QUOTE(wejazzitup @ Feb 13 2020, 09:20 PM)

Yes, it can, with a new policy and transfer of medical card to the new policy.All about PRUDENTIAL & insurance updates!, any insurance related issue are welcome

All about PRUDENTIAL & insurance updates!, any insurance related issue are welcome

|

|

Feb 13 2020, 09:55 PM Feb 13 2020, 09:55 PM

Return to original view | Post

#261

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

|

|

|

|

|

|

Feb 14 2020, 09:24 AM Feb 14 2020, 09:24 AM

Return to original view | IPv6 | Post

#262

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

QUOTE(wejazzitup @ Feb 14 2020, 08:09 AM) Oh.. that is good news. Will it need to go through all the underwriting again or is a straightforward transfer without going through the incontestability period all over again? A Medical Underwriting will apply on the upgraded medical card.If there are elements of non disclosure of material fact the old medical card will be reinstated and claim from there. There is no waiting period on the new medical card, eg, 120 days specified illness |

|

|

Feb 17 2020, 04:34 PM Feb 17 2020, 04:34 PM

Return to original view | IPv6 | Post

#263

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

QUOTE(wejazzitup @ Feb 14 2020, 06:07 PM) Oh ok. So meaning we don't have to go through the 2 years incontestability period again. Worst case is claim via old medical card. Is my understanding correct? Your understanding is incorrect. There is a reason why medical Underwriting is applied when you do the upgrade as it imposed higher risk to the insurer. Otherwise, everyone would just get the lowest plan and when health takes sideways, apply for upgrade. The 2 years Incontestibility still apply, which gives the insurer the right to investigate on the upgraded medical plan. |

|

|

Mar 10 2020, 12:41 PM Mar 10 2020, 12:41 PM

Return to original view | IPv6 | Post

#264

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

QUOTE(mavric @ Mar 10 2020, 09:11 AM) Hi sifus, I would appreciate an explanation what SLACK benefit is. Slack does not contribute to the insurance charges as it is not for buying of any coverage. It is more to built up the cash value in order to sustain the policy longer.Is this a rider? How does it work? How does it benefit me? Is this an optional benefit that can be removed or included on request? You may increase or reduce the slack as you wish. However for any Reduction, you will need to sign a policy sustainability form that the policy may not be able to sustain as per in the initial quote. Benefit is that the cash value in the policy can be more as compared to policy without the slack. Also, if a payor or waiver is included in the policy, if CI or TPD, then the waiver will kick in. Ofc if you only look at it from the investment part and you have another vehicle that can generate better returns, by all means, go ahead... No right or wrong. |

|

|

Mar 10 2020, 03:59 PM Mar 10 2020, 03:59 PM

Return to original view | IPv6 | Post

#265

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

QUOTE(footie_ft @ Mar 10 2020, 02:32 PM) Hi.. I have a Prulink Assurance Account for many years. There is a maturity for the policy at 70 years old. Is there anywhere I can check if there is any return upon policy maturity? Other than my cash value. Thanks. You may check the policy book if there is any maturity value payable. AFAIK for ILP, there is no maturity value other than the cash valueQUOTE(mavric @ Mar 10 2020, 02:55 PM) Thanks for the response. You mentioned Slack can be increased/decreased. Can it be removed completely from the policy as this is a rider. Whether it can be removed or reduced will depend on whether the policy can be sustain based on the terms that you selected. Eg if you want the policy to sustain until age 80,90 or 100.Eg. In a quote, there is a line item description Slack with a benefit amount of RM500. What does this mean? How does it work? Where does the RM500 go or come from? Don't quite understand the payor or waiver kick in part. The rm500 slack will be used to buy units for generating cash value, not insurance. Since it goes to your cash value, you may withdraw the money ti use if you need it. For the waiver/payor part, if you are down with Critical Illness or Total disability, the rm500+your premium will be paid by Pru until the end of the agreed term. |

