haha... that didn't take long... at least the idea of 4 million ringgit is enough for retirement did last a year at least.

inflation is a tricky thing, because the word means different thing to different people… kinda reminded me of the fact that a he may not be a he anymore. (in this case: lifestyle inflation).

Nonetheless, what I know from own experience of being alive for at least 40 years and being aware almost the same number of years, it is genuinely not as high as everyone thinks. (of course it is not zero also).

A few concrete examples of numbers that I so happen to know:

My current car bought in 2009 for 150K, latest version price is ~190K : inflation ~1.8% pa

Chicken rice in late 1980s is 1 rm, now is 7 to 8rm : inflation ~6%

Education in a Ivy U in late 1990s is ~ 70K rm (@3.8) per year, now is ~300K rm (@4.7) per year: inflation ~5.5%

One of the few items I noticed that really has high inflation rate is luxury watches. A entry level AP watch was like around 30K rm in 2011, now if want to buy even second hand is like above 200K rm. That’s like 16% increase. Btw, this is just one luxury brand, not all brands can command such inflation rate.

What about medical bill? Anyone has factual numbers to share?

Media always claim education and healthcare will always have some of the highest inflations. Of all the unis, i would guess the US Ivies would command the highest inflation right? and that also is around 5 to 6% pa only in ringgit terms when our ringgit already crashed vs usd.

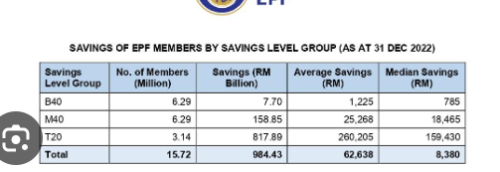

So to claim that we need EPF to be running at 10 to 20% return is silly… but beating inflation is a given and it is in EPF’s mandate to do so…

Medical inflation generally is 10-20% per annum, you can read up on it as its a real concern for a lot of insurers. But gomen is RM1 haha.

Luxury watches are not inflation, its just artificial pricing to create scarcity, thats why no all brands can do the same because they don't command that fomoness. But its good for my "portfolio" even if I probably would never sell any of it

Mar 21 2024, 07:38 PM

Mar 21 2024, 07:38 PM

Quote

Quote

0.0867sec

0.0867sec

0.63

0.63

7 queries

7 queries

GZIP Disabled

GZIP Disabled