Outline ·

[ Standard ] ·

Linear+

Fund Investment Corner v3, Funds101

|

MUM

|

Jan 25 2022, 07:24 PM Jan 25 2022, 07:24 PM

|

|

QUOTE(senyii @ Jan 25 2022, 07:16 PM) Thanks for the reply… what are some of the unit trust that are doing fairly good currently? On the loss honestly off course prefer no lost at least breakeven..not a gambler hence wont go for those high risk one…i prolly will hold for a max a yr for it to go back up? Unit trust investing will be subjected to risk of losses even for Fixed income funds,...unless you select those money market funds or extremely low risk type of Fixed income funds

For stashaway the thread mostly talk about stashaway alone not comparing with other.. i want to know how it is different with other unit trust? Stashaway is investing in ETFs while Unit trust is investing in Stocks

Stashaway is like FSM managed portfolio....both is whre you let them do the managing, selections or changing of the portfolio composition....you got no say in what or how much you want to allocateFor the monthly question was not about dividen but the payment for the investment in unit trust is there type when u can pay monthly and accumulate or it has to pay one lumpsum type? there are Regular Saving Plan (RSP) in FSM

check out the FAQs on Regular Savings Plan - RSPhttps://www.fsmone.com.my/support/frequentl...routeFaqId=7075 |

|

|

|

|

|

MUM

|

Feb 20 2022, 10:04 AM Feb 20 2022, 10:04 AM

|

|

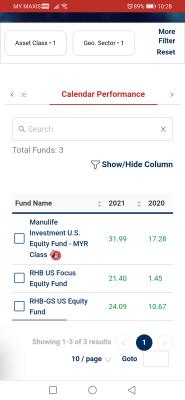

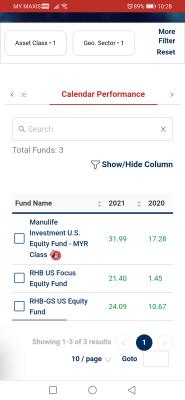

QUOTE(zhitou @ Feb 20 2022, 09:48 AM) Akru's highest risk portfolio beat 90% of locally managed global unit trust funds in 2021. See www.akrunow.com/articles/perfromance-report-december-2021 and Julian Ng's latest Facebook page post at m.facebook.com/story.php?story_fbid=10158532442872671&id=534737670 Start now with Akrunow.com. Please use the PASSIVE20 promo code so that Akru can give you a RM20 top up as a token of appreciation. What are the geographical allocation of this Akru's highest portfolio? Does it has a heavy allocation (like more than 50%) to a certain country/sector/segment mkts? What is the current year YTD performance of this highest risk portfolio? Some don't like the biased n heavy allocation to a certain country/sector/segment even though it can managed to beat 90% of locally managed global unit trust funds in 2021. Btw, I think alot of unit trust funds that focused heavily in US mkt would do well in 2021 also. What is the 2021 returns of that Akru's highest risk portfolio? This post has been edited by MUM: Feb 20 2022, 10:44 AM Attached thumbnail(s)

|

|

|

|

|

|

MUM

|

Feb 20 2022, 11:08 AM Feb 20 2022, 11:08 AM

|

|

QUOTE(zhitou @ Feb 20 2022, 11:03 AM) The portfolio mix is as follows: S&P500 57% Ex-US Equity 40% US & International Bond 3% Per Akru Performance Report www.akrunow.com/articles/perfromance-report-december-2021, it was 22.8% in 2021 for P10 (highest risk portfolio) At 57% us... 2021 MYR performance is 22.8%? Global ut funds had broken that ROI for 2021. Btw, any idea for the current 2022 YTD returns for akru portfolio 10?.. Global UT funds are bad YTD, just hope portfolio 10 can be different |

|

|

|

|

|

MUM

|

Feb 20 2022, 12:39 PM Feb 20 2022, 12:39 PM

|

|

QUOTE(zhitou @ Feb 20 2022, 12:15 PM) In Jan 2022, Akru P10 down ~3.8% (vs S&P500 -5.2%). How do the Global UT funds do in 2021 and Jan 2022? Global UT funds BAD as i mentioned earlier on those listed earlier Attached thumbnail(s)