|

|

Mar 11 2020, 02:28 PM Mar 11 2020, 02:28 PM

Return to original view | Post

#266

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

QUOTE(netguy @ Mar 11 2020, 11:00 AM) Hi there! Was reading your advice here, and find it very informative I don't normally answer a question with more questions but in order for you to have a better decision making on whether to switch, you need to be aware of these things... Recently, my agent contacted me for 'policy updates' He asked me to switch from my current PRUvalue med (under PRUlink One) to PRUmil med (under PRUwith you). Why do you think you will need rm1.38m annually for hospital bill? Is it to cater for medical inflation? 🤔 Supposed that you claimed out Rm500k for the hospital bill, then what? Do you think you can still work to still generate an income? If not HOW MUCH DOES PRUDENTIAL PAY TO YOU since we already paid Rm500k to the hospital... I would opine that this is MORE important than to worry of how much is being paid to the hospital and NOT A SINGLE cent is paid to you. On the PVM n PMM Are you also been made aware that the medical insurance charges for the PruMil Med will cost Rm10k pa when you are age 76-80? Do you know that if you don't claim for PVM for 2 years, the Med Value Point (MVP) will increase by 2% (Rm20k pa) for a Rm1m MVP? QUOTE As I understand, I would need to surrender my main policy. QUOTE SOOO, my concern is: 1. They would charge me a new cycle of "Unallocated premium", which is quite a big chunk for first 8 years (current policy only 6 years with unallocated premium). Is that why he wants to 'update' my policy, or is PRUlink One being phased out? The Unallocated and agent commission starts all over, and the 2 years Incontestibility period applies to the upgraded medical plan, as already mentioned few post back. PruLink One is not phased out as it is an ILP product that is up to age 100. It is because PMM can only be a rider in PruWith You policy that it needs to be on a separate policy. Why is it so? Sorry I don't know cause I am not involved in the product design. QUOTE 2. Add that, with my now 0 cash value, would this be sustainable for me until the end of my policy (another 30yrs)? You also went with the PVM, non-surrender options, may I get your view on this? Bear in mind that the sustainability is using a fixed formula to calculate on paper, it may differ from the actual performance. More importantly is that you need to keep track of the projected vs the actual to really understand whether the policy is sustainable in the real world rather on paper. The recent events (political, pandemic etc) that saw the collapse of many funds are things that is not being foreseen in the projection of the cash values. QUOTE 3. PVM lifetime value is quite low (RM1 mil), hence PMM is quite attractive without lifetime limit. But if by doing so, it's not sustainable for my policy, then it's not worth it right? So get the Rm1.5 or Rm2m, PVM if you are that worried of medical inflation. Appreciate your advice! At the same time do remember to top up on your CI/TPD as explained above. If unable to work due to serious illness/accidents and if your income is Rm5k per mth, that is Rm600k loss of income for the next 10 years to you or your family. That IMHO is better to be protected rather than worry about just the medical cost... |

|

|

|

|

|

Mar 12 2020, 08:17 AM Mar 12 2020, 08:17 AM

Return to original view | Post

#267

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

QUOTE(netguy @ Mar 12 2020, 02:39 AM) Medical inflation is definitely at my mind, considering bypass, and cancer treatments costing more than RM50k now itself, whatmore 30-40 years down the road, haha. I guess that's why was looking around for a higher coverage. Correct me if I am wrong, it seems that you got yourself a "no med saver" aka full claim plan - which is why the COI is at RM9.7k at age 76-80.But, PVM also RM9.7k for the same R&B, at 76-80. Seems like the insurance charges are quite similar between PVM/PMM. Or did I see sth wrongly? The high COI is the reason why Prudential has co-insurance/medsaver/deductible plan available but the idea of having to pay something when one needs to be hospitalized doesn't go well with the general public. Take a look at RM300 med saver or even RM20K deductible. Have you ever compared the COI between Full claim, RM300 and RM20K? 1. Let me ask you, when was the last time were you admitted to a hospital? 2. In your lifetime, how many times were you admitted to the hospital? Calculate the COI saved vs the various plans and you be surprised that RM20K (per policy year) deductible is NOTHING compared to what you paid. Value for money, as some may say. Of course as an agent, most of them would not want to recommend clients getting a RM20K deductible, if the client don't afford. Secondly the commission is really half as compared to a RM300 med saver plan. QUOTE Also, as I see it, insurance charges for both life insurance, and medical card, increases every bday of the policyholder. So, why do we get recommendation to buy medical card as young as you can, to keep it cheap? (except the part where you get more disease as you get older). To get covered when you are healthy as the coverage may be declined or subjected to loading/exclusion once a person comes in with health condition.QUOTE Yea, thanks for that advice. Definitely need to get income, once you have lost ability to do so. Even consider looking at getting a CI coverage until say age 60/70 (might need to do a separate policy if your current policy is up to age 100) as its main purpose is as a replacement of income when you are working.Am looking into increasing my CI. My current is Crisis Defender. Seems like the new Total Multi Crisis, covers more and have early CI repayment. But charges are more than double. For PA, I think I'll get separate from Pru, heard it's more worth it. Early CI sounds good, if you are worried that once diagnosed with ECI, you may be off from work for few months to heal. If cost of insurance concerns you, just look at the normal CI as that is what stops us from totally be at work permanently! That way you may get a higher coverage. Better bang for your buck! HTH |

