Outline ·

[ Standard ] ·

Linear+

Savings Account in Malaysia

|

55665566

|

Jan 31 2018, 09:20 AM Jan 31 2018, 09:20 AM

|

|

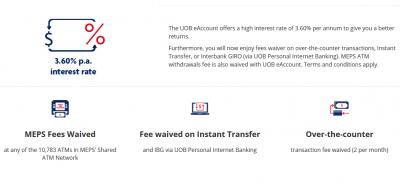

QUOTE(shuin1986 @ Jan 30 2018, 11:16 PM) Thanks for the update, seems like top 3 saving accounts are these, for now: 1. UOB eAccount: 3.60% p.a. for above RM50k [no max amount]  2. OCBC 360: 3.60% p.a. for 2 easy-to-achieve monthly requirements, 4.10% p.a. with min monthly spending of RM500 [interest earned only up to first RM100k]  3. Alliance SavePlus: 3% p.a. for above RM100k [no max amount]

MEPS waiver means can withdraw at any ATM without charges? GIRO and Instant transfer fee waiver is really literally free? 3.60% is for RM50k above without any spending or condition? |

|

|

|

|

|

55665566

|

Feb 8 2018, 08:30 AM Feb 8 2018, 08:30 AM

|

|

QUOTE(shuin1986 @ Feb 8 2018, 12:05 AM) Yes, yes, and yes.  As long as your saving is above RM50k (up to infinite amount), u will get 3.60% p.a. interest, credited monthly, no need to do anything. - Told by UOB pretty amoi Can play with the calculator here: https://uniservices1.uob.com.my/jsp/calcula...sav_deposit.jspMEPS and Instant transfer waiver have no cap for per month?! Too good to be true. Will go and open one when I on leave. |

|

|

|

|

|

55665566

|

Feb 9 2018, 10:03 AM Feb 9 2018, 10:03 AM

|

|

QUOTE(Ramjade @ Feb 8 2018, 08:36 AM) You can get free IBFT transfer charges with RM0 amount - Standard Chartered Just One account What is the purpose of doing transfer of RM0 amount? |

|

|

|

|

|

55665566

|

Feb 9 2018, 11:11 AM Feb 9 2018, 11:11 AM

|

|

QUOTE(lordadvantine @ Feb 9 2018, 10:15 AM) RM0 means no minimum balance required on the acct. I thought UOB automatically waive the fee too despite the balance of your account? |

|

|

|

|

|

55665566

|

Apr 9 2018, 09:55 AM Apr 9 2018, 09:55 AM

|

|

anyone can explain what is this? http://www.maybank2u.com.my/mbb_info/m2u/p...d=/mbb/PersonalQUOTE Important Notice: Reclassification of imteen/-i Account to Personal Saver/-i Account

Effective 5 May 2018, imteen/ imteen-i Account will be reclassified to Personal Saver/ Personal Saver-i Account upon the account holder attaining the age of 18 years old.

This reclassification exercise will also involve all existing imteen/ imteen-i account holders aged 18 years old and above.

Please note that the account number will remain unchanged and the customers may continue to operate the account with all existing services as usual.

To find out more on Personal Saver/ Personal Saver-i please click here.

Thank you. currently above 18 liao, but why now just change? what is the differences? |

|

|

|

|

|

55665566

|

Apr 9 2018, 04:13 PM Apr 9 2018, 04:13 PM

|

|

QUOTE(MilesAndMore @ Apr 9 2018, 11:44 AM) Because the account is meant for under legal age people. I guess previously they just ignore it when one attains the legal age but now they have decidedly to change this and not to let you guys to enjoy high interest anymore. Basically this means less for you guys. thats very sad to hear...  but how do i know my acc is imteen ? |

|

|

|

|

|

55665566

|

Dec 26 2018, 05:16 PM Dec 26 2018, 05:16 PM

|

|

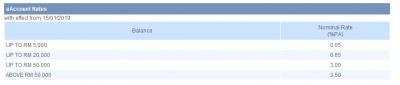

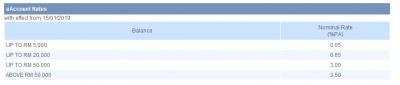

recently found out the uob eaccount actually only give 3.6% for the balance starting from 50k and not for the balance of the first 50k

Anyone can confirm this?

|

|

|

|

|

|

55665566

|

Jan 15 2019, 09:37 AM Jan 15 2019, 09:37 AM

|

|

QUOTE(Cookie101 @ Jan 15 2019, 09:29 AM) yes. it is for the full entire amount. not tiered nonsense. very straightforward... as if, my account got rm50000 for entire year, i get 50000*0.035 = 1750 every year? are you sure? https://uniservices1.uob.com.my/jsp/finance/fin_sav.jsp

not sure any misunderstanding or not. |

|

|

|

|

|

55665566

|

Jan 15 2019, 09:56 AM Jan 15 2019, 09:56 AM

|

|

QUOTE(Cookie101 @ Jan 15 2019, 09:55 AM) Yes. been getting around 100/monthly for bal of 35k~. sorry, should be 50001 to enjoy the 3.5% |

|

|

|

|

|

55665566

|

Jan 23 2019, 09:14 AM Jan 23 2019, 09:14 AM

|

|

QUOTE(shuin1986 @ Jan 22 2019, 11:42 PM) Confirmed with UOB's lenglui staff, if: 1. Ur saving - 20,001 to 49,999, you get 3% p.a. for whole balance 2. Ur saving - above 50,000, you get 3.5% p.a. (was 3.6%) for whole balance, no max limit for now So if ur acc got rm1,000,000, u get rm35,000 per year. Good to hear, not bad eh! yea, not sure why they adjust the -0.1% |

|

|

|

|

|

55665566

|

May 30 2019, 12:52 PM May 30 2019, 12:52 PM

|

|

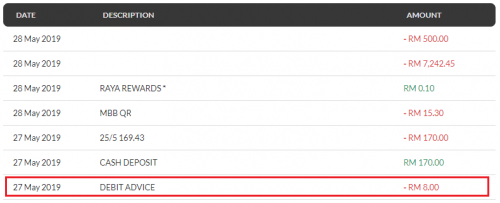

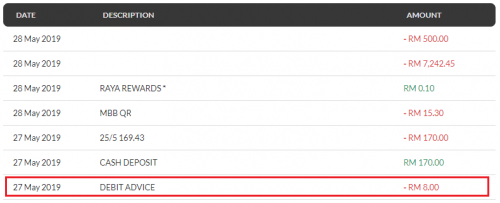

QUOTE(#Victor @ May 30 2019, 12:15 PM) no annual fees was charged until few days ago saw this DEBIT ADVISE, not sure is it the annual fee, yet call to CS to enquire that.  same here, i called cs to ask about it, it says for unlimited atm withdrawal. can go to branch to change to norm acc |

|

|

|

|

Jan 31 2018, 09:20 AM

Jan 31 2018, 09:20 AM

Quote

Quote

0.0548sec

0.0548sec

0.33

0.33

7 queries

7 queries

GZIP Disabled

GZIP Disabled