QUOTE(rahtid @ Jun 21 2019, 11:47 AM)

yes, it will, my agent just told me and ask me to decide before July or she will re-quote the price for me.

Then how come we receive circular that there will not be any increase in the premium?

The Star - Insurance Premium Unchange

The Star - Insurance Premium UnchangeIf by Jul and your birthday is up, then it make sense that it goes up.

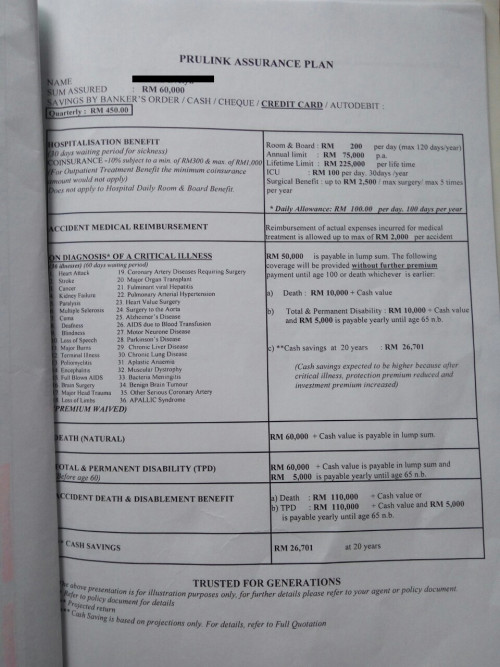

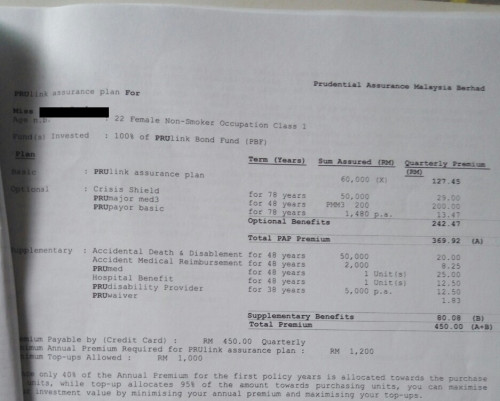

Also take note that the premium can be adjusted with minimum slack or more slack depending on your budget. More slack means more money is invested to built up the cash values to have the policy with better sustainability

QUOTE(kochin @ Jun 21 2019, 12:03 PM)

how much if one were to buy a fresh insurance now for say 1mil death, 400 - 500 per day medical?

profile:

male and female

age: 40-50

smokers: no

For age 51 next birthday, male nonsmoker

1m death or tpd

2m if death due to accident

3m if death on public transport

4m if death whilst overseas

Premium target sustainability till age 80, Rm1165 mth

Premium target sustainability till age 90, Rm1651 mth

——-

For the medical with Rm500 Room, Rm1.98m per year, no lifetime limit, Rm300 deductible

Sustainability age 90, Rm956 mth

Sustainability age 100, Rm1167 mth

This post has been edited by roystevenung: Jun 21 2019, 12:42 PM

Apr 4 2019, 03:06 PM

Apr 4 2019, 03:06 PM

Quote

Quote

0.0546sec

0.0546sec

0.51

0.51

7 queries

7 queries

GZIP Disabled

GZIP Disabled