|

|

Mar 13 2020, 03:31 PM Mar 13 2020, 03:31 PM

Return to original view | IPv6 | Post

#268

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

QUOTE(netguy @ Mar 13 2020, 03:56 AM) Agree on the savings I'll get for the co-insurance plans, haha. Look at the rm20k deductible, and you'll even be more surprised. At least that plan is maintainable until age 90/100Actually, I saw that for R&B 200, Medsaver 300: PVM RM9.7k, PMM RM10.2k. I attached the pics. Just very curious about the same charges, for such big benefit difference, haha. Yea, my Crisis Def is until 70. Does it make a difference in terms of costs, if someone gets until 100? We still would be paying the same insurance charges, in the same group right? Ok, that sounds like a good advice. Thanks for that [attachmentid=10447045] [attachmentid=10447046] |

|

|

Mar 26 2020, 01:26 PM Mar 26 2020, 01:26 PM

Return to original view | IPv6 | Post

#269

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

QUOTE(mataharih @ Mar 26 2020, 12:32 PM) Hi Roy, The main differences between TMCC vs PL is that TMCC offers a more comprehensive CI coverage (101 Early CI, 53 CI, Special Benefit Payout) than PL as PL is more focus on the female illnesses. For example mild Stroke, Heart Attack, coma is covered in TMCCWould like to ask for your advice. I'm currently holding the PruValue Med and am not looking to upgrade but am looking for Critical Care, mainly for female cancers. My agent has suggested getting the PruwithYou and Total Multi Crisis Care riders with coverage of up to RM100k (for both). Not much info is available online regarding the payout amount compared to PruLady. What is the difference between this and Prulady? For PruLady, I was looking at the RM50k sum assured and was mainly interested in this due to the payout for lifestyle and early cancer detection. Also, PruwithYou and TMCC seems slightly cheaper than PruLady even though the sum assured for PWC and TMCC is higher compared to PruLady. Thanks! Another notable differences for the PL, lifestyle claim is claimable, the TMCC doesn't have this. PL will also refund back all the premiums paid at the end of the policy term. TMCC no refund of premiums paid, but only the cash values (if any). You may ask your agent to disclose to you the technical FAQ on TMCC, to have a clearer picture on the covered conditions (as the training materials are for internal circulation only) The TMCC brochure can be downloaded << HERE >>, though I must admit, the brochure is poorly done on the covered conditions. |

|

|

Mar 26 2020, 02:10 PM Mar 26 2020, 02:10 PM

Return to original view | IPv6 | Post

#270

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

QUOTE(mataharih @ Mar 26 2020, 01:57 PM) Hi Roy, A 50% of your sum insured will be paid out for Early CI (in your example above is Early Breast Cancer) and a subsequent 100% upon diagnosis of the covered late stage CI.Thanks for your reply! In this case, I feel that since I’m generally healthy, will probably go with PL since I’m more worried about cancer. Just wondering though, how does the payout work for TMCC? Let’s say I get the TMCC rider and years down the road, if I get breast cancer (touch wood), what percentage of the sum assured will be paid to me for the early detection of breast cancer? Thanks! This post has been edited by roystevenung: Mar 26 2020, 02:11 PM |

