Outline ·

[ Standard ] ·

Linear+

Fund Investment Corner v3, Funds101

|

rebeka

|

Dec 23 2021, 09:21 AM Dec 23 2021, 09:21 AM

|

Getting Started

|

QUOTE(MUM @ Dec 22 2021, 10:24 PM) :thumbsup: good info, mind sharing the list of funds that does not requires to be an accredited investors (“AI”) and their minimum investments amount and preferably their related charges?  There are 2 type of funds with minimum investment of USD 10k & 25k ,subscription fee is 1% & redemption fee is 0.5% . If you need more details, kindly pm me ... |

|

|

|

|

|

MUM

|

Dec 23 2021, 09:36 AM Dec 23 2021, 09:36 AM

|

|

QUOTE(rebeka @ Dec 23 2021, 09:21 AM) There are 2 type of funds with minimum investment of USD 10k & 25k ,subscription fee is 1% & redemption fee is 0.5% . If you need more details, kindly pm me ... wow, so secretive one,...need to PM if wanted more details... anyway thanks for the same posted details....   too bad those that wanted to know more about its years of inception, mandate, performance, risk factors etc etc,...will just have to forgo it or PM for it |

|

|

|

|

|

MUM

|

Dec 23 2021, 09:49 AM Dec 23 2021, 09:49 AM

|

|

QUOTE(Avicted @ Dec 23 2021, 06:48 AM) RHB Big Cap investment fund now not good?yes, now not good if compared it to past July 2019 till Feb 2021 period compared to it all time ATH in Feb 2021 No, now is good if buy now compared to Feb 2021 (or any buy since July 2020) compare to 10 yrs ago,...it is still way up from 100 to 250 (per indicator in the chart) just don't sailang all in ....if your portfolio construction requires it, then perhaps under supplementary or "commando/striker" section of a diversified port Attached thumbnail(s)

|

|

|

|

|

|

Avicted

|

Dec 23 2021, 01:26 PM Dec 23 2021, 01:26 PM

|

New Member

|

QUOTE(MUM @ Dec 23 2021, 09:49 AM) yes, now not good if compared it to past July 2019 till Feb 2021 period compared to it all time ATH in Feb 2021 No, now is good if buy now compared to Feb 2021 (or any buy since July 2020) compare to 10 yrs ago,...it is still way up from 100 to 250 (per indicator in the chart) just don't sailang all in ....if your portfolio construction requires it, then perhaps under supplementary or "commando/striker" section of a diversified port Should i sell it ? Or waiting until new year to see the trend? |

|

|

|

|

|

MUM

|

Dec 23 2021, 01:28 PM Dec 23 2021, 01:28 PM

|

|

QUOTE(Avicted @ Dec 23 2021, 01:26 PM) Should i sell it ? Or waiting until new year to see the trend? how many % of it is in your portfolio? any similar mandated fund in your port? how many % of losses are you having on this particular fund? does this losses impacted you in any way? do you needed that money (from selling it) for something in less than 3 yrs down the road? This post has been edited by MUM: Dec 23 2021, 01:30 PM |

|

|

|

|

|

Avicted

|

Dec 23 2021, 05:03 PM Dec 23 2021, 05:03 PM

|

New Member

|

QUOTE(MUM @ Dec 23 2021, 01:28 PM) how many % of it is in your portfolio? any similar mandated fund in your port? how many % of losses are you having on this particular fund? does this losses impacted you in any way? do you needed that money (from selling it) for something in less than 3 yrs down the road? 1. 29% from overall 2. Not really. 3. Around 27% 4. & 5. : Nope |

|

|

|

|

|

MUM

|

Dec 23 2021, 05:49 PM Dec 23 2021, 05:49 PM

|

|

QUOTE(Avicted @ Dec 23 2021, 05:03 PM) 1. 29% from overall 2. Not really. 3. Around 27% 4. & 5. : Nope At 27% still hv "nope" for 4 & 5,... Then it would make the decision as to whether to sell or continue to hold easier... 👍👍 |

|

|

|

|

|

rebeka

|

Dec 24 2021, 05:07 PM Dec 24 2021, 05:07 PM

|

Getting Started

|

QUOTE(MUM @ Dec 23 2021, 09:36 AM) wow, so secretive one,...need to PM if wanted more details... anyway thanks for the same posted details.... :thumbsup:  too bad those that wanted to know more about its years of inception, mandate, performance, risk factors etc etc,...will just have to forgo it or PM for it ( min investment USD 25k ) The Sharpe ratio was developed by Nobel laureate William F. Sharpe and is used to help investors understand the return of an investment compared to its risk. The ratio is the average return earned in excess of the risk-free rate per unit of volatility or total risk. Usually, any Sharpe ratio greater than 1.0 is considered acceptable to good by investors. A ratio higher than 2.0 is rated as very good. A ratio of 3.0 or higher is considered excellent. A ratio under 1.0 is considered sub-optimal. https://www.cpgbl.com/mta-performance/( min investment USD 10k )  |

