QUOTE(MGM @ Mar 9 2022, 10:23 AM)

The rising inequality, consequences of contemporary capitalism add fuel to democratic docialism. Its a battle btw 2 ideology.Real problem is with rising inflatio n leaks, the once upper middle class might get downgraded to upper B40.

When that happens, mindset change n oso ask for taxing the rich, mmt, food stamps, etc.

Its growing trend...the great politicians will always play the minds of the poor...as the number of rich is shrinking.

Just like stocks...once many great companies are dying/dead, except the top 5 getting richer.

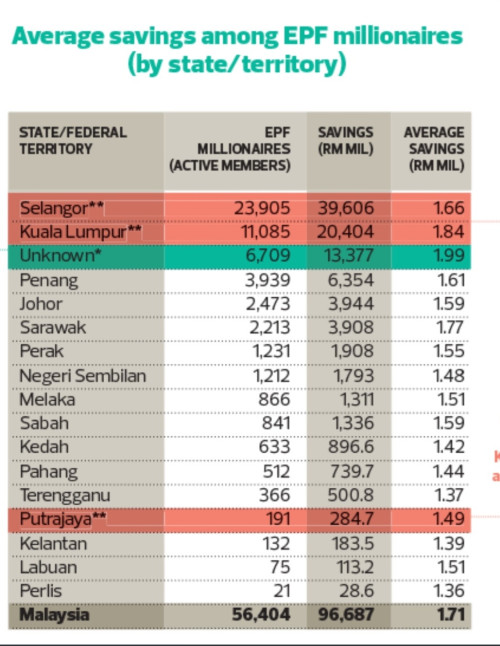

Kwsp offer 6.1% dividend, but if we study real inflation..is it 2%, 5% or 10%?

Comparatively, our purchasing power gets eroded...just how slow. Those who find themselves in 40s, 50s w/o $1m nest egg getting desperate n frustrated.

Grabbing at straws.

Normally, unker dont write too much...wfh (open laptop), due to colleague positive case.

This post has been edited by Unkerpanjang: Mar 9 2022, 11:05 AM

Mar 9 2022, 11:01 AM

Mar 9 2022, 11:01 AM

Quote

Quote

0.0488sec

0.0488sec

0.56

0.56

7 queries

7 queries

GZIP Disabled

GZIP Disabled