|

|

Apr 6 2020, 12:31 AM Apr 6 2020, 12:31 AM

Return to original view | IPv6 | Post

#271

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

QUOTE(drew86 @ Apr 5 2020, 11:57 PM) Hi. Got an enquiry here..i own a prulinkone ILP, with prufleximed med card rider amongst others. I intend to switch it to pruvaluemed, so am wondering what are the implications doing so in terms of: 1. If the application for upgrade is approved, then there is no waiting period (since PruFlexi Med (PFM) was launched IIRC in 2012). However do note that application on the PruValue Med (PVM) the insurer is subjected to a 2 year incontestability period.1. Will waiting period for claims be affected/reset upon switching? 2. Any fees/charges incurred for switching? 3. Any changes to allocation of premium? (Specifically unallocated portion..will it be reset?) 4. Possible to remain at current premium and top up later if needed? Or does the policy premium need to be recalculated to compel sustainability? 5. Any other major issues that i need to be concerned of? Appreciate any feedback given..thanks in advance! Should there be any evidence to show that there was a non-declaration of a material fact (especially on the pre-existing illness) the application for the upgrade may be downgraded back to PVM. 2. It is considered an upgrade, therefore do expect the premium to increase, depending on the age sustainability option, 70, 80 90 or 100. 3. Only for the upgraded portion (ie PVM to PFM), the changes of the allocation of the premium will be affected and reset. Eg, if you are previously paying RM200 and now it cost you Rm250, only the RM50 allocation is reset. Same goes to the agent commission. 4. It depends on your current PFM. For example if your current PFM is at age 90, and if you intend to maintain the current premium, you may try to lower down the sustainability option to say age 70 or 80 for the PVM. If you decided to lower the sustainability age to 70, and only top up later, it needs to be going thru another round of endorsement (upgrade) whereby health declaration is required. If you are still healthy then its not an issue to do any upgrade. Otherwise, it may be imposed with exclusion/loading/rejected (depending on the severity of the illness). 5. Do declare all questionnaires properly |

|

|

Apr 6 2020, 07:33 PM Apr 6 2020, 07:33 PM

Return to original view | IPv6 | Post

#272

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

QUOTE(hoong2188 @ Apr 6 2020, 07:29 PM) my parent is going to retire soon. Yes it is possible to reduce the coverage to only maintain the medical card for those ILP policies.and no income to continue to pay for insurance. shall they terminate, or continue to pay insurance by using their saving? any insurance plan can terminate? only keep the medical card? You may contact your insurance agent or walk in to any of the Prudential branches (after the MCO). |

|

|

Apr 7 2020, 10:31 AM Apr 7 2020, 10:31 AM

Return to original view | IPv6 | Post

#273

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

QUOTE(darksin_90 @ Apr 7 2020, 10:21 AM) Heard from my agent we can still sign up insurance policy by just providing them IC copy during this MCO period, is it true? Yes, it is correct.We are able to do Whatsapp / Wechat / emails / video calls together with selfie+holding the IC to sign up the policy. Once approved, the policy document will also be an e-policy copy. For the claims it can also be done by e-copy (keeping the original receipts) |

|

|

|

|

|

Apr 17 2020, 09:59 PM Apr 17 2020, 09:59 PM

Return to original view | IPv6 | Post

#274

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

QUOTE(Zegoon681111 @ Apr 17 2020, 09:22 PM) Good evening. Yes you can.Can I just buy funds from prudential and pay online via boost without buying any insurance policy? Fundsupermart |

|

|

Apr 17 2020, 10:40 PM Apr 17 2020, 10:40 PM

Return to original view | IPv6 | Post

#275

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

QUOTE(Zegoon681111 @ Apr 17 2020, 10:35 PM) Thanks for your reply. Yes you can buy from any Prudential agent who has Unit Trust license or buy Prudential Funds that is available on FSM.I meant buying funds from prudential, instead of fundsupermart. And also using boost ewallet to buy the funds. I understand that we can use boost to buy prudential insurance policy. Some of the Prudential funds you can also utilise yr epf via the epf iakaun I am uncertain if you can buy funds using Boost though |