|

|

|

|

|

Avicted

|

Dec 25 2021, 11:25 AM Dec 25 2021, 11:25 AM

|

New Member

|

QUOTE(MUM @ Dec 23 2021, 05:49 PM) At 27% still hv "nope" for 4 & 5,... Then it would make the decision as to whether to sell or continue to hold easier... 👍👍 Yalo.. Since that one saving money. No borrowing. Just sad when the price drop. If selling also ,currently no need so urgently that moneyy |

|

|

|

|

|

onepunch369

|

Jan 11 2022, 09:08 PM Jan 11 2022, 09:08 PM

|

New Member

|

Hi everyone new to this forum!

I've been using both unit trusts and robos for a few years. Any reason why most OGs still opt for unit trusts rather than roboadvisors? sorry if noob question

|

|

|

|

|

|

MUM

|

Jan 11 2022, 09:15 PM Jan 11 2022, 09:15 PM

|

|

QUOTE(onepunch369 @ Jan 11 2022, 09:08 PM) Hi everyone new to this forum! I've been using both unit trusts and robos for a few years. Any reason why most OGs still opt for unit trusts rather than roboadvisors? sorry if noob question Does Robo advisors allows you to select your own countries or regions or sectors & the % of allocation to each of them at the choice you preferred like unit trust funds does in the composition of your DIY portfolio? This post has been edited by MUM: Jan 11 2022, 09:41 PM |

|

|

|

|

|

Jitty

|

Jan 21 2022, 09:37 AM Jan 21 2022, 09:37 AM

|

|

QUOTE(onepunch369 @ Jan 11 2022, 09:08 PM) Hi everyone new to this forum! I've been using both unit trusts and robos for a few years. Any reason why most OGs still opt for unit trusts rather than roboadvisors? sorry if noob question I had been with Stashawway for 3 yr and been with FSM for 2 yr Return for FSM dropped to 9% return for SA maintained at 40++% so I will stick with SA as per for now. |

|

|

|

|

|

rebeka

|

Jan 22 2022, 08:15 PM Jan 22 2022, 08:15 PM

|

Getting Started

|

QUOTE(Jitty @ Jan 21 2022, 09:37 AM) I had been with Stashawway for 3 yr and been with FSM for 2 yr Return for FSM dropped to 9% return for SA maintained at 40++% so I will stick with SA as per for now. Mind to share which SA portfolio maintained at 40++% ? TQ |

|

|

|

|

|

MUM

|

Jan 23 2022, 07:09 AM Jan 23 2022, 07:09 AM

|

|

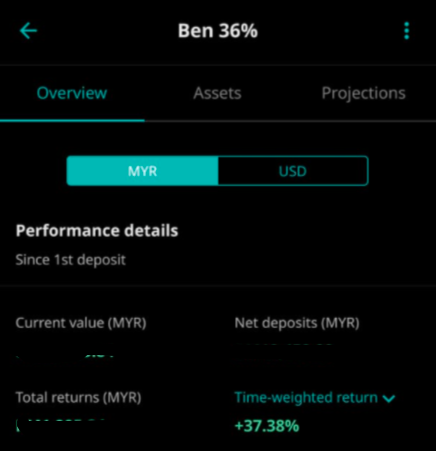

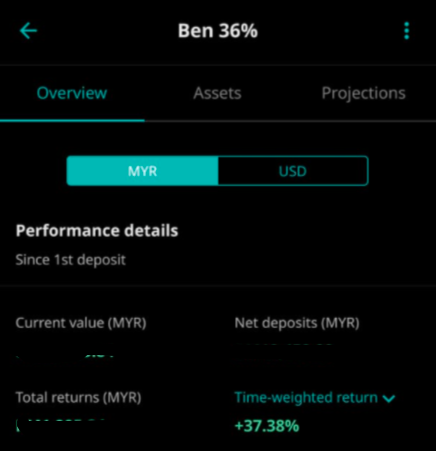

QUOTE(rebeka @ Jan 22 2022, 08:15 PM) Mind to share which SA portfolio maintained at 40++% ? TQ while waiting for his response,.... unknown of his investment period or if he did made any additional big top up at the "right" time (ex: in 2020) my wild guessed based on mentioned annualised returns, invested since inception and no top up since then....looks likely from the 30 & 36% SRI https://www.stashaway.my/how-we-invest#performance Attached thumbnail(s)

|

|

|

|

|

|

rebeka

|

Jan 23 2022, 11:55 AM Jan 23 2022, 11:55 AM

|

Getting Started

|

QUOTE(MUM @ Jan 23 2022, 07:09 AM) while waiting for his response,.... unknown of his investment period or if he did made any additional big top up at the "right" time (ex: in 2020) my wild guessed based on mentioned annualised returns, invested since inception and no top up since then....looks likely from the 30 & 36% SRI https://www.stashaway.my/how-we-invest#performanceThanks for your feedback ... u mean it’s the return since inception ? |

