QUOTE(rajivshm @ Jul 31 2012, 11:09 PM)

Thanks bro.. What worries me is that many ppl are discussing abt 3.x% while BR giving 4%.. logically ppl will go for that rite.. So my decision as a newbie to choose BR shud be not wrong, right? Thanks...

QUOTE(Gen-X @ Aug 1 2012, 12:29 AM)

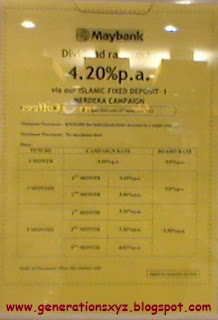

Bro, if your logic refers to greed, yes it is human nature tongue.gif However each of us also have different views and opinions and who is to say what is right or wrong? Having said that, if a financial institution is offering you like 8% for 12 months FD today, then I guess you better ask yourself how is that possible.

And you got to understand that Fixed Deposit and Bank Rakyat Islamic Investment Account are actually different. The Bank Rakyat's products are based on profit sharing principles, so with my little or no knowledge of this profit sharing meaning, I would think logically if they are making more profit, you should be getting more in dividends and vice-versa right? But this is not the case.

QUOTE(rajivshm @ Aug 1 2012, 09:44 AM)

I still dont really understnd. read those posts d... but being insured by govt of Malaysia shud also be safe, right? Im just worried if i dun get back my $$ upon maturity of FD. DIE liao.. haha...

rajivshm, my comments on Bank Rakyat's accounts at my FD PAGE has evolved into an article thanks to your previous postings where it gave me some ideas for my contents. Click below link to read it

Bank Rakyat Qiradh General Investment Account-i

Bank Rakyat Qiradh General Investment Account-i

Aug 8 2012, 02:18 AM

Aug 8 2012, 02:18 AM

Quote

Quote

0.0292sec

0.0292sec

0.42

0.42

6 queries

6 queries

GZIP Disabled

GZIP Disabled