QUOTE(plumberly @ Nov 24 2020, 10:03 AM)

Thanks.

Dont know whether to be happy or sad to see this list! So dominant in Msian shares. OK if it has no political hands in there.

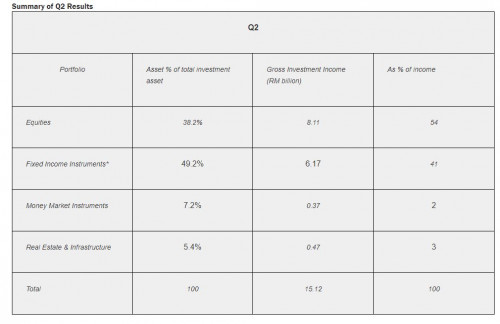

Right now it is around 45% in Malaysia and 55% overseas for their equity portion unless they have changed it drastically in the past year or so but overall still around 70% of assets are Malaysian.

Their overseas portfolio has saved any underperformance from their local holdings but just imagine where the fund would be if their local holdings were top notch.

In the end of the day EPF, PNB and KWAP might not have a choice in investing in certain companies in Malaysia because if they don't buy them up then who will....

That is why like you said earlier one can hope people question that and force the media to hold their investments accountable instead of publishing articles about withdrawals that are misleading and hopefully proper economic reforms can take place which leads to these companies doing well.

QUOTE(adamhzm90 @ Nov 24 2020, 03:21 PM)

as long as still profitable and giving good dividends to EPF subsequently to pencarum, so no problem la

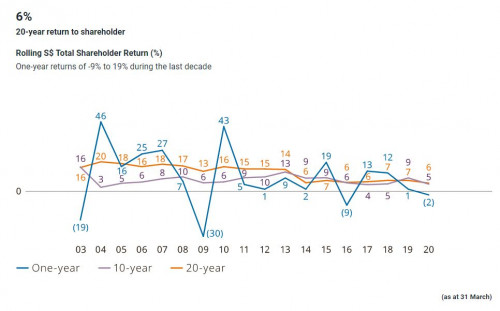

For now it works but do remember of the Malaysian 10 Years Government Bond yield is around 2.7% so equities are going to need to do the heavy lifting for the future contributions if the dividends are to stay or improve from current levels.

QUOTE(TheEquatorian @ Nov 24 2020, 04:09 PM)

This seems to be their equity positions in the respective company? Are the investments ranked according to size also ie the no1 is the largest domestic equity investment for EPF? I don’t think so.

To me this only shows EPFs stake in companies not their actual equity value. I am not sure what to do with this info, besides that I do not think EPF should be the major stakeholder in any company. It is a pension fund not an investment holding company.

Any data on how many % their local equity in Bursa Malaysia is compared to the entire fund?

You are right.

Below is based on the value of holdings that I got from a friend so apologies if there are mistakes:

QUOTE

1 Malayan Banking Bhd 12,862,885,118

2 Public Bank Bhd 11,702,465,128

3 Tenaga Nasional Bhd 10,739,666,686

4 RHB Bank Bhd 8,600,540,696

5 Cimb Group Holdings Bhd 5,929,466,237

6 Sime Darby Plantation Bhd 5,694,415,519

7 Axiata Group Berhad 5,371,810,712

8 Digi.Com Berhad 4,800,888,432

9 Petronas Chemicals 4,796,796,160

10 IHH Healthcare 4,710,449,264

11 Maxis Berhad 4,655,141,280

12 Petronas Gas Bhd 4,435,696,128

13 Hong Leong Bank 4,092,736,698

14 Kuala Lumpur Kepong Bhd 3,802,318,236

15 IOI Corporation Bhd 3,689,119,495

16 Top Glove 3,633,249,969

17 MISC 2,965,991,814

18 Telekom Malaysia Bhd 2,933,862,520

19 Malaysia Building Society Bhd 2,599,796,986

20 Nestlé Malaysia 2,562,103,600

21 Hartalega Hldgs 2,542,689,380

22 Petronas Dagangan 2,279,409,300

23 Dialog Group Berhad 1,902,732,459

24 Sime Darby 1,657,123,718

25 Kossan 1,379,209,800

26 Malaysia Airport Holdings Bhd 1,343,010,634

27 Gamuda Berhad 1,307,798,288

28 Pmetal 1,241,376,230

29 Genting Plantations 965,883,406

30 IJM Corp Berhad 938,235,338

This post has been edited by zacknistelrooy: Nov 25 2020, 01:00 AM  for 2016 as compared to 6.40% in 2015

for 2016 as compared to 6.40% in 2015

Sep 9 2016, 06:40 PM

Sep 9 2016, 06:40 PM

Quote

Quote

0.0535sec

0.0535sec

0.79

0.79

7 queries

7 queries

GZIP Disabled

GZIP Disabled