Finally manage to change my Hong Leong Bank savings account to BSA without

annual fees.

Here are the hassles I went thru just to resolve this issue:

At first went to home branch but was told no such thing

I told them it's stated in HLB website, also called HQ only they admit have such product.

Then, I was told that need to open new BSA without annual fees instead of change/convert from existing SA, and I agreed but was excused that system offline for the branch, unable to perform account opening.

I was told to go other branch if want to open the BSA, and I follow their instructions and went to other branch. When went other branch, I was told the same story again - no such SA without annual fees

then I slowly explain to them and they verified have such BSA

When they verify my document to open BSA, they notice that I have existing SA and told me I can change/convert my existing SA to BSA without have to open new BSA but only can be done at home branch

I told them I just came from home branch and the story home branch told me, finally they filled up a request form and send over home branch to perform my request as only home branch can perform the account change request.

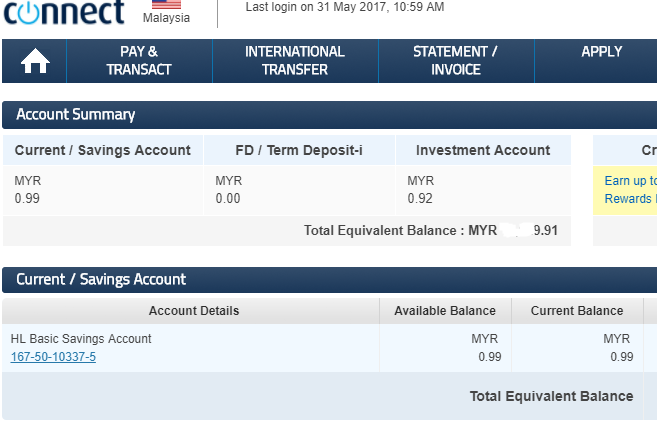

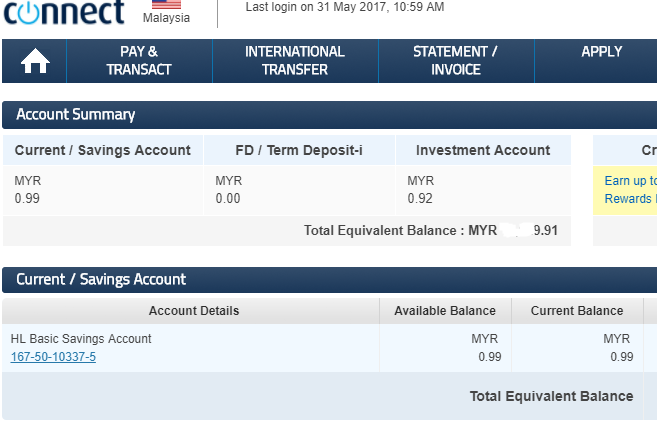

After few weeks suddenly remember this and check at my Hong Leong Connect, finally can see the account type changed to BSA, contacted and confirmed with CS that my account is now BSA with no annual fees without to have open new BSA.

Jan 30 2018, 06:13 PM

Jan 30 2018, 06:13 PM

Quote

Quote

0.0245sec

0.0245sec

1.25

1.25

6 queries

6 queries

GZIP Disabled

GZIP Disabled