QUOTE(zenwell @ Jul 21 2014, 02:53 PM)

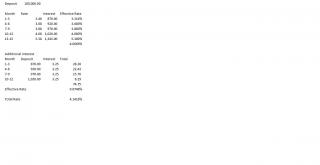

Just placed Maybank Merdeka FD. Is it ok that the cert did not mention the interest for month4-6? The officer told me they will auto adjust it to 3.30, 3.40 & 5.48 respectively for month 4, 5, 6. Anyone have placed this promo FD?

QUOTE(??!! @ Jul 22 2014, 02:14 PM)

U r rite in that the FD cert does not state the interest for month 4-6. Insisted that i need some confirmation and they gave me a computer print out listing the fd as Merdeka FD and they rubber stamp n sign on it.

I placed the same FD today and i'm uncomfortable when the cert itself doesn't mention clearly of the 3+3 FD promo interest. I asked the bank officer to issue me a proper document to go with the FD cert which they reluctant to do so. came back home and checked online on maybank2u my FD cert no. says its a 3 month FD with 3.3% interest rate. kinda pissed since i took half a day just to get this done. Due to my pass bad experience with this bank i'm cancelling the FD placement with maybank tomorrow, I made my mind to move the funds to OCBC for 3.9% deal instead.

This post has been edited by pinpinmiao: Jul 22 2014, 05:06 PM

Jul 22 2014, 05:05 PM

Jul 22 2014, 05:05 PM

Quote

Quote

0.0336sec

0.0336sec

0.75

0.75

6 queries

6 queries

GZIP Disabled

GZIP Disabled