QUOTE(David83 @ Sep 30 2014, 12:40 PM)

Standing by to top up Asia ex Japan funds Fundsupermart.com v7, DIY unit trust investing

Fundsupermart.com v7, DIY unit trust investing

|

|

Sep 30 2014, 04:18 PM Sep 30 2014, 04:18 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

|

|

|

Sep 30 2014, 04:29 PM Sep 30 2014, 04:29 PM

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(RO Player @ Sep 30 2014, 04:15 PM) mine problem is my prob...ur prob is ur prob... LOL! Your pantun kung-fu suxs......so dont tell me or someone to do what u say... me or someone is not ur client... no doubt, funds always go up...must come down... by then, i alrdy switch my funds... BTW, if you do comprehend my powderful england hor... you got understand I no say what you or anyone should do this or dat hor... I only pointed out some inaccuracies in your earlier post. Don't get so butt hurt easily can or not? Xuzen This post has been edited by xuzen: Sep 30 2014, 04:31 PM |

|

|

Sep 30 2014, 05:19 PM Sep 30 2014, 05:19 PM

|

Senior Member

1,938 posts Joined: Nov 2009 From: Bolehland |

|

|

|

Sep 30 2014, 05:30 PM Sep 30 2014, 05:30 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

Sep 30 2014, 05:33 PM Sep 30 2014, 05:33 PM

|

Senior Member

1,938 posts Joined: Nov 2009 From: Bolehland |

|

|

|

Sep 30 2014, 05:50 PM Sep 30 2014, 05:50 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

|

|

|

Sep 30 2014, 06:40 PM Sep 30 2014, 06:40 PM

|

All Stars

48,494 posts Joined: Sep 2014 From: REality |

World markets were in hesitant mood on Tuesday as investors wondered what China's response would be to civil unrest in Hong Kong, while the U.S. dollar eased off the throttle after its biggest quarterly gain in six years.

MSCI's 45-country All World stock index , was on course for a drop of almost 3 percent on the month and its and biggest quarterly fall since Q2 2012 when the euro zone's debt crisis was at its most intense. |

|

|

Sep 30 2014, 06:42 PM Sep 30 2014, 06:42 PM

|

Senior Member

1,938 posts Joined: Nov 2009 From: Bolehland |

|

|

|

Sep 30 2014, 07:15 PM Sep 30 2014, 07:15 PM

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(RO Player @ Sep 30 2014, 04:40 PM) It is fine, you are entitled to whether accept or reject my pointers. However, my bigger reason for replying to you and engaging in light banter is to let those silent reader of the inaccuracies that you are saying. The deserve to know correct info. Call it corporate social responsibility.....on my part. Xuzen |

|

|

Sep 30 2014, 07:39 PM Sep 30 2014, 07:39 PM

|

Senior Member

661 posts Joined: Feb 2007 |

|

|

|

Sep 30 2014, 08:11 PM Sep 30 2014, 08:11 PM

|

Senior Member

8,259 posts Joined: Sep 2009 |

|

|

|

Oct 1 2014, 12:16 AM Oct 1 2014, 12:16 AM

|

All Stars

48,494 posts Joined: Sep 2014 From: REality |

PMB Dana Bestari - income distribution of three sen per unit

It said on Tuesday the distribution was for Dana Bestari’s financial year ended Sept 30, 2014. “The distribution, to be made in the form of new units, represents a yield of 7.4% over the fund’s net asset value as at Aug 15, 2013. The year-end of the fund was recently changed to Sept 30,” it said. PMB Investment said Dana Bestari is a growth and income Shariah-compliant equity fund that invests primarily in a diversified portfolio of Shariah-compliant equity and equity related securities of companies listed on Bursa Malaysia to achieve a steady return and capital growth in the medium- to long-term. All unit holders of Dana Bestari on the register at the close of Sept 30, are entitled to the distribution in the form of units. |