|

|

|

|

|

|

gunavision

|

Mar 13 2022, 08:23 PM Mar 13 2022, 08:23 PM

|

New Member

|

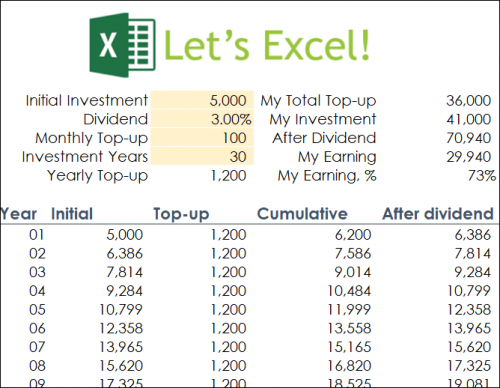

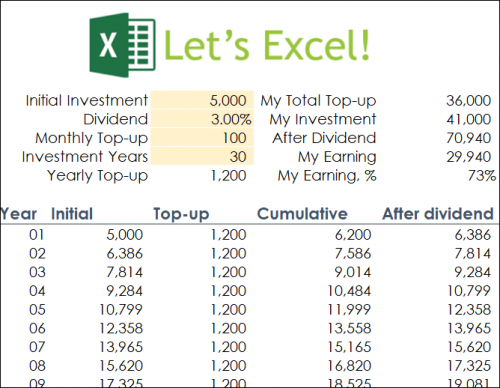

𝑪𝒐𝒎𝒑𝒐𝒖𝒏𝒅𝒊𝒏𝒈 𝑪𝒂𝒍𝒄𝒖𝒍𝒂𝒕𝒐𝒓 𝒗1.0A compounding calculator is very useful for the below purposes; a) To forecast growth of an investment after a certain period of time b) To estimate the monthly investment I should make to achieve my final target If you have no knowledge about investments, and you don't know where to start, just find out a compounding instrument and start to invest. For example, in Malaysia, we could invest in 𝑬𝑷𝑭, 𝑨𝒎𝒂𝒏𝒂𝒉 𝑺𝒂𝒉𝒂𝒎 𝒂𝒏𝒅 𝑺𝑺𝑷𝑵 to grow our money using this compounding factor. Just start with a little initial investment and keep investing monthly to grow your money. Feel free to download this Compounding Calculator and see how your money could grow over time. https://1drv.ms/x/s!AiQmyS0-LNsOnbpEcVS...S167eg?e=4XZHj7 This post has been edited by gunavision: Mar 13 2022, 08:25 PM This post has been edited by gunavision: Mar 13 2022, 08:25 PM

|

|

|

|

|

|

Tyeway0on P

|

May 1 2022, 08:27 AM May 1 2022, 08:27 AM

|

New Member

|

QUOTE(belialjo @ May 17 2019, 11:50 AM) Anyone heard of CP Global before? SG based private equity hedge fund, would like to seek opinion if it’s worth going in and legit. Hi, may I know if you joined this investment thingy? If yes, is it leggit or a scam? |

|

|

|

|

|

MUM

|

May 1 2022, 09:40 AM May 1 2022, 09:40 AM

|

|

QUOTE(Tyeway0on @ May 1 2022, 08:27 AM) Hi, may I know if you joined this investment thingy? If yes, is it leggit or a scam? If you meant this.... CP Global Asset Management,... According to their website,.... Registered Fund Management Company ("RFMC") and Exempt Financial Adviser regulated by the Monetary Authority of Singapore ("MAS") https://cpglobal.com.sg/new-our-firm |

|

|

|

|

|

SUSTOS

|

May 1 2022, 09:58 AM May 1 2022, 09:58 AM

|

|

QUOTE(Tyeway0on @ May 1 2022, 08:27 AM) Hi, may I know if you joined this investment thingy? If yes, is it leggit or a scam? Yes, it is legit. It has been around for some time since a few years back. This is the MAS license info. https://eservices.mas.gov.sg/fid/institutio...PRIVATE-LIMITED |

|

|

|

|

|

rebeka

|

May 3 2022, 09:58 AM May 3 2022, 09:58 AM

|

Getting Started

|

QUOTE(TOS @ May 1 2022, 09:58 AM) Yes, it is legit. It has been around for some time since a few years back. This is the MAS license info. https://eservices.mas.gov.sg/fid/institutio...PRIVATE-LIMITEDMy family members have been invested since inception ( almost 30 years ) |

|

|

|

|

|

SUSTOS

|

May 3 2022, 10:04 AM May 3 2022, 10:04 AM

|

|

QUOTE(rebeka @ May 3 2022, 09:58 AM) My family members have been invested since inception ( almost 30 years ) Hmm... so lots of fortunes amassed, I guess?  Did you have a chance to speak to the fund managers themselves and have a glimpse of their strategies and holdings? In any case, just make sure you don't put all your money/wealth in it. |

|

|

|

|

|

rebeka

|

May 3 2022, 04:30 PM May 3 2022, 04:30 PM

|

Getting Started

|

QUOTE(TOS @ May 3 2022, 10:04 AM) Hmm... so lots of fortunes amassed, I guess?  Did you have a chance to speak to the fund managers themselves and have a glimpse of their strategies and holdings? In any case, just make sure you don't put all your money/wealth in it. They actually outperform the top investment fund in USA... They also organise yearly client seminar where we could meet the find managers on their investment strategy with Q&A session ... |

