequate amount of units to accommodate mass withdrawal during crash periods). As a result of that, depositors will receive average returns. I'd love to associate myself with Nestle for some pleasant & respectable return, and will still hold on to ASx for some moderate & acceptable income. Either way, I find it comfortable to invest and grow my money |

|

|

Sep 27 2014, 12:29 PM Sep 27 2014, 12:29 PM

|

Senior Member

5,752 posts Joined: Jan 2012 |

QUOTE(HJebat @ Sep 27 2014, 11:19 AM) Yes, I see your point. But I share the same belief with one wise apek that prefers company that sells consumer staples with strong brand names The main core reason that why ASNB stop introducing fixed price fund. I come across that IF, all the funds under PNB is variable funds, will they perform better? Or worse? Or real excellent that providing > 7% pa. Because we know that they ALWAYS reserve some % to overcoming bad years.With ASx (especially the fixed-price fund), either market bloom or doom, the RM1 is always there. We wouldn't know the exact figure when the economy is good or bad because PNB controls the the price (maybe to enable the funds to have adequate amount of units to accommodate mass withdrawal during crash periods). As a result of that, depositors will receive average returns. I'd love to associate myself with Nestle for some pleasant & respectable return, and will still hold on to ASx for some moderate & acceptable income. Either way, I find it comfortable to invest and grow my money |

|

Topic ClosedOptions

|

| Change to: |  0.0283sec 0.0283sec

0.82 0.82

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 09:06 AM |