|

|

Oct 1 2014, 11:02 AM Oct 1 2014, 11:02 AM

|

All Stars

14,990 posts Joined: Jan 2003 |

|

|

|

|

|

|

Oct 1 2014, 03:14 PM Oct 1 2014, 03:14 PM

|

Senior Member

1,007 posts Joined: Oct 2006 From: island up north |

|

|

|

Oct 1 2014, 04:42 PM Oct 1 2014, 04:42 PM

|

Senior Member

1,938 posts Joined: Nov 2009 From: Bolehland |

|

|

|

Oct 1 2014, 04:50 PM Oct 1 2014, 04:50 PM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(zDarkForceSz @ Oct 1 2014, 04:42 PM) er.. that's the chart today or?today HanSeng + Shanghai closed for holidays leh http://markets.on.nytimes.com/research/mar...orldmarkets.asp |

|

|

Oct 1 2014, 04:55 PM Oct 1 2014, 04:55 PM

|

All Stars

48,494 posts Joined: Sep 2014 From: REality |

|

|

|

Oct 1 2014, 04:57 PM Oct 1 2014, 04:57 PM

|

All Stars

48,494 posts Joined: Sep 2014 From: REality |

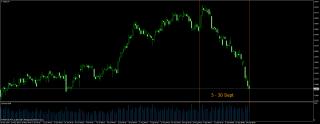

QUOTE(wongmunkeong @ Oct 1 2014, 04:50 PM) er.. that's the chart today or? The chart show 23 dec 2013 until 25 Sept 2014 today HanSeng + Shanghai closed for holidays leh http://markets.on.nytimes.com/research/mar...orldmarkets.asp |

|

|

Oct 1 2014, 05:48 PM Oct 1 2014, 05:48 PM

|

Senior Member

1,938 posts Joined: Nov 2009 From: Bolehland |

QUOTE(wongmunkeong @ Oct 1 2014, 04:50 PM) er.. that's the chart today or? Sorry my wrong i should make it clear.today HanSeng + Shanghai closed for holidays leh http://markets.on.nytimes.com/research/mar...orldmarkets.asp Is a daily chart. 3 - 30 Sept

This is 4hr chart.

|

|

|

Oct 1 2014, 06:36 PM Oct 1 2014, 06:36 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

FSM Fund Choice: Libra VersatileEXTRA Fund [October 2014] Since its hefty decline during the 2008 Global Financial Crisis, the Malaysia equity market (as represented by FTSE Bursa Malaysia KLCI Index) had rebounded and rallied significantly with the index achieving a new all-time high of 1892.65 points as of 8th July 2014, delivering a compelling cumulative return of 153.62% over the past 5.5 years! In reference to the bull run of the Malaysia market over the past few years, coupled with the index’s lacklustre performance since the beginning of 2014 (merely 1.57% on a year-to-date basis), some investors may have doubts on the stock market’s performance moving forward and there might be a tendency for some of them to shift their money out from the Malaysia equity market into other equity markets. Likewise, some investors might also consider shifting their funds from equities into bonds as a precaution. As quoted from Peter Lynch, “far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves”, investors often perform market timing or fall into the trap of “fear-and-greed” when they make investment decisions, resulting in missed opportunities or a loss of their funds. Thus, it is vital for investors to perform thorough evaluations before making any investment decision in order to prevent these mistakes. While some investors may not have the time and extensive resources to perform in-depth research on market conditions, they can still mitigate these issues by opting for balanced funds, effectively shifting the duty of managing fund to experienced fund managers who are in a better position to make informed investment decisions. URL: http://www.fundsupermart.com.my/main/resea...?articleNo=5063 In that it's under 1% promotional SC: URL: http://www.fundsupermart.com.my/main/resea...?articleNo=5067 |

|

Topic ClosedOptions

|

| Change to: |  0.0306sec 0.0306sec

0.69 0.69

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 08:46 AM |