|

|

May 8 2020, 10:17 PM May 8 2020, 10:17 PM

Return to original view | IPv6 | Post

#276

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

QUOTE(alandhw @ May 7 2020, 01:58 PM) have some question on the Prudential Pulse apps. Yes it is free for Prudential Customers and a small RM10 for non-Prudential Customers who downloaded Prudential Pulse.The online consultation is FOC for policy holder? What is the rewards for the Fitness challenge? Reward for the Fitness Challenge is get a hand sanitizer QUOTE(py yong @ May 8 2020, 09:04 PM) I am holding PruValue Med. I never look into my policy until this MCO since I am free ( I leave it to the agent to propose). After look into my policy, I realized my Room & Board is cover up to Rm300, which I think it is more than my requirement. For your information, the PruValue Med (PVM) with the room RM300, it comes with a Med Value Point Bonus (MVPB). For every 2 years of non-claim from the medical card, the Med Value Point will increase by 2%, eg RM20K.I plan to walk in to Prudential customer service center in stead of ask my agent to help. Is there any possibility to readjust certain term in the policy? Another question is, is there any possibility that my premium pay become lower if I can adjust the room rate from 300 to 200 If you lower to RM200, the MVPB will also be removed as the MVPB is only available for option RM300. However, if you wish, yes, you may opt for a lower R&B and definitely RM200 comes with a lower insurance charges |

|

|

May 8 2020, 10:32 PM May 8 2020, 10:32 PM

Return to original view | IPv6 | Post

#277

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

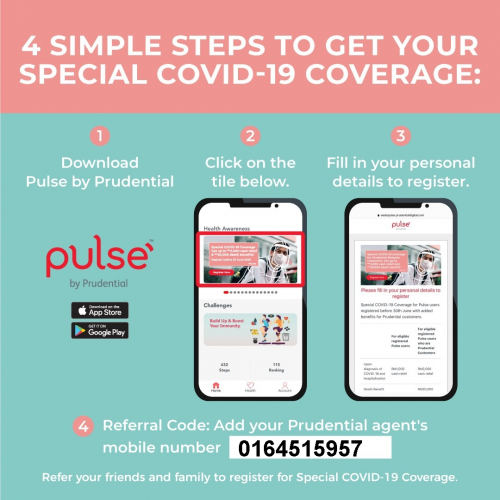

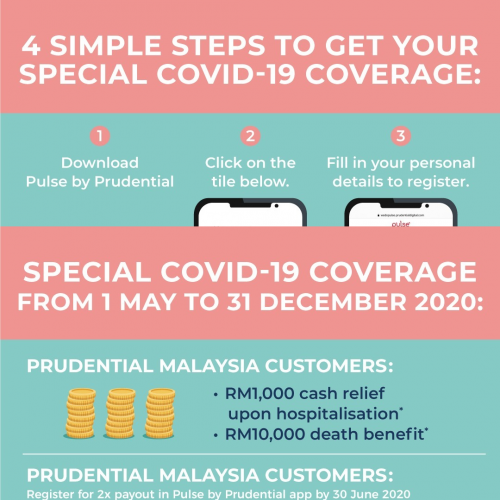

Please be informed that Prudential is having an additional coverage for Covid 19 for FREE to anyone who download Prudential Pulse App. There is also a 10% on Starbucks!

