QUOTE(St0rmFury @ Apr 4 2015, 07:47 AM)

Thefiguremall is a small business run by one guy so I doubt it makes 500K annually to qualify for gst.

QUOTE(killerjeya @ Apr 4 2015, 01:03 AM)

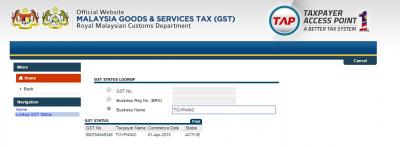

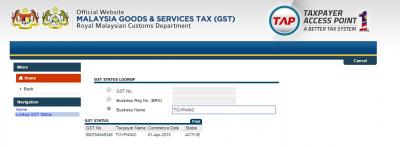

It looks like Toypanic is registered...Here's the link to lookup GST status:

https://gst.customs.gov.my/TAP ...If you guys see the original post by nifoc2099, on the top right of the screenshot there is a link to "Download Tax Invoice", which leads to an itemised invoice complete with GST registration number(which is 000784949248. Btw, I also kena

)...And I'm sure there are plenty of other local shops which don't impose GST...Searched for AF Hobby, Figuremall, XL-Shop, none are registered...OFC, I might be wrong about the first two, as I only searched the name (could only find the business reg. number for XL)...I think it would be helpful if everyone here could share whether the local shops they use impose GST or not...

QUOTE(WingNut @ Apr 4 2015, 12:37 PM)

regardless... still gotto register and pay. this is a tax to be borne by the consumer, not the retailer/service provider that is cascaded down to the consumer. previously the tax is only applicable to your business if your revenue is more than rm500k/year (ie related to your business) but now it is a tax on the goods and services regardless of your revenue. retailers can claim back the tax they paid to wholesalers through cascading the cost down to the consumers but the consumer has no such avenue and bears the full brunt of the 6% gst. and no, you do not get a 6% off your income tax so yeah, it's gonna be an inflationary effect 'cept that most of the stuff in the inflationary basket is either excluded/zero rated so you'll have a tailored official inflationary figures

TheFigureMall & LittleAkiba confirm no GST charges, but i dont really buy from them nowadays. Their boss announced it in his FB days before GST was implemented, i saw it. AF Hobby, i dunno lah. But knowing the boss, i dont think they charge GST. Even if they do and they are valid/registered, i dont mind paying the tax.

And yes, only if your annual revenue is >500k you have to register for GST (and charge customers for it). Or else, you dont have to register - and you cant charge your customers GST. If a non-registered company charges customers GST, customers can lodge a complaint for actions to be taken.

I dont really care about GST, just deal with it. The Japanese has been paying another 8% for a lot of things they spend on. Im willing to pay the tax if i have to, the issue is, do i have to run to the customs office again to pay 30 or 50bucks? I saw GST's website has a "make a payment" section, not yet working, i wonder if it applies to consumers. If i can pay tax online like that i will happily start combining my shipments and choose to pay tax instead. My problem is the convenience issues related to paying taxes.

This post has been edited by EXkurogane: Apr 4 2015, 02:40 PM

Apr 2 2015, 12:33 AM

Apr 2 2015, 12:33 AM

Quote

Quote

0.0300sec

0.0300sec

0.46

0.46

6 queries

6 queries

GZIP Disabled

GZIP Disabled