|

|

|

|

|

SUSTOS

|

May 3 2022, 04:41 PM May 3 2022, 04:41 PM

|

|

QUOTE(rebeka @ May 3 2022, 04:30 PM) They actually outperform the top investment fund in USA... They also organise yearly client seminar where we could meet the find managers on their investment strategy with Q&A session ... Nice. Are the seminars held in KL or you fly to their head office in SG? |

|

|

|

|

|

rebeka

|

May 3 2022, 05:00 PM May 3 2022, 05:00 PM

|

Getting Started

|

QUOTE(TOS @ May 3 2022, 04:41 PM) Nice. Are the seminars held in KL or you fly to their head office in SG? I joined d KL session |

|

|

|

|

|

WhitE LighteR

|

May 5 2022, 09:53 PM May 5 2022, 09:53 PM

|

|

QUOTE(TOS @ May 3 2022, 10:04 AM) Hmm... so lots of fortunes amassed, I guess?  Did you have a chance to speak to the fund managers themselves and have a glimpse of their strategies and holdings? In any case, just make sure you don't put all your money/wealth in it. most hedge fund dont disclose their strategy. some times they will share their allocation but usually that it. they are not require to disclose this type of information unlike unit trust or etf |

|

|

|

|

|

WhitE LighteR

|

May 5 2022, 09:55 PM May 5 2022, 09:55 PM

|

|

QUOTE(rebeka @ May 3 2022, 04:30 PM) They actually outperform the top investment fund in USA... They also organise yearly client seminar where we could meet the find managers on their investment strategy with Q&A session ... hasnt been any siminar since covid. the founder expanded into robo advisor in malaysia thru a subsidiary here. |

|

|

|

|

|

SUSTOS

|

May 5 2022, 09:56 PM May 5 2022, 09:56 PM

|

|

QUOTE(WhitE LighteR @ May 5 2022, 09:53 PM) most hedge fund dont disclose their strategy. some times they will share their allocation but usually that it. they are not require to disclose this type of information unlike unit trust or etf What if you are a very big client (e.g. akin to a family office)? Still no special treatment?  |

|

|

|

|

|

WhitE LighteR

|

May 5 2022, 09:59 PM May 5 2022, 09:59 PM

|

|

QUOTE(TOS @ May 5 2022, 09:56 PM) What if you are a very big client (e.g. akin to a family office)? Still no special treatment?  probably if is really big, they will try to cater them better thru some private consultation. its not like they have that many layers also. so getting thru to the fund manager is not that difficult. jst see if he wan to layan u or not only. the amount u bring must be damn damn big i guess. hahaha. |

|

|

|

|

|

SUSTOS

|

May 5 2022, 10:05 PM May 5 2022, 10:05 PM

|

|

QUOTE(WhitE LighteR @ May 5 2022, 09:59 PM) probably if is really big, they will try to cater them better thru some private consultation. its not like they have that many layers also. so getting thru to the fund manager is not that difficult. jst see if he wan to layan u or not only. the amount u bring must be damn damn big i guess. hahaha. I see. You sound like an insider in the fund management industry.  And no, I am not that rich.  Just curious to learn more about the "dark" high finance world. |

|

|

|

|

|

WhitE LighteR

|

May 5 2022, 10:17 PM May 5 2022, 10:17 PM

|

|

QUOTE(TOS @ May 5 2022, 10:05 PM) I see. You sound like an insider in the fund management industry.  And no, I am not that rich.  Just curious to learn more about the "dark" high finance world. its not dark la. its jst for ppl with money to invest. actual "sophisticated" investor instead of the self declared one like in FSM or whatever...  coz for those type of ppl, a consistent return is better than beating the market performance. anyway the entry level isnt as much as one would think. a season investor in his 40's should easily have such amount to allocate some to such strategy This post has been edited by WhitE LighteR: May 5 2022, 10:19 PM |

|

|

|

|

|

SpringBreak2012

|

May 13 2022, 08:49 PM May 13 2022, 08:49 PM

|

New Member

|

Hi, would like to ask for sifus opinion.

A family member would like to apply for a long-term savings and investment plan (it's legit, 12m x 5y w/ 20 year maturity) in my name with payments fully made by them. It's a nice gesture, but since it's being made in my name I would like to know what is the worst case scenario that could happen?

e.g.

1) Payment is not made on time - any impact on my CCRIS?

2) Payment is not made on time - will I be hounded by payment reminders?

3) And anything else that could happen?

This post has been edited by SpringBreak2012: May 13 2022, 08:49 PM

|

|

|

|

|

Jan 25 2022, 07:24 PM

Jan 25 2022, 07:24 PM

Quote

Quote

0.0244sec

0.0244sec

0.54

0.54

6 queries

6 queries

GZIP Disabled

GZIP Disabled