QUOTE(wil-i-am @ Sep 12 2016, 03:35 PM)

i try not to~~but on and off the feelings come...lol....hoping for the best..or just dont bother...EPF DIVIDEND, EPF

EPF DIVIDEND, EPF

|

|

Sep 13 2016, 01:07 AM Sep 13 2016, 01:07 AM

|

Senior Member

520 posts Joined: Jul 2015 |

|

|

|

|

|

|

Sep 13 2016, 09:07 AM Sep 13 2016, 09:07 AM

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(LNYC @ Sep 13 2016, 01:07 AM) wise men say worry not those you are not in control of, lest you not get good sleep.wise men say worry those that you are in control so that you may change it and get a good sleep. Xuzen This post has been edited by xuzen: Sep 13 2016, 09:09 AM |

|

|

Sep 13 2016, 11:54 PM Sep 13 2016, 11:54 PM

|

Senior Member

520 posts Joined: Jul 2015 |

QUOTE(xuzen @ Sep 13 2016, 09:07 AM) wise men say worry not those you are not in control of, lest you not get good sleep. Saya bercita cita menjadi wise man so that i will not have panda eyes..wise men say worry those that you are in control so that you may change it and get a good sleep. Xuzen thanks bosss |

|

|

Sep 14 2016, 06:10 PM Sep 14 2016, 06:10 PM

Show posts by this member only | IPv6 | Post

#1904

|

Senior Member

10,001 posts Joined: May 2013 |

EPF's Simpanan Shariah hits RM41.1 bil

http://www.theedgemarkets.com/my/article/e...-hits-rm411-bil 41% take up rate is consider gud or slow? |

|

|

Sep 14 2016, 06:26 PM Sep 14 2016, 06:26 PM

|

Senior Member

1,033 posts Joined: Dec 2009 |

QUOTE(wil-i-am @ Sep 14 2016, 06:10 PM) EPF's Simpanan Shariah hits RM41.1 bil It looks like it is slowing down since the first two weeks it was around RM25.1 Billion.http://www.theedgemarkets.com/my/article/e...-hits-rm411-bil 41% take up rate is consider gud or slow? Now around a month later it is RM41.1 Billion. That is kind of expected but just like EPF said, I feel more people may move towards it at the end of year. |

|

|

Sep 28 2016, 02:54 AM Sep 28 2016, 02:54 AM

|

All Stars

48,538 posts Joined: Sep 2014 From: REality |

Wanita MCA has backed a Bar Council’s proposal that the Employees’ Provident Fund (EPF) Regulations be amended to ensure the spouse and children of a deceased contributor would still benefit even if they were not named as beneficiaries.

There have been cases of EPF members who named other beneficiaries prior to their marriage, thus leaving their spouses and children in a lurch when they die, said Wanita MCA chief Datuk Heng Seai Kie. http://www.thestar.com.my/news/nation/2016...ciary-proposal/ |

|

|

|

|

|

Sep 28 2016, 08:49 AM Sep 28 2016, 08:49 AM

|

Senior Member

5,272 posts Joined: Jun 2008 |

QUOTE(nexona88 @ Sep 28 2016, 02:54 AM) Wanita MCA has backed a Bar Council’s proposal that the Employees’ Provident Fund (EPF) Regulations be amended to ensure the spouse and children of a deceased contributor would still benefit even if they were not named as beneficiaries. Or maybe update the epf members beneficiaries every 5 years? Or remind them? I don't like this one way approach. I have my dad as my Beneficiary as I know he will need it to care for my family. Forcing this would go against thy willThere have been cases of EPF members who named other beneficiaries prior to their marriage, thus leaving their spouses and children in a lurch when they die, said Wanita MCA chief Datuk Heng Seai Kie. http://www.thestar.com.my/news/nation/2016...ciary-proposal/ |

|

|

Sep 28 2016, 11:00 AM Sep 28 2016, 11:00 AM

|

All Stars

48,538 posts Joined: Sep 2014 From: REality |

QUOTE(Avangelice @ Sep 28 2016, 08:49 AM) Or maybe update the epf members beneficiaries every 5 years? Or remind them? I don't like this one way approach. I have my dad as my Beneficiary as I know he will need it to care for my family. Forcing this would go against thy will Good idea Write email or something to them.. Not sure if they have peti cadangan at their office.. U can write |

|

|

Sep 29 2016, 03:51 PM Sep 29 2016, 03:51 PM

|

All Stars

48,538 posts Joined: Sep 2014 From: REality |

EPF plans to invest more in private equity, property

http://www.thestar.com.my/business/busines...quity-property/ so we can expect better EPF rate in future |

