QUOTE(nexona88 @ Feb 28 2024, 02:12 PM)

Huh??

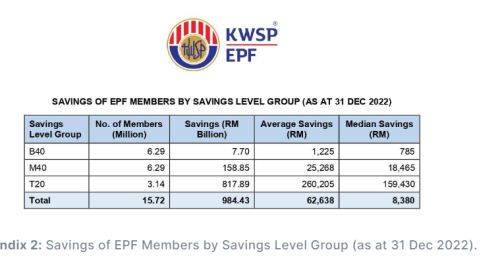

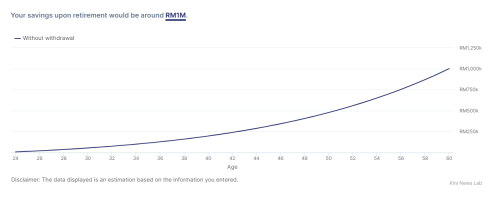

B40 can get dividend up to 40k in EPF yearly??

Boss your classification really off target...

T20 one should be okay...

M40 one also little off...

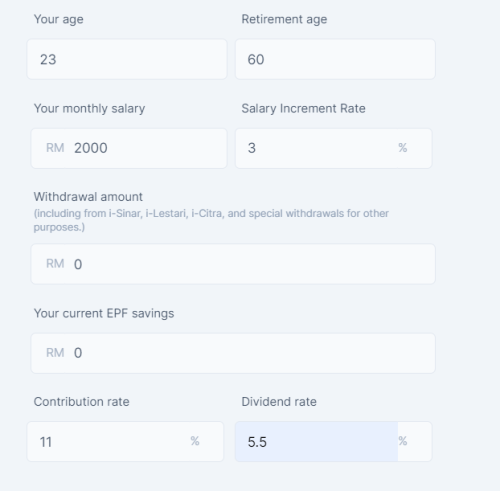

B40 I think should be lower like 3k to 10k max (depending on age & what balance they got)

B40 with 700k in EPF. Makes sense lolB40 can get dividend up to 40k in EPF yearly??

Boss your classification really off target...

T20 one should be okay...

M40 one also little off...

B40 I think should be lower like 3k to 10k max (depending on age & what balance they got)

Feb 28 2024, 02:19 PM

Feb 28 2024, 02:19 PM

Quote

Quote

0.0453sec

0.0453sec

0.56

0.56

7 queries

7 queries

GZIP Disabled

GZIP Disabled