QUOTE(HJebat @ Sep 25 2014, 09:32 AM)

Nestle caught my attention too

Referring only to its price attribute, I've seen it rose from RM29-30 to today's >RM60 quotation.

Don't dare to calculate what is the % of return rate if I purchase it then vs the % that I've received while holding the ASX...

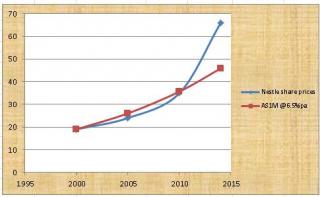

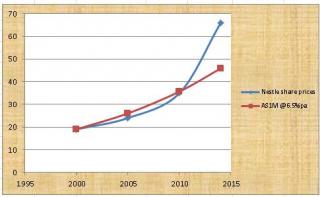

I was curious and did a comparison.

I know AS1M only started recently but using the average 6.5% pa dividend, I plotted the returns since 2000 for AS1M & Nestle.

Only in recent years, Nestle did better than AS1M. Nestle price trend seems to reach a flat line now, undecided whether to increase further or take a breather.

Yes, I did not include Nestle's dividend in there.

With Nestle, the profit is only on paper until you sell it. It may drop (small or big) in the coming recession. With AS1M, no worry, the amount is always there and cannot go down unless you withdraw.

Cheerio.

This post has been edited by plumberly: Sep 25 2014, 12:45 PM

Sep 14 2014, 06:01 PM

Sep 14 2014, 06:01 PM

Quote

Quote

0.3140sec

0.3140sec

0.81

0.81

7 queries

7 queries

GZIP Disabled

GZIP Disabled