|

|

Sep 29 2016, 05:23 PM Sep 29 2016, 05:23 PM

Show posts by this member only | IPv6 | Post

#1910

|

Senior Member

10,001 posts Joined: May 2013 |

I presume EPF will c returns via PE from 2020 onwards

|

|

|

Sep 30 2016, 11:52 PM Sep 30 2016, 11:52 PM

Show posts by this member only | IPv6 | Post

#1911

|

Junior Member

274 posts Joined: Oct 2012 |

EPF will increase basic savings starting 2017

|

|

|

Oct 1 2016, 07:27 AM Oct 1 2016, 07:27 AM

Show posts by this member only | IPv6 | Post

#1912

|

Senior Member

10,001 posts Joined: May 2013 |

Higher savings @ 55 yo plus lower withdrawal for EPF-MIS scheme

http://www.theedgemarkets.com/my/article/e...age-55-rm228000 |

|

|

Oct 1 2016, 10:35 AM Oct 1 2016, 10:35 AM

|

Senior Member

1,135 posts Joined: Sep 2015 |

QUOTE(wil-i-am @ Oct 1 2016, 07:27 AM) Higher savings @ 55 yo plus lower withdrawal for EPF-MIS scheme EPF should retain at least 50% of the sum for gradually withdrawal during retirement. http://www.theedgemarkets.com/my/article/e...age-55-rm228000 I have seen many folks who are pittyful begging for monthly allowance from their children, after spending all their EPF saving, either for self use, or family purpose. This post has been edited by kpfun: Oct 1 2016, 10:36 AM |

|

|

|

|

|

Oct 1 2016, 12:10 PM Oct 1 2016, 12:10 PM

Show posts by this member only | IPv6 | Post

#1914

|

Senior Member

3,336 posts Joined: Nov 2007 From: Pluto |

QUOTE(Avangelice @ Sep 28 2016, 08:49 AM) Or maybe update the epf members beneficiaries every 5 years? Or remind them? I don't like this one way approach. I have my dad as my Beneficiary as I know he will need it to care for my family. Forcing this would go against thy will Beneficiaries need to fill in form at th epf office right? Last time i check, cant do online |

|

|

Oct 1 2016, 12:37 PM Oct 1 2016, 12:37 PM

|

Senior Member

5,272 posts Joined: Jun 2008 |

|

|

|

Oct 1 2016, 08:45 PM Oct 1 2016, 08:45 PM

|

All Stars

48,538 posts Joined: Sep 2014 From: REality |

EPF keen to add more highway assets

QUOTE It is believed that the EPF is keen on acquiring highway assets that are still at a growth phase and have yet to experience strong traffic growth. They include highways that are located in the Klang Valley as well as intercity expressways in other states. Instead of investing in public listed companies whose subsidiaries own highway assets as in the past, the fund is said to be opting for direct ownership in the operators instead. This ensures that the earnings derived from the highway operations will flow directly to the fund as opposed to their holding companies. http://www.thestar.com.my/business/busines...highway-assets/ EPF is seeking to maintain or increase their dividend in near future. Good for contributors |

|

|

Oct 2 2016, 07:55 AM Oct 2 2016, 07:55 AM

Show posts by this member only | IPv6 | Post

#1917

|

Senior Member

10,001 posts Joined: May 2013 |

QUOTE(kpfun @ Oct 1 2016, 10:35 AM) EPF should retain at least 50% of the sum for gradually withdrawal during retirement. I presume some will say yes n noI have seen many folks who are pittyful begging for monthly allowance from their children, after spending all their EPF saving, either for self use, or family purpose. For me, I will say no bcoz I know how to manage my funds plus I blif discipline is important |

|

|

Oct 2 2016, 09:57 AM Oct 2 2016, 09:57 AM

|

Senior Member

1,135 posts Joined: Sep 2015 |

QUOTE(wil-i-am @ Oct 2 2016, 07:55 AM) I presume some will say yes n no Frequent visitors to this thread generally are like you. But, I strongly believe that we are not the majority.For me, I will say no bcoz I know how to manage my funds plus I blif discipline is important By visiting the threads like "AKPK, Debt Issues", and "CCRIS, CTOS, Blacklisted by Ban", we can know that how poor these people in money management. Basically, their minds has nothing other than thinking of where they can borrow money! This post has been edited by kpfun: Oct 2 2016, 09:58 AM |

|

|

Oct 2 2016, 08:12 PM Oct 2 2016, 08:12 PM

|

Junior Member

431 posts Joined: Apr 2010 |

Is one allowed to keep his savings in epf even after he retires at 55, with the intent of drawing only dividend annually?

Its hard to find 6+% annual returns passively. |

|

|

Oct 3 2016, 11:33 AM Oct 3 2016, 11:33 AM

|

Senior Member

4,436 posts Joined: Oct 2008 |

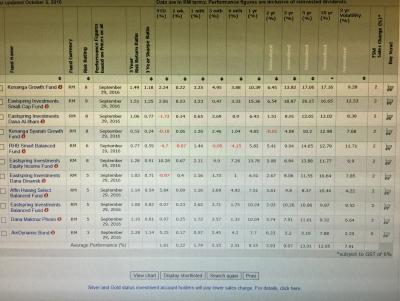

QUOTE(nanan75 @ Oct 2 2016, 08:12 PM) Is one allowed to keep his savings in epf even after he retires at 55, with the intent of drawing only dividend annually? Hard or not is subjective. Its hard to find 6+% annual returns passively. But if one were to participate as an unit-holder into one of these UTF for the past ten years, his money would have grown minimally 7.88% per annum to a maximum of 17.16% per annum. Xuzen This post has been edited by xuzen: Oct 3 2016, 11:38 AM Attached thumbnail(s)

|

| Change to: |  0.0251sec 0.0251sec

0.55 0.55

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 16th December 2025 - 06:04 AM |