QUOTE(batman1172 @ Nov 19 2023, 09:20 AM)

actually I didn’t calculate much on yield. It’s very hard to do with gearing.

My purchase window was 2000 to 2011. That time as long as I can come up with 20 to 30% capital the rest was funded by rent. Cost was mostly about 150 to 200k that time around Klang valley. I could sell between 850 to 950 now and earn lots more in bonds and equity but should I? Probably not because epf and CPF is still better bet for retired old people.

In all fairness, focus on where you know you can generate more income. That for me is employment and I still encourage young to do that. how hard is it to pull SGD200k at age 30 odd nowadays?

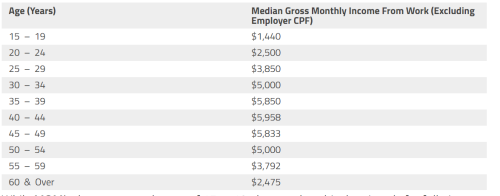

Looking at SG stats, almost impossible to pull 200k SGD in salary regardless of age haha.My purchase window was 2000 to 2011. That time as long as I can come up with 20 to 30% capital the rest was funded by rent. Cost was mostly about 150 to 200k that time around Klang valley. I could sell between 850 to 950 now and earn lots more in bonds and equity but should I? Probably not because epf and CPF is still better bet for retired old people.

In all fairness, focus on where you know you can generate more income. That for me is employment and I still encourage young to do that. how hard is it to pull SGD200k at age 30 odd nowadays?

So if one is pulling that, better focus on enhancing and strengthening that like you say.

Nov 19 2023, 10:11 PM

Nov 19 2023, 10:11 PM

Quote

Quote

0.0507sec

0.0507sec

0.92

0.92

7 queries

7 queries

GZIP Disabled

GZIP Disabled