WE DO PULSE BY PRUDENTIAL For Prudential Customers • RM1,000 (RM2,000 for customers who register in Pulse on or before 30 June 2020) upon hospitalisation to any of the Ministry of Health Malaysia (MOH) designated hospital within the coverage period due to COVID-19 • RM10,000 (RM20,000 for customers who register in Pulse on or before 30 June 2020) per life upon death due to COVID-19 within the coverage period • Subject to maximum limit of RM1,000,000 Non-Prudential customers who are “Pulse by Prudential Malaysia” registered users • Must register in Pulse by Prudential Malaysia on or before 30 June 2020. If you want to help support your boi, please use the Referral Code 0164515957 • RM1,000 upon hospitalisation to any of the Ministry of Health Malaysia (MOH) designated hospital within the coverage period due to COVID-19 • Subject to maximum limit of RM300,000 (sponsored by Prudential CSR fund)     This post has been edited by roystevenung: May 8 2020, 10:34 PM |

|

|

May 9 2020, 08:27 AM May 9 2020, 08:27 AM

Return to original view | IPv6 | Post

#278

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

QUOTE(py yong @ May 9 2020, 06:52 AM) I See. MVP 1.5mil means that should your total cumulative hospitalization claims Exceeded the MVP value, then Prudential will pay 80% of the bill and 20% is to be borne by you.1.According to my policy, the insurance I am holding is with Med Value Point 1.5mil (question: this 1.5mil is renewable / lifetime value point). Refer back to my policy, it written MVPB of RM30k( what’s the meaning?) 2. There are 2 clauses I do not understand which both written in the policy. -PruValue Med for 300/1.5mil with expiry age of 70. -PruFelxi Med for 300/1mil with expiry age of 70. Besides these points, my agent told me that I am cover till the age of 80. However I read the policy,my understand is 70 years old. Correct me if I am wrong. The MVPB of RM30K per every 2 years of no claim means that the MVP value of RM1.5m will gradually increase by RM30K for every 2 years of non hospital claim. Meaning after 2 years, assuming there is no hospitalization claim the initial MVP value of RM1.5m will be RM1,530,000 after 2 years. There is no lifetime value for PVM. As for the point no 2, I am uncertain as to why you have 2 medical cards running. It would be best to seek for the agent's clarification as to why you are having 2 medical cards running. Don't get me wrong, I also do have client that has 2 medical cards running at the same time (since the first medical card is an older and lower limit). When the client wanted to upgrade, he already have ailment which makes the application for an upgrade an Exclusion. Therefore we have to apply for another medical card with an Exclusion whilst maintaining the 1st medical card. Well if the policy book says the term is until age 70, that is what it literally means, until age 70. |

|

|

May 22 2020, 12:21 PM May 22 2020, 12:21 PM

Return to original view | IPv6 | Post

#279

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

QUOTE(Magickian @ May 22 2020, 12:05 PM) Hi Roy, Do note that it is the calculation of the limit is by the policy annexure year (depending on when you start the policy) and not by the calendar year, but for the sake of discussion lets stick to the calendar year:- First of all thank you for your time in reading this question. I am also approach by my insurance agent selling me the PruValue Med. From the quotation, I understand that the Med Value Point of RM 1,000,000 is for the whole policy years like, assuming: Year 2021 = RM300,000 hospitalisation Year 2022 = RM600,000 hospitalisation Year 2023 = RM500,000 hospitalisation For year 2023, I need to pay 20% of RM400,000 as I have exceeded RM1,000,000 in Year 2023. But my insurance agent told me that the Med Value Point of RM1,000,000 will be refreshed yearly (no annual limit but Med Value Point will be reset each year). Like for the above case, even in Year 2023, I do not need to pay any amount (except for the RM300), as my hospitalisation fee for that year did not exceed RM1,000,000. Just want to get a second opinion before I make my decision. Once again, thanks you so much! Year 2021 = RM300,000 hospitalisation - insured to pay RM 300 if med saver is attached Year 2022 = RM600,000 hospitalisation - insured to pay RM 300 if med saver is attached Year 2023 = RM500,000 hospitalisation - first RM100K, insured to pay RM 300 if med saver is attached - subsequent RM400,000, insured to pay RM80,000 (80/20 rule applies) On a related note, it means you had 3 times of Critical Hospitalization with that type of claims and YET SURVIVE, which I had never seen before in my career as an insurance agent. |

|

|

May 23 2020, 08:58 PM May 23 2020, 08:58 PM

Return to original view | IPv6 | Post

#280

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

|

| Change to: |  0.0653sec 0.0653sec

0.86 0.86

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 18th December 2025 - 07:55 AM |