|

|

|

|

|

MUM

|

Jan 23 2022, 12:04 PM Jan 23 2022, 12:04 PM

|

|

QUOTE(rebeka @ Jan 23 2022, 11:55 AM) Thanks for your feedback ... u mean it’s the return since inception ? Reading his posting, I think he meant 40+% since he invested in SA 3 yrs ago |

|

|

|

|

|

senyii

|

Jan 23 2022, 05:20 PM Jan 23 2022, 05:20 PM

|

|

Hi I am fairly new in investment, only invest in unit trust before but didn't really know much.

Now i am thinking to invest in another unit trust. I have some general question:

1. I see generally unit trust return around 5-10% ? what is the minimum year investment lock for?

2. Previously my unit trust were paid monthly a X amount, is all unit trust has these option or must be 1 lump sum investment?

3. I'm told by my friend stashway is also good to consider, anyone can share more thoughts against other unittrust?

Lastly love to have some suggestion which unit trust to consider, I'm looking at no more than 5years investment. or if there is any other investment you would suggest, looking for low to medium risk and doesn't require extensive monitoring.

|

|

|

|

|

|

MUM

|

Jan 23 2022, 06:43 PM Jan 23 2022, 06:43 PM

|

|

QUOTE(senyii @ Jan 23 2022, 05:20 PM) Hi I am fairly new in investment, only invest in unit trust before but didn't really know much. Now i am thinking to invest in another unit trust. I have some general question: 1. I see generally unit trust return around 5-10% ? what is the minimum year investment lock for? Unit trust investments are subject to investment risks, including the possible loss of the principal amount invested.

Past performance is not indicative of future performance.

The value of the unit trusts and the income from them may fall as well as rise.

Thus there is no guaranteed that it can be 5~10% every year.....at times it can go into BIG negatives too (like 50% off from your purchased NAV price)2. Previously my unit trust were paid monthly a X amount, is all unit trust has these option or must be 1 lump sum investment? YES, there are monthly dividend distributing unit trust funds.

NO, not all unit trust has this monthly dividend distributing option.

Some only do it once a year and some also did not distribute dividend

btw, in unit trust investing, the dividend distribution does not make the $$ value you have inside it to be more. There is no variance of the $$ you have BEFORE or AFTER dividend distribution process.

For, When a unit split/distribution is declared, the NAV per unit will be reduced from pre-unit split NAV/cum-distribution NAV to post-unit split NAV/ex-distribution NAV.

there is a minimum amount of money you need to buy initially (lumpsum of that initial amount)

3. I'm told by my friend stashway is also good to consider, anyone can share more thoughts against other unittrust? There is a Stashaway thread in LYN...you can try follow/read/explore from there...

StashAway Malaysia, Multi-Region ETF at your fingertips!https://forum.lowyat.net/topic/4750563Lastly love to have some suggestion which unit trust to consider, I'm looking at no more than 5years investment. or if there is any other investment you would suggest, looking for low to medium risk and doesn't require extensive monitoring. i would suggest you think of it this way,......which unit trust funds you would consider that allows you to accept possible XX% pa of losses and when this losses happens; it will not have impact your emotional well being, impact your work/family life. and you will not quit/sell off? (in short, what amount of % of losses you will accepts before calling it quits?)

How many % of ROI will you want to try to make at the end of that 5 years? |

|

|

|

|

|

Jitty

|

Jan 24 2022, 12:47 PM Jan 24 2022, 12:47 PM

|

|

QUOTE(rebeka @ Jan 22 2022, 08:15 PM) Mind to share which SA portfolio maintained at 40++% ? TQ Dear Rebeka, yeah, since inception. end of year 2019 now dropped to 30++ %  |

|

|

|

|

|

senyii

|

Jan 25 2022, 07:16 PM Jan 25 2022, 07:16 PM

|

|

QUOTE(MUM @ Jan 23 2022, 06:43 PM) Thanks for the reply… what are some of the unit trust that are doing fairly good currently? On the loss honestly off course prefer no lost at least breakeven..not a gambler hence wont go for those high risk one…i prolly will hold for a max a yr for it to go back up? For stashaway the thread mostly talk about stashaway alone not comparing with other.. i want to know how it is different with other unit trust? For the monthly question was not about dividen but the payment for the investment in unit trust is there type when u can pay monthly and accumulate or it has to pay one lumpsum type? |

|

|

|

|

Dec 23 2021, 09:21 AM

Dec 23 2021, 09:21 AM

Quote

Quote

0.0262sec

0.0262sec

0.69

0.69

6 queries

6 queries

GZIP Disabled

